FSW Markets

Industry Differentiation Will Continue in 2026

February 5, 2026

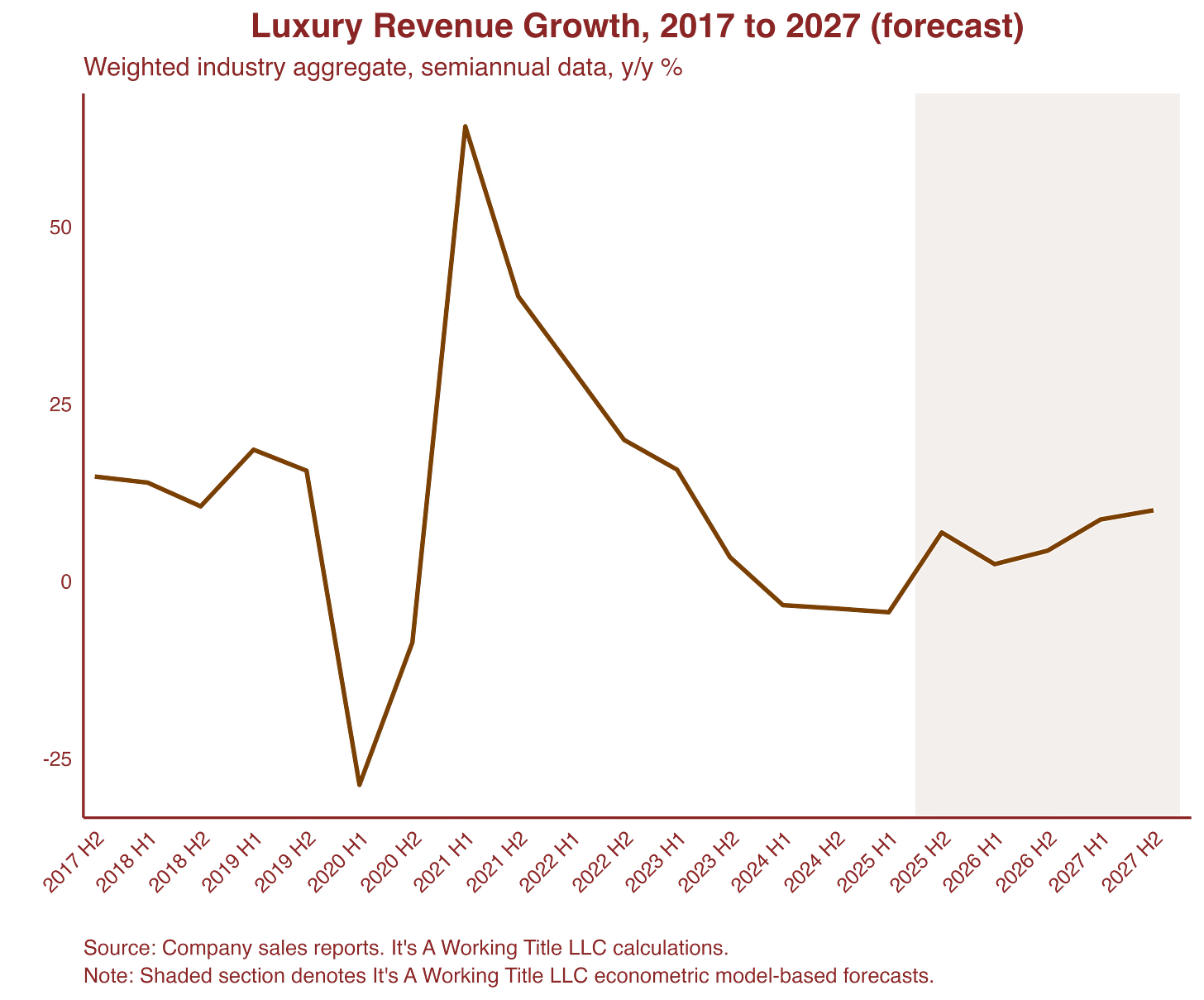

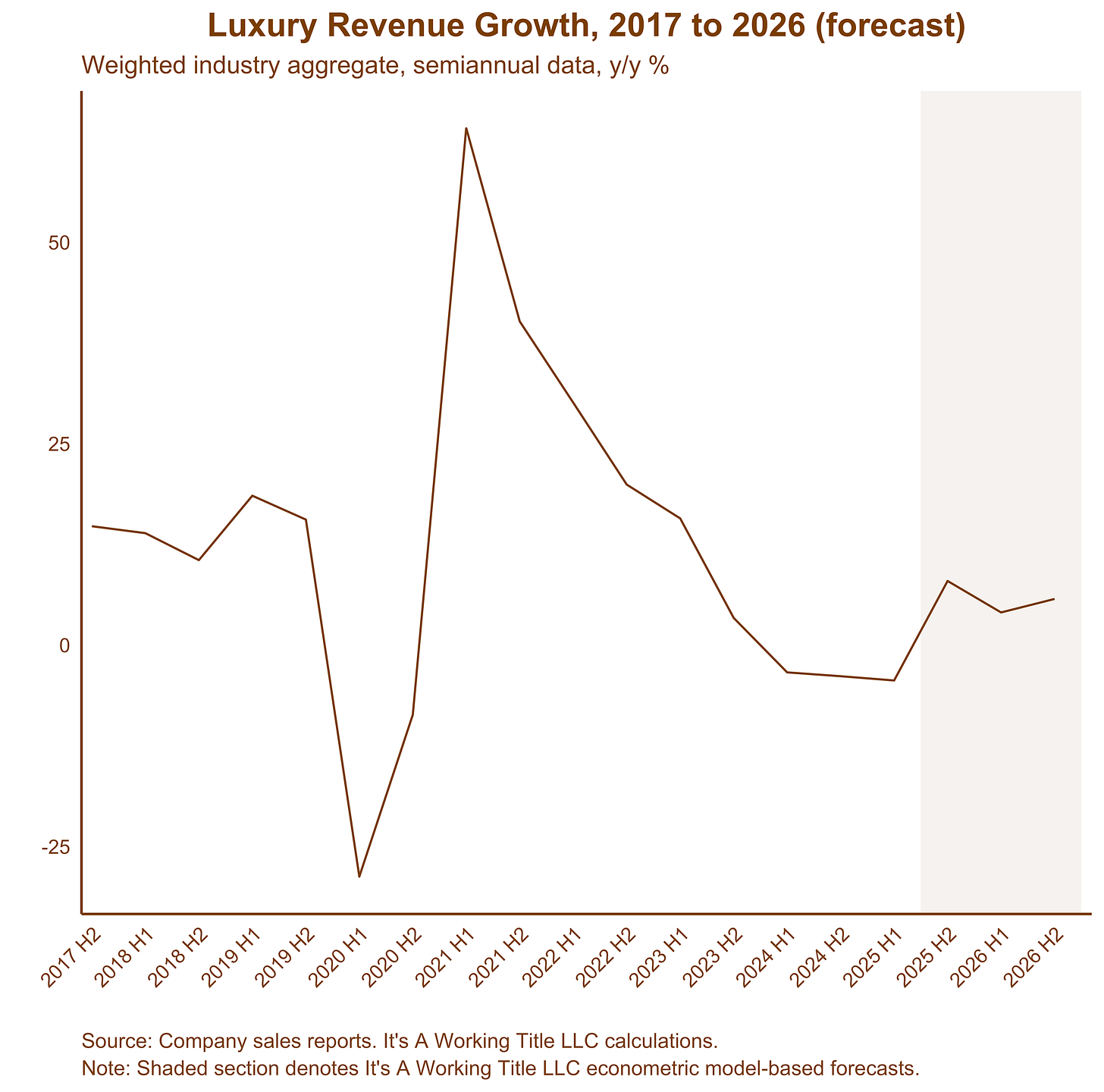

The luxury industry seems to have broken its losing streak in late 2025. After six consecutive quarters of negative sales growth, earnings data for the three months ending in September point to very slight positive growth. Depending on what organisations/brands you include in your sample, how you weight it, and what definition of ‘revenue’ you use, you can get estimates between 0.01 and 0.4 percent growth or so. This does not signal an abrupt regime shift, but it may give some hope as a signal of stabilisation after the longest industry recession since the 2008 Global Financial Crisis. Using our econometric model-based forecasts, we expect industry growth to remain relatively weak, by historical standards, though positive for 2026 and 2027.

Yet, while most of the narrative around luxury for the past couple of years has been about a slowdown, the real story has been one of historically high differentiation. Some segments of the industry (for instance, beauty and wellness, travel and hospitality, and some automobiles) have exhibited resilience, while large segments of the fashion, leather goods, and wine and spirits businesses have struggled. But even among those luxury segments in recession, there has been a historically high degree of differentiated performance between winners and losers.

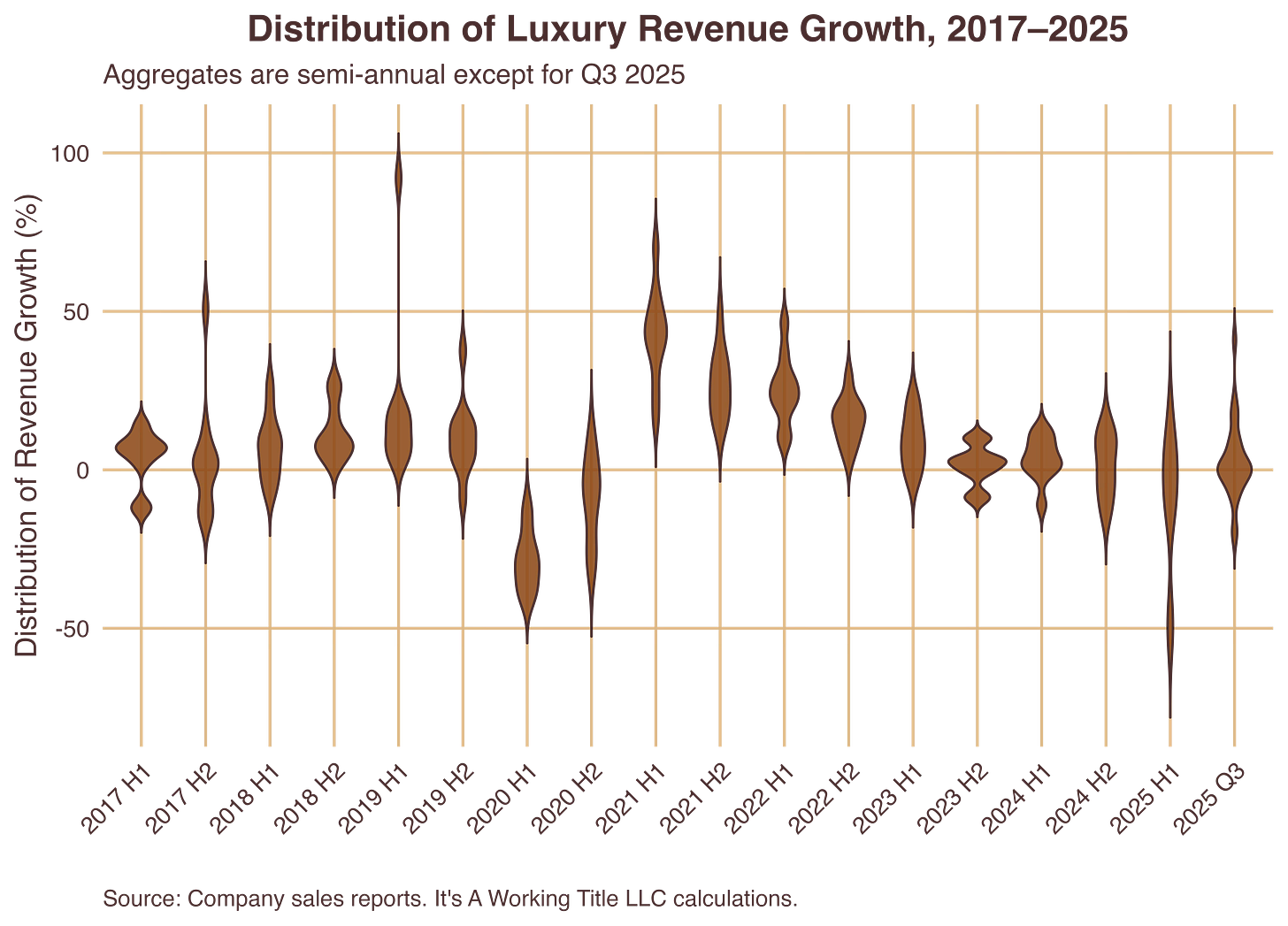

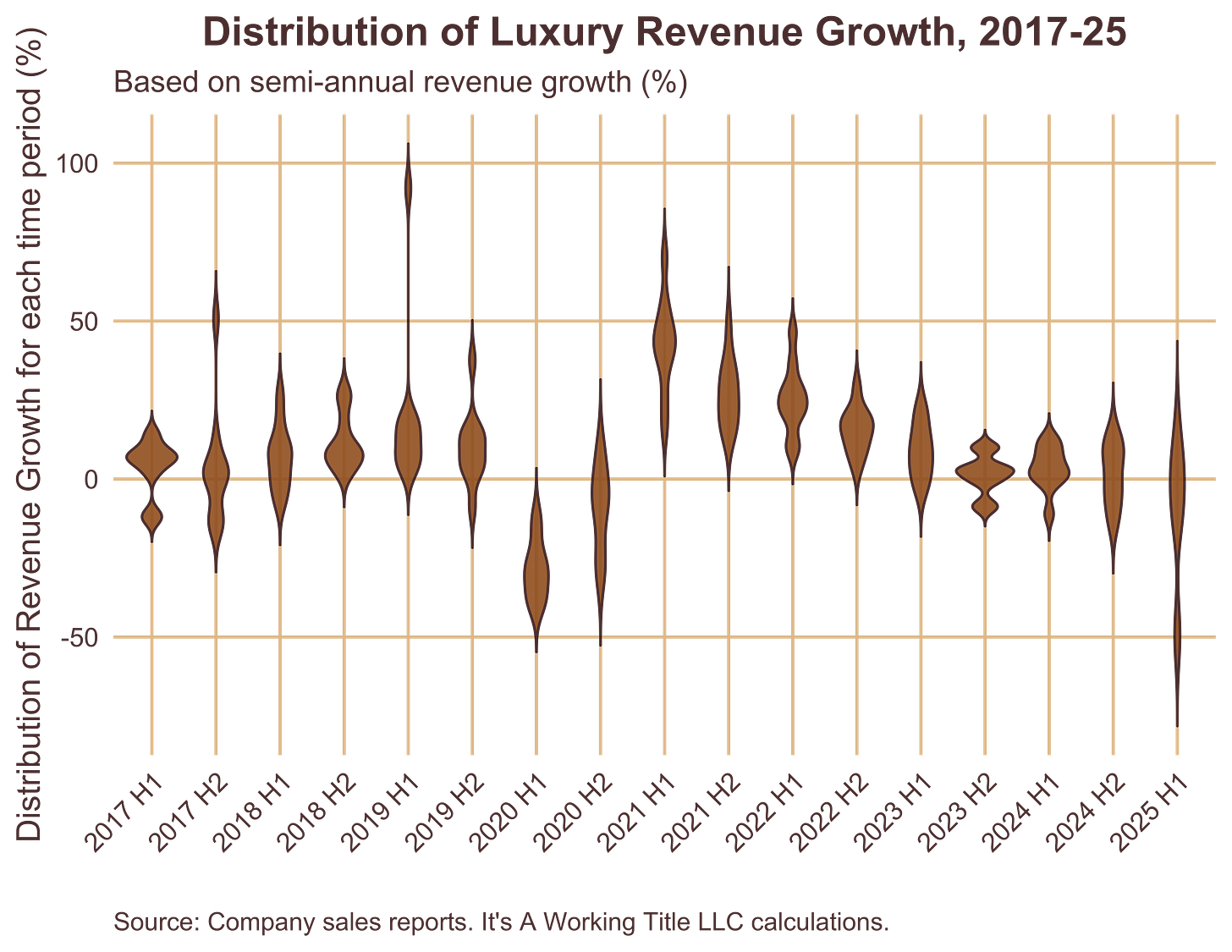

In fact, there has never been a period in recent history when performance by luxury brands has been so heterogeneous. To get a sense of the heightened level of dispersion in performance, we created a violin plot below, which illustrates how luxury firms’ revenue growth was distributed across the industry from 2017 to the latest results in 2025. The vertical axis shows revenue growth as a percentage for the luxury firms in our sample, while the width of the “violin” indicates the number of firms with results at that level. Taller, stretched violins indicate that firms’ performances were more scattered, while shorter, wider ones suggest they were more similar. The violin for the last two quarters is the longest over this nine-year period, and its thinness indicates relatively low clustering of similar results.

In fact since the pandemic, the volatility of luxury revenue growth has risen dramatically. Some standard measures of statistical variance point to this trend. The standard deviation of revenues, which shows the absolute spread of results, jumped from about 8–10 percentage points before 2019 to regularly above 20 and even into the 40s in recent periods. The coefficient of variation, which measures volatility relative to average growth, has spiked erratically since COVID—rising from around 0.7–1.0 before 2019 to levels above 2.0 and even near 4.0 in some recent half-years—showing that even strong years came with unstable performance. Meanwhile, the interquartile range—the spread between the middle 50 percent of firms—has widened from roughly 5–7 percentage points in the late 2010s to more than 12–13 percentage points after 2020, signalling that dispersion is no longer confined to a few outliers but now affects the core of the industry.

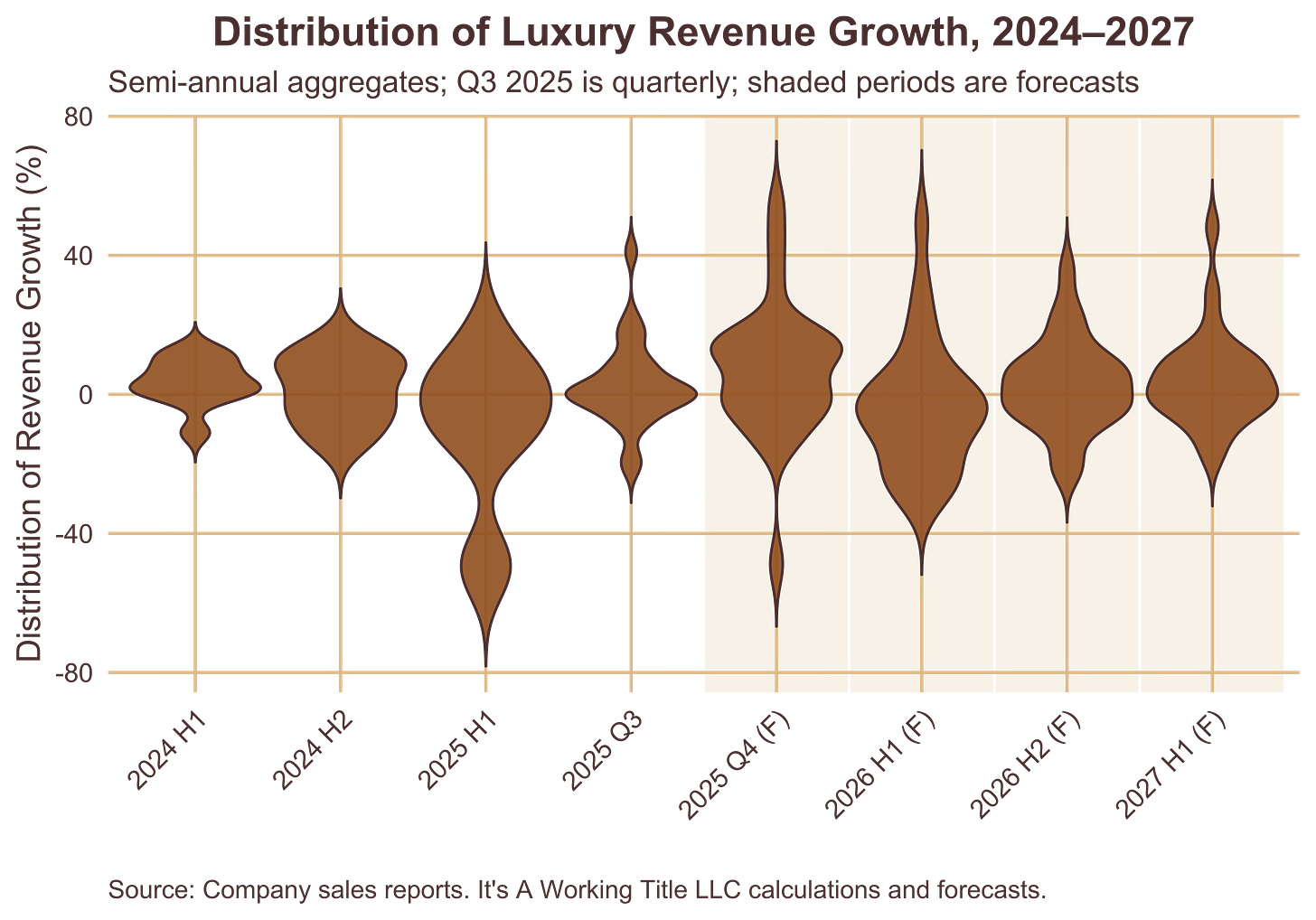

Our forecast is that differentiation will remain pronounced for the next two years, though it will come off its historic highs. The below figure exhibits our violin plots for 2024 and H1 2025 with forecasts for the fourth quarter of 2025 and semiannual forecasts for 2026 and 2027. We expect the standard deviation to decline from 21.9 in full-year 2025 to 17.4 this year and 13.1 next year. The coefficient of variation will decline from 2.3 in 2025 to 1.2 in 2027 while the interquartile range should drop from 26.1 to 14.6 during the same period. So we should start to see more cross-industry convergence as the broader industry emerges from recession, as we have predicted. But differentiation will remain above historical norms. What drives this unique period of differentiated performance across the luxury business?

Has the Luxury Recession Bottomed Out?

December 2, 2025

The luxury industry appears to have broken its losing streak. After six consecutive quarters of negative sales growth, earnings data for the three months ending in September point to very slight positive growth. Depending on what organisations/brands you include in your sample, how you weight it, and what definition of ‘revenue’ you use, you can get estimates between 0.01 and 0.4 percent growth or so. This does not signal an abrupt regime shift, but it may give some hope as a signal of stabilisation after the longest industry recession since the 2008 Global Financial Crisis.

As always, weighted averages and other central tendencies hide significant variation in performance across the industry. As we discussed in our September 2025 industry macro overview (Why Some Luxury Brands Continue to Grow in this Market), this luxury recession has been accompanied by the highest level of differentiated performance across brands that our data sources could pin down: the coefficient of variation jumped from around 0.7 in the 10 years before the pandemic to nearly 4.0 in this recession. However, as the below ‘violin plot’ exhibits, there is more industry compression in the latest quarter.

The chart below shows year-over-year revenue growth for 26 brands (or quasi-brands in the case of the LVMH and Richemont product aggregates, which we use since these conglomerates do not report brand-level data) for the July to September (brown bar) and April to June (yellow dot) periods of this year. In the most recent quarter, 14 of the 26 brands reported positive sales growth, compared with 9 in the previous quarter. Some of the top performers continued to report consistent growth (Miu Miu) or even stronger growth in the last quarter (Coach, Richemont Jewelry Maisons, and Ralph Lauren). Six brands that reported negative growth the last time round returned to the black (Kate Spade, Richemont Specialist Watchmakers, LVMH Watches & Jewelry, LVMH Perfumes & Cosmetics, Burberry, and Boss). Gucci and the transitioning Versace continued to earn the wooden spoon, though even most of the weaker performers have improved in the recent quarter (Gucci, Thom Browne, Saint Laurent, Jimmy Choo, LVMH Fashion & Leather, and Michael Kors).

At the regional level, the turnaround in Asia has been the biggest surprise, while consumers in the Americas continue to anchor the luxury goods business. The slowing of economic growth, and in particular private consumption, in China has been a major driver of the industry recession. Onshore Chinese luxury spending has been a major driver of the industry’s growth and evolving character over the past 15 years. So the turnaround from negative annual growth to positive, albeit very small, from July to September may represent an important leading indicator of a turning point. If macroeconomic forecasts for China’s annual GDP growth over the next year are to be believed (and, by and large, these types of projections tend to be wrong), hopes for greater onshore China luxury consumption will need to hope that there is a growing propensity to spend on luxury from a mostly unchanged rate of economic growth. The IMF’s latest forecasts are for China’s economy to grow by 4.2 percent in 20265, which 0.8 percentage points slower than it was in 2024.

Luxury Share Price Index Up Over 10 percent As We Enter Q4

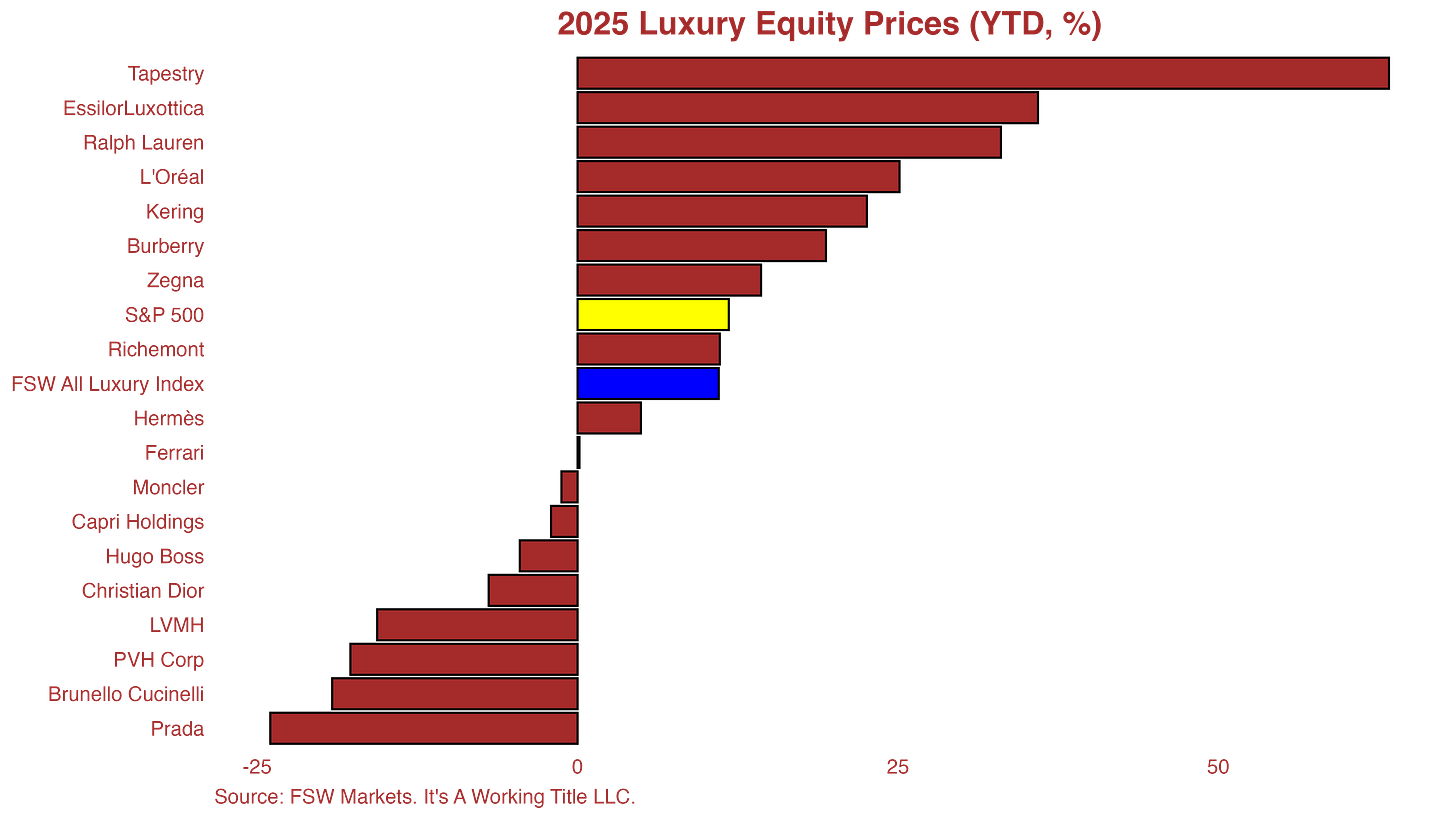

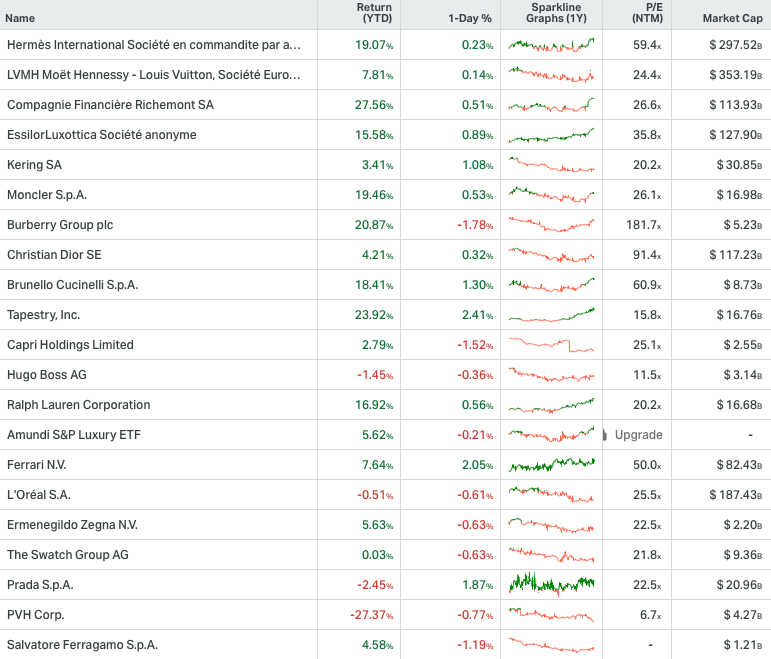

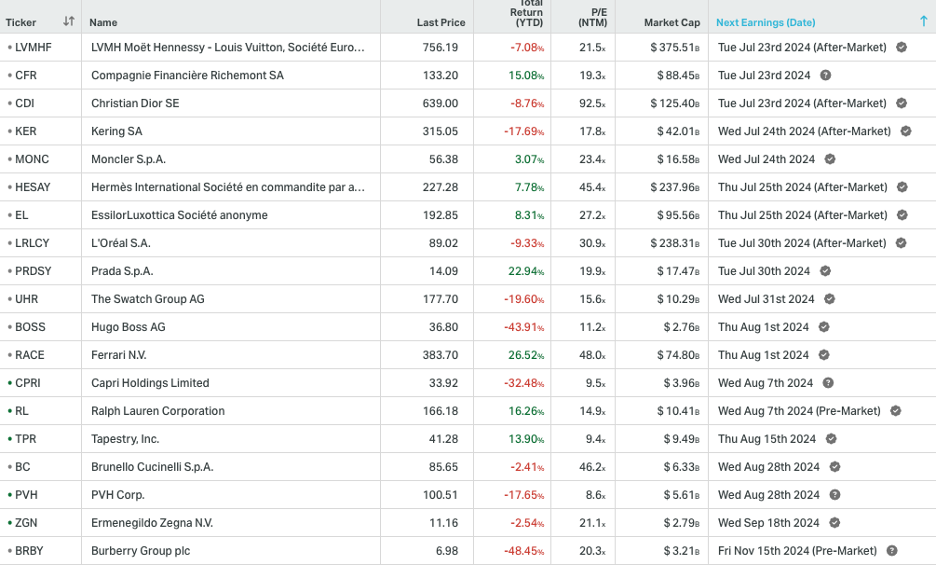

As we start the fourth quarter, below is a snapshot of the state of luxury share price trends so far this year.

🔘 Our FSW Markets All Luxury Index is up 10 percent year-to-date as compared with 13 and 12 percent gains for the Euro Stoxx 50 and S&P 500, respectively. The three indexes have recorded almost identical linear returns though arrived in that spot through different paths.

🔘 Luxury prices reached an annual peak of over 20 percent growth in Q1, driven by expectations of a return to sales growth, but then declined in April as actual earnings reports fell below expectations. The S&P, by contrast, has staged a solid rally since April after a sharp slide during Q1.

🔘 This comes as the industry recorded its sixth consecutive quarter of negative revenue growth. Our cap weighted index put the industry at -4 percent y/y growth in H1 though diversity in cross-brand performance was near a historic high as we discuss in our latest Fashion Strategy Weekly (https://lnkd.in/ejQs7xEC)

🔘 A 60+ percent surge in Kering’s share price since April has helped drive the overall industry index on hopes that Luca de Meo can steady the ship at Gucci.

Luxury Brand Performance Differentiation at Historic High

September 22, 2025

It is now pretty widely reported that luxury sales, particularly ‘soft luxury’, have cooled off from the breakneck growth experienced during the industry-wide super cycle that followed the pandemic. Some of the industry’s biggest names are reporting some historically bad numbers. However, industry averages (or medians) mask another trend: a sharp increase in performance differentiation across luxury brands and product categories. If you like, average growth is slowing but the standard deviation of the industry’s performance is rising. There are some losers but also some remaining winners.

Let’s start by identifying which brands continue to win with consumers. Here, we looked at a large sample of earnings reports, readily available on company websites for public companies, for luxury fashion, jewelry, watches, cosmetics, and fragrance brands. We are excluding some other major verticals, such as eyewear, travel and wellness, and automobiles, for several reasons. In many cases, these brands have characteristics that make comparison with others in our sample difficult, and we can conduct a separate analysis later on that relies less on large-sample (Large-N) comparisons at a later stage.

Below we show annual revenue growth for the period of April to June 2025. (You can find our analysis for the full year 2024 and January to March 2025, which provides a similar comparison.) We cover 24 different public brands or quasi-brands. As LVMH and Richemont do not report individual brand data separately, we pulled out some high-level product categories that are reported: LVMH watches and jewelry, LVMH perfumes and cosmetics, LVMH fashion and leather goods, Richemont jewelry, and Richemont specialist watchmakers. This results in something different than a pure apples-to-apples comparison with the other brands (which themselves may be a mix of different types of products), but this is better than nothing and seems necessary given that LVMH and Richemont represent around 35 and 10 percent of the industry, respectively.

So of our 26 brands, 9 reported positive sales growth during the period of April to June 2025. These brands include Miu Miu, Brunello Cucinelli, Richemont Jewelry Maisons, Coach, Hermès, Stone Island, Ralph Lauren, Church’s, Tom Ford Fashions, and Zegna. The rest of the industry recorded negative growth with three brands (Stuart Wietzman, Thom Browne, and Gucci) recording 20+ percent declines in annual growth during the same period.

At the industry level, luxury remains in recession. The plot below shows annual revenue growth for a weighted index of major luxury organizations. The plot displays a fairly lengthy time series that encompasses semi-annual growth before, during, and after the pandemic, and includes the It’s A Working Title LLC industry forecasts for the period from H2 2025 to H2 2026. The industry has reported negative revenue growth for about six consecutive quarters. By our count, the only other instance of this occurrence was during and after the 2008 global financial crisis. This is a historically unique slowdown.

Yet, as we saw in the revenue numbers for the latest quarter, the slowdown is not universal. In fact, there has never been a period in recent history when performance by luxury brands has been so heterogeneous. To get a sense of the heightened level of dispersion in performance, we created a violin plot below, which illustrates how luxury firms’ revenue growth was distributed across the industry from 2017 to the latest results in 2025. The vertical axis shows revenue growth in percentage terms for the luxury firms in our sample, while the width of the “violin” indicates the number of firms with results at that level. Taller, stretched violins indicate that firms’ performances were more scattered, while shorter, wider ones suggest they were more similar. The violin for the last two quarters is the longest over this nine-year period of time, and the thinness shows that there is relatively low clustering of similar results.

In fact since the pandemic, the volatility of luxury revenue growth has risen dramatically. Some standard measures of statistical variance point to this trend. The standard deviation of revenues, which shows the absolute spread of results, jumped from about 8–10 percentage points before 2019 to regularly above 20 and even into the 40s in recent periods. The coefficient of variation, which measures volatility relative to average growth, has spiked erratically since COVID—rising from around 0.7–1.0 before 2019 to levels above 2.0 and even near 4.0 in some recent half-years—showing that even strong years came with unstable performance. Meanwhile, the interquartile range—the spread between the middle 50 percent of firms—has widened from roughly 5–7 percentage points in the late 2010s to more than 12–13 percentage points after 2020, signaling that dispersion is no longer confined to a few outliers but now affects the core of the industry.

Content Strategy Can Act as a Tool of Risk Management for the Luxury Industry

June 23, 2025

The only certainty so far this year is persistent uncertainty. This is always true to a degree, but our clients report feeling the weight of the unknown more in their short-term and medium-term planning over the past three months than in the past few years since the pandemic.

Our near-term forecasts for luxury industry sales remain pretty tepid given slowing consumer demand in, well, most of the industry’s key markets. We now expect sales growth to be 3 percent lower this year than last and to decline by around 0.5 percent in 2026. This looks pretty ugly when compared with the 14 percent average annual growth rate in the five years prior to the pandemic, nevermind the 27 percent average growth in the post-pandemic super cycle years of 2021-23, underpinned by decent volume growth and enormous price increases (you can listen to my recent discussion with Sanja Bećirović about recent pricing dynamics: https://lnkd.in/eDqG_wBi).

And the risks to the luxury sales environment appear to be tilted to the downside, as the cool forecasting kids like to say. Last week, the World Bank knocked 0.7 percentage points off its global forecast for 2025-26. China is now expected to see a steady decline in economic growth from 5.0 percent last year to 4.5 percent this year, and 4.0 percent over the next two years. Growth in the U.S. is expected to fall from its recent rate of around 3.0 percent to around 1.5 percent for a while.

But not all is doom and gloom. Historically, the luxury industry has proven fairly resilient during previous economic slumps, with a significant share of sales (maybe as much as 40 percent) anchored by buyers whose luxury purchase decisions may be relatively inelastic. And indeed, even in the current environment not everyone is struggling.

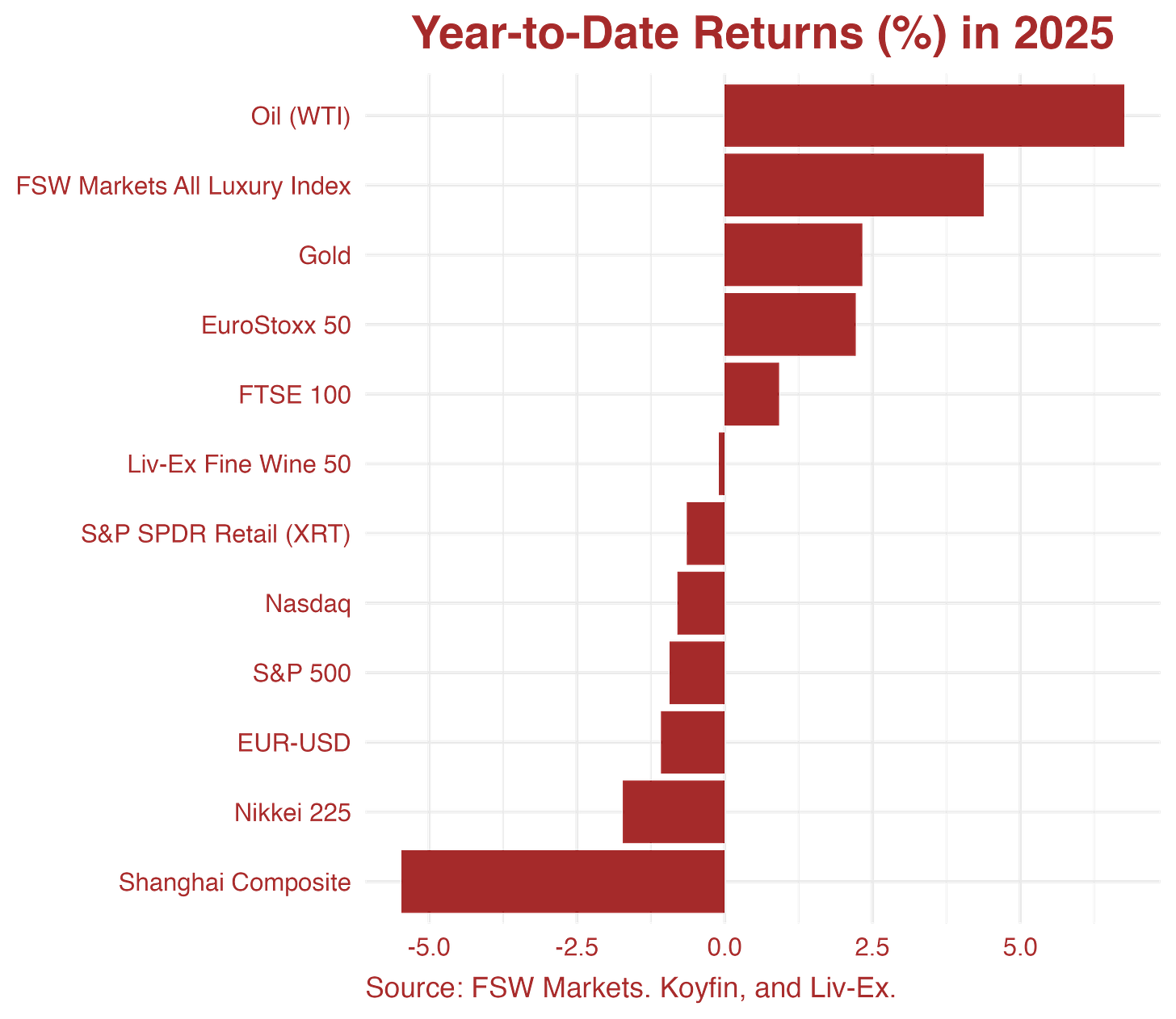

We observed some brands achieve decent sales growth in Q1 and the market’s expectations of future cash flows appear decent for many names, reinforcing the substantial market divergence that we observed last year. Our FSW Markets cap-weighted industry index is up about 8 percent year-to-date (vs. ~2.5 percent for S&P 500 and ~9.5 percent for the Euro Stoxx 50) with half of the index’s constituents up on the year.

What drives the wedge between the winners at the losers in this environment? The story up close is of course, complicated and the model messy, but take a step back and many of those doing well are successfully projecting their brand story across all of the digital and IRL customer touchpoints.

Using recent data, we found a positive correlation between hitting KPIs and exemplifying a strong content strategy. Quality products are essential. A brand story is important. However, implementing a content strategy, underpinned by effective content operations, helps deliver enduring results in both good times and bad. You can read our latest report on the topic.

Luxury Stock Prices Surge Over 15% from Trough though Sales Forecasts Remain Grim

May 7, 2025

Asset prices have recovered a fair amount of the ground they ceded after the launch of broad-based tariffs by the U.S. on April 2. However, a wave of optimism (justified or not) has swept through markets over the past couple of weeks on hopes that we are past peak policy uncertainty. After a strong start to the year, the S&P 500 is now just down around 4 percent YTD after hitting a trough of -14 percent in mid-April. The Euro Stoxx 50, which remained much more resilient than U.S. indexes, is now up almost 8 percent. The VIX sits at 24 after peaking at 49. Policy actually remains as uncertain as ever, which continues to depress the dollar and power demand for gold, but we seem to be at least taking a small break from the panic.

Our FSW Markets All Luxury Index is now up 11 percent on the year. Like other asset classes, luxury stocks have been on a rollercoaster. Our 18-company, cap-weighted index was up over 20 percent in February on hopes that 2025 would produce a better year for the industry, underpinned by strong U.S. growth, making up for persistently weak demand onshore in China. The bursting of those hopes drove the index down to a 3 percent decline by early April. At the moment, the index has recovered about half of its post-tariff losses and is up 11 percent.

Eight of the index’s 18 company constituents are up on the year. This list comprises: L’Oréal, Hermès, EssilorLuxottica, Moncler, Tapestry, Richemont, Ferrari, and Ralph Lauren. Industry bellwether LVMH (which has again passed Hermès as the largest public luxury organization in the world by market capitalization) is down over 20 percent, having failed to make up any ground after reporting a 2 percent dip in Q1 revenue.

Despite some bounce back in investor sentiment, forward guidance remains grim. Our own FSW Markets forecast is for a 5 percent decline in full-year sales growth. This forecast is down from our January 2025 vintage, which was for a 4 percent increase over last year. The industry contracted 4 percent last year following years of strong, post-pandemic growth well above historical norms for much of the industry.

FSW Markets All Luxury Index Finishes Up After Volatile Week

April 14, 2025

The FSW Markets Index was on the same roller coaster ride as the rest of the equities universe last week. The index closed up 4 percent from April 4 to 11, reflecting a big recovery after closing down 4 percent during the early part of the week. Eleven of the index’s fourteen constituents finished up on the week, led by Hermès, PVH, and Capri Holdings. Prada was up around 1 percent on the week after they announced a 1.25 billion acquisition of Versace.

You can read our commentary on the Prada-Versace deal in Vogue Business: https://www.voguebusiness.com/story/companies/whats-happening-with-the-prada-versace-deal or see our interview on CNN International with Richard Quest:

When the correlations all go to 1

Our FSW Markets All Luxury Index was up almost 25 percent in mid-February. Currently, it is down around 2 percent. As of intraday today, most of the index’s constituents are down on the year with a few exceptions: Hermès (4.0%), EssilorLuxottica (2.6%), and Moncler (0.82%).

In the past week, we have downgraded our luxury industry growth forecasts by around 6 percentage points from the February forecast to -2.5 percent year-over-year. Of course, this point forecast is based on anyone's best guess on the macroeconomic environment that will take root for the remainder of the year, and the interval forecast would be quite wide.

Another strong week for luxury equities

February 17, 2025

The FSW Markets All Luxury Index closed up almost 7 percent last week. Outside of small declines from Burberry and PVH Corp., every constituent of the index was up on the week and most of them big.

The biggest gainer was Kering. On Tuesday, Kering announced that its full-year 2024 annual revenues were down 12 percent, with recurring operating income down 46 percent, and gross margins collapsing from 24.3 percent in 2023 to 14.9 percent (vs. an industry average of 30 percent). And yet, the market believes that it is finally looking at the trough despite or because of CEO turnover at Gucci, YSL, and BALENCIAGA and the removal of Sabato De Sarno.

Hermès closed up over 7 percent after issuing yet another strong earnings report. On Friday, Hermès revealed that annual revenue reached €15.2 billion, a 15 percent increase at constant exchange rates, and a net profit of €4.6 billion, representing 30.3 percent of sales. Growth was everywhere you could look in all geographies and all product lines apart from watches. Hermès' share price is up almost 25 percent on the year, and its market capitalization has now exceeded €300 billion.

This strong week pushed the FSW Markets All Luxury Index up over 20 percent for the year as compared to a roughly 4 percent gain for the S&P 500, which is within 1 percent of an all-time high despite the fact that the January CPI print pointed to stubborn inflation that pushed back market expectations for another interest rate cut. The Euro Stoxx 50 (of which about 10 percent is luxury) closed up over 3 percent amid some positive earnings numbers. In China, the CSI 300 closed up just over 1 percent despite continued fears over the trajectory of tit-for-tat tariffs with the U.S. and more bad news out of the property market.

In the coming week, we will get a look into consumer confidence and retail sales in the UK, the FOMC will release its latest minutes, and we get the countdown to the German national election on February 23.

Another strong Hermès earnings report points to the dispersion in the global luxury market

February 14, 2025

When scrolling the luxury news during the past few earnings seasons, it is becoming increasingly less remarkable to see the latest autopsy of a global luxury crisis followed by deep dives into the income statement of Hermès that use words like “remarkable” and “resilient.” February 14 was one of those days. Many industry watchers will again be pulling out positive adjectives to describe Hermès’ newly released full-year 2024 results and may also be hoping to receive an orange box with brown trim in their Valentine’s Day stash.

Hermès’ 2024 financial results showed the brand delivering more exceptional growth with annual revenue reaching €15.2 billion, a 15 percent increase at constant exchange rates, and a net profit of €4.6 billion, representing 30.3 percent of sales. Growth was everywhere you could look in all geographies and all product lines apart from watches. Demand from China was noted to be softer but Asia (x. Japan) sales were still up 7 percent with strong growth recorded in Japan (23 percent), Europe (19 percent), and the Americas (15 percent). Product categories such as leather goods (+18 percent), ready-to-wear (+15 percent), and jewelry/home collections (+17 percent) performed well, while watches saw a slight decline (-4 percent) due to a high comparison base. While we read a lot about luxury having weaker pricing power after misusing it for so many years, Hermès remains confident in its pricing strategy (+6-7 percent increase for 2025) and its ability to maintain exclusivity and desirability in the luxury market.

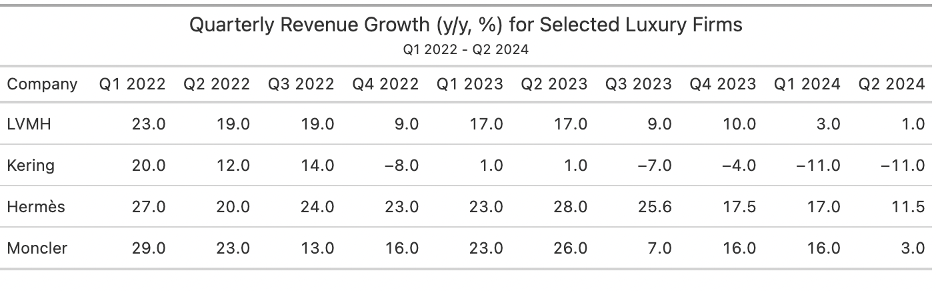

So far this earnings season, most industry central tendency measures of sales growth such as average or median growth have softened, yet the standard deviation has risen.

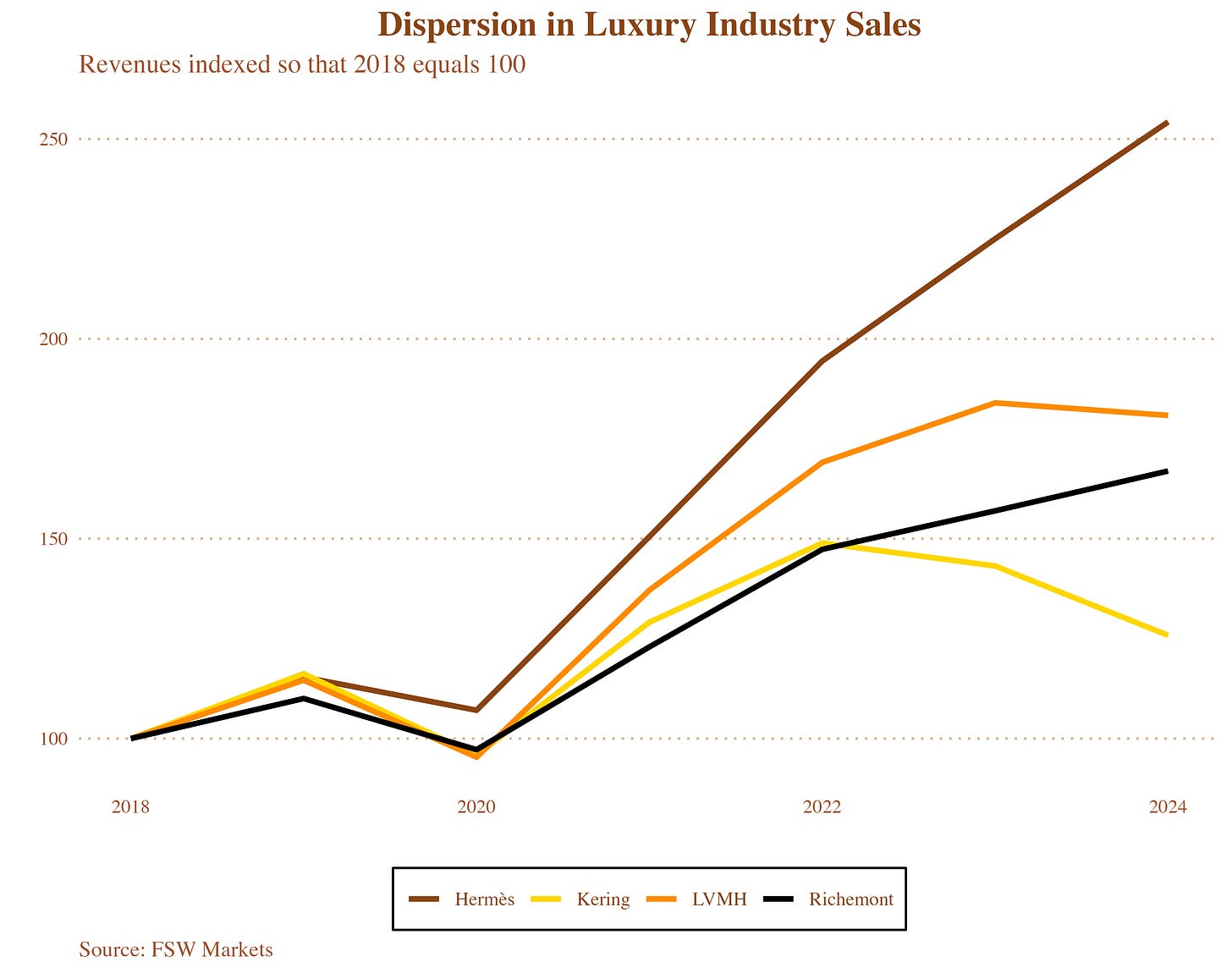

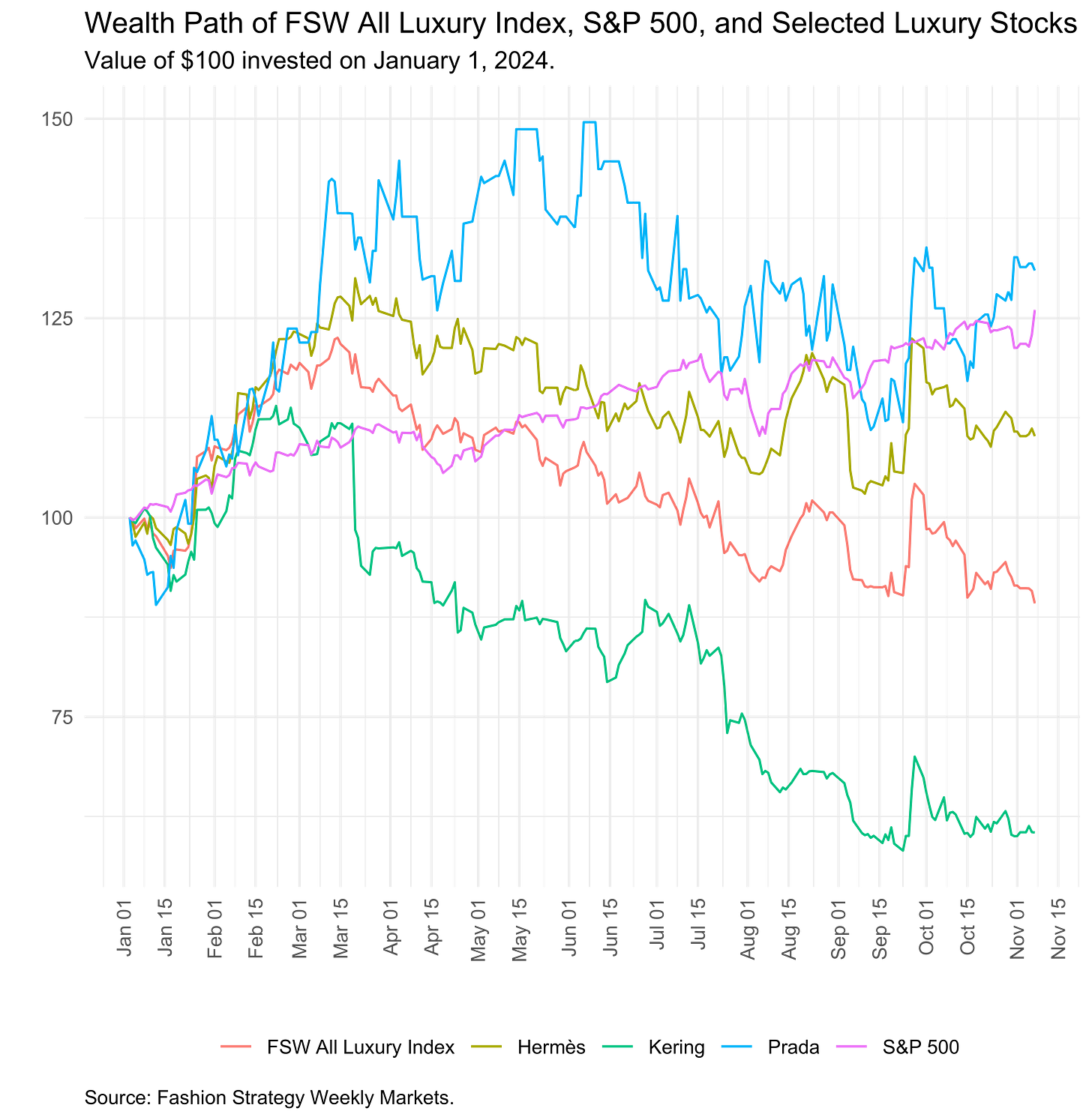

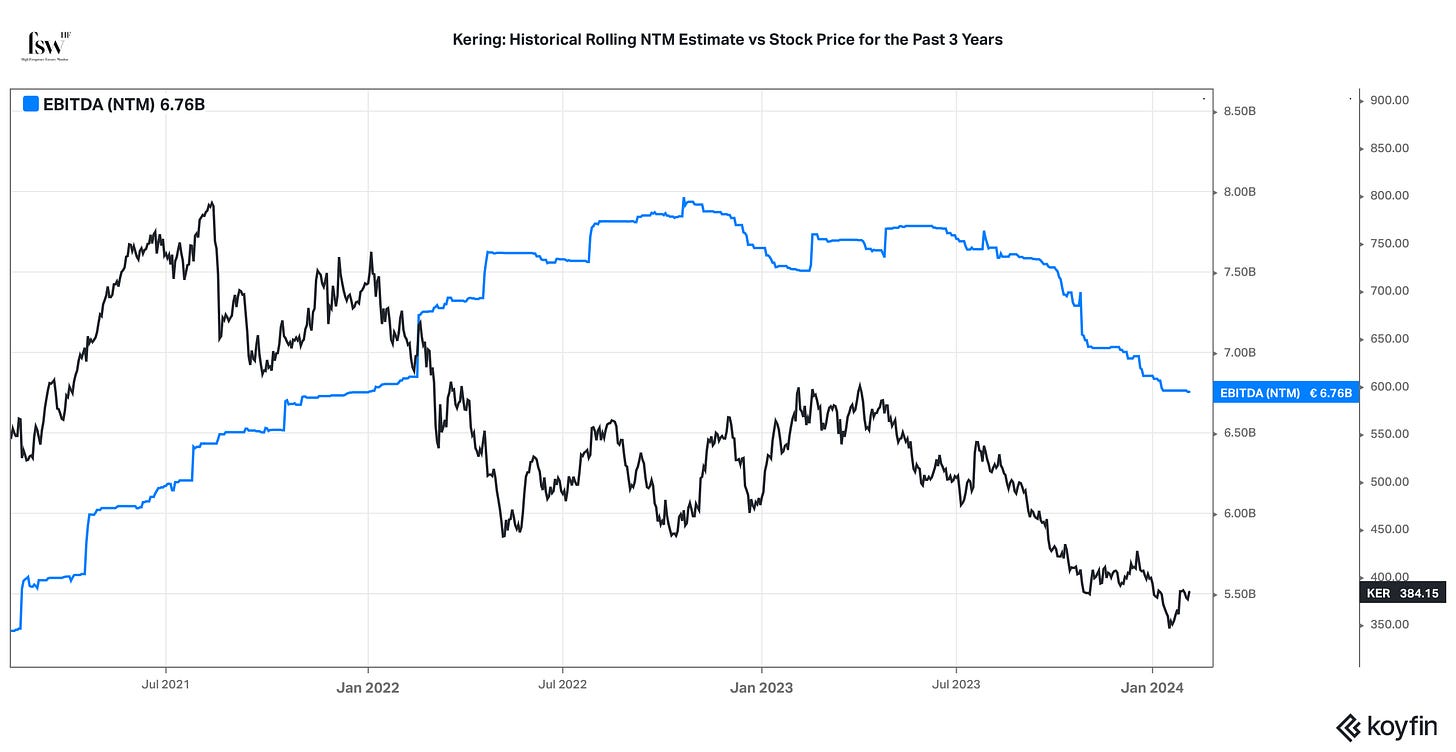

In the below, I pulled out the earnings for four of the industry heavyweights and indexed them to 2018 level so that we could see some evolution from before, through, and after the pandemic. Coming out of the pandemic, most of the industry realized explosive growth. That growth continued at rates that exceeded historical norms for many brands with Kering a notable exception as poor sales at Gucci began to pull down in 2023 when much of the rest of the business was still growing over 10 percent a year and maintaining strong margins.

Yet, 2024 has been a year of a mini structural break. We were already seeing quite a bit of industry dispersion in 2023, but this year the variance really stands out now that LVMH (about a third of luxury fashion revenues) tipped slightly down.

Market yawns as Kering reports more terrible results

February 11, 2025

🔘 Kering has been the sick man of the luxury for a while now. Their participation in the post-pandemic luxury top-line growth party was substantially less than that of many of its competitors (e.g., revenue growth in 2021 was 10 percentage points lower than LVMH) and the revenue buying glow faded faster with Kering reporting negative sales growth in 2023 when the rest of the industry was still growing. In the last year, there has been CEO turnover at Gucci, YSL, and BALENCIAGA. And let us not forget that Sabato De Sarno left Gucci last week after less than two years. As an instinct, I normally write that Gucci comprises about half of Kering’s group revenues. But, after a 23 percent collapse in FY24, Gucci now kicks in 44 percent.

🔘 It is a sign of Kering’s times when the market mostly shrugged off today’s results. As of the time of writing, Kering’s intraday share price is actually up over 100 basis points, lifting its YTD by 3.4 percent. This is well below the 13 percent gain for our FSW Markets All Luxury Index, but it shows that the market mostly expected today’s results and perhaps was somewhat cheered by the dedication to make FY25 a year of stabilization.

🔘 So how low did it go? Revenues were down 12 percent year-over-year when recurring operating income was down 46 percent. Operating margins collapsed from 24.3 percent in 2023 to 14.9 percent last year. Looking at the decomposition of gross margins, top-line growth was down 12 percent, gross margin rate (revenue remaining after subtracting the costs of goods sold) was down 2 percent, FX/hedging was down 3 percent, while scope was up 2 percent, which presumably was due to the continued integration of Creed into the Kering portfolio. However, these margins really stand out in an industry where operating margins typically fall in the 25-35 percent range. Free cash flow was down 27 percent (though this looks better if you exclude real estate transactions), while net financial debt rose almost 25 percent with acquisitions of buildings in New York and Milan.

🔘 Much has been written about what has gone wrong at Gucci and Kering and what it will take to return to industry norms. Today’s report leaned heavily into FY25 being about stabilizing the income statement - in effect, hitting a trough. We will see.

You can find the full report here: https://lnkd.in/emf9sUzb

You can reach how we ranked Kering brands against competitors in content effectiveness in our 2025 industry preview here: https://lnkd.in/gEesD7eJ

Ralph Lauren and Tapestry release strong sales numbers that underline the importance of content effectiveness in an increasingly diffuse luxury market

The dispersion story continues in luxury fashion as more end-of-2024 earnings numbers roll in. Tepid results from LVMH on January 27 led to a small luxury market sell-off, but earnings numbers from Ralph Lauren and Tapestry today show that it is not all doom and gloom.

On February 6, Ralph Lauren reported blowout results for the period of October to December, which showed an 11 percent increase in their third-quarter revenue, reaching $2.1 billion, up from $1.9 billion in the same quarter the previous year. This growth was driven by increases across all reportable segments despite unfavorable foreign currency effects. The company achieved a gross profit of $1.5 billion, with a gross margin of 68.4 percent, up from 66.5 percent in the prior year. Notably, revenue growth in China was in excess of 20 percent and fairly balanced across geographies. This allowed Ralph Lauren to lift their full year FY25 forecast to 6-7 percent.

Tapestry, the parent company of Coach, kate spade new york, and Stuart Weitzman, reported a 5 percent year-over-year increase in second-quarter revenue, totaling $2.2 billion. This growth was primarily driven by a 10 percent increase in Coach sales, attributed to the popularity of items like the Tabby and Brooklyn bags, which have resonated with Gen Z consumers. Over half of the 2.7 million new North American customers acquired by Tapestry in Q2 were Gen Z and millennials. In contrast, sales at Kate Spade and Stuart Weitzman declined by 10% and 16%, respectively. Tapestry, presumably meaning Coach, also recorded positive growth in China at 2 percent on a constant currency basis. The company achieved a gross profit of $1.6 billion, representing a 9.4% increase, supported by operational improvements and reduced freight costs. Tapestry raised its full-year 2025 earnings per share outlook to $4.85 to $4.90, up from the prior guidance of $4.50 to $4.55, and now anticipates revenue of over $6.9 billion, representing approximately 3 percent growth.

Intra-day trading in New York sees Tapestry up over 12 percent and Ralph Lauren up over 9 percent, implying YTD price appreciation of over 25 and 17 percent, respectively.

As we argued in our 2025 luxury industry preview (https://lnkd.in/djJwqbaG), brands with effective content strategies, like Ralph Lauren and Tapestry, continue to deliver strong results. This strengthens the thesis that the luxury market is not in decline as much as it is experiencing extreme dispersion. Brands that can connect with consumers with effective stories and offer seamless digital shopping experiences are winning with consumers. Note the positive correlation between sales growth and the Fashion Strategy Weekly content effectiveness index, produced by staff at It’s A Working Title, LLC®️, below.

Amid mixed 2024 earnings reports, investors’ confidence in luxury has taken a beating in the past week

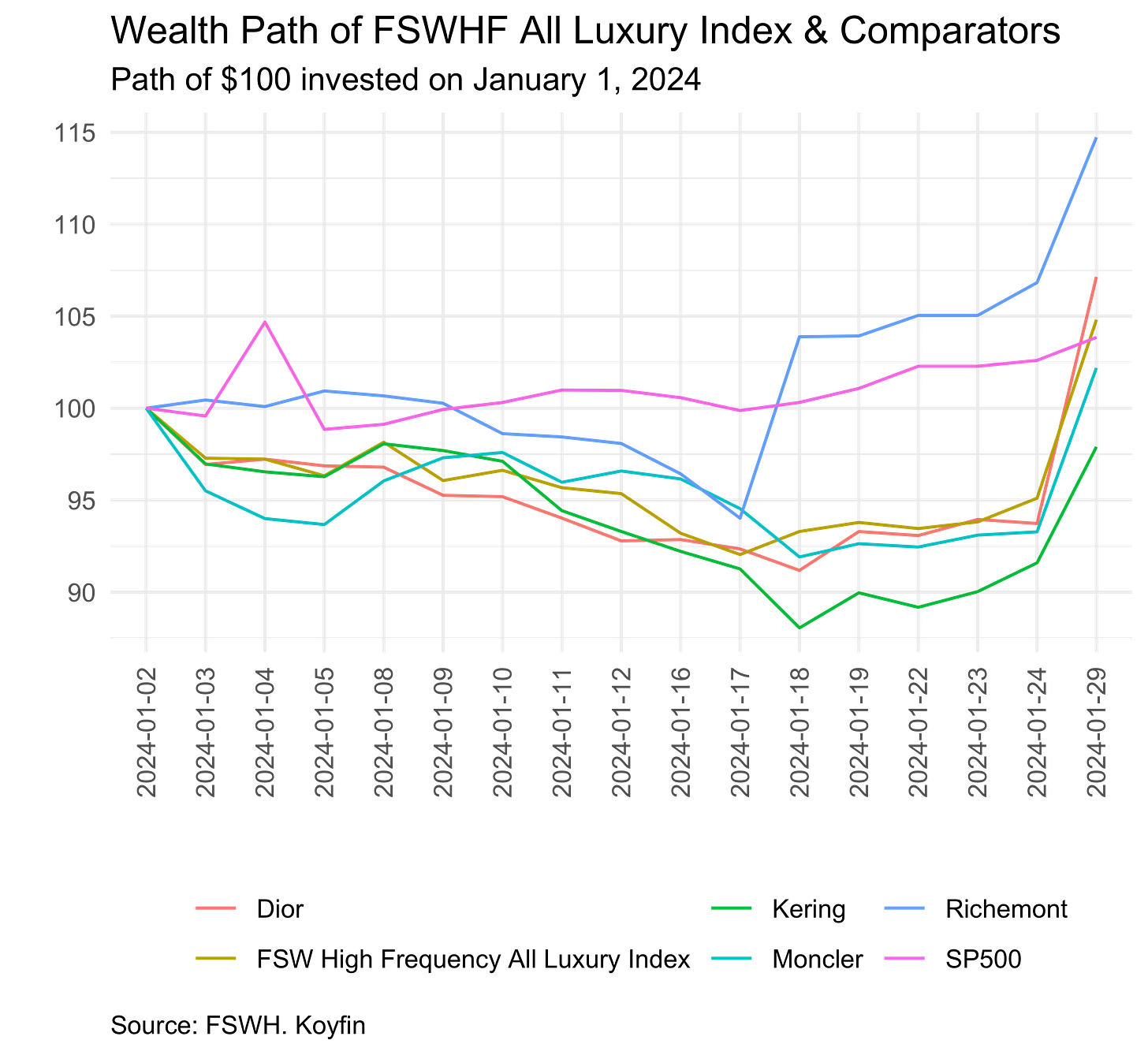

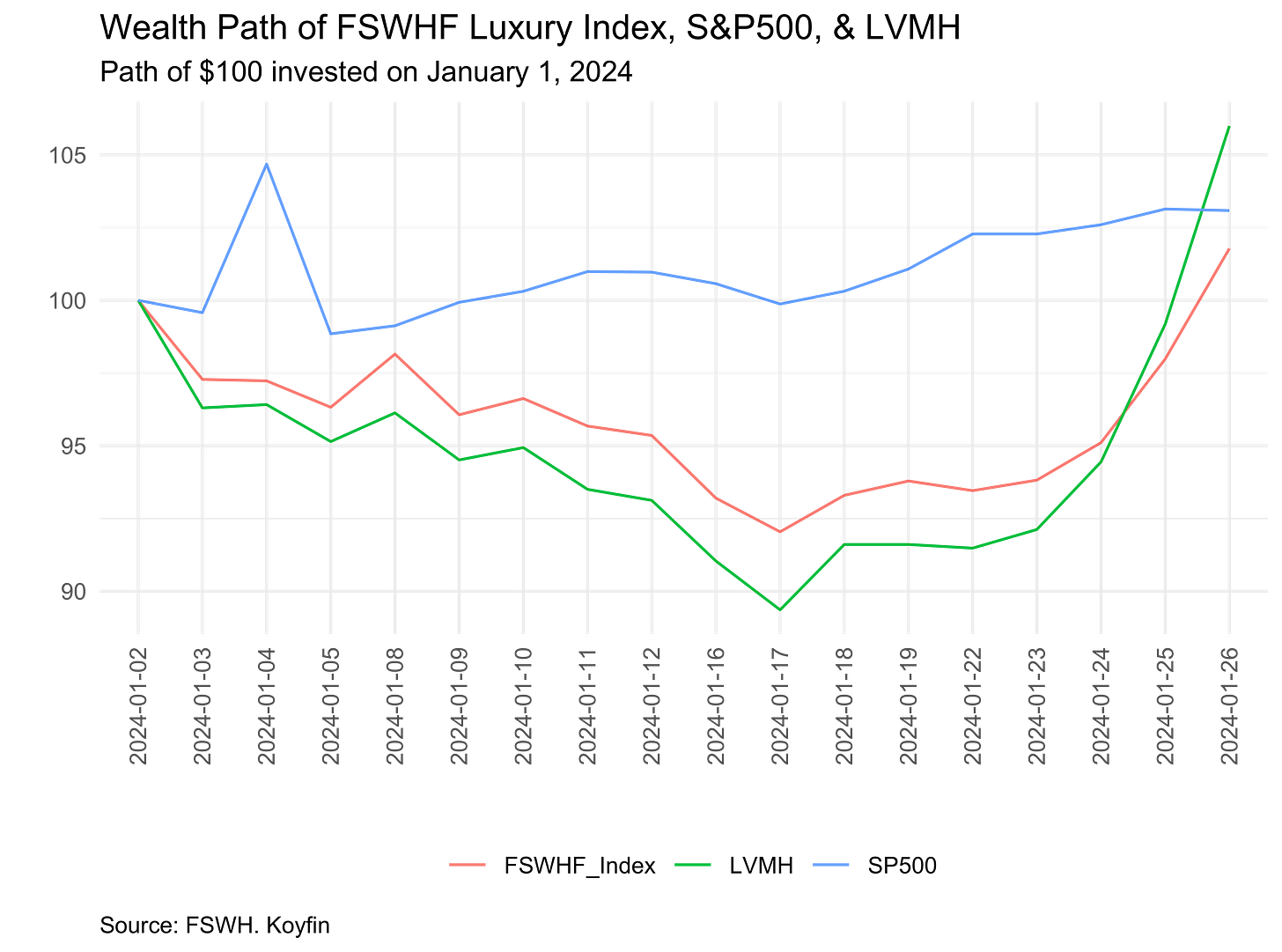

Luxury industry earnings reports have been a bit mixed over the past week as the full year 2024 numbers rolled in. Richemont, Ferrari, and Zegna punched above analyst expectations while LVMH was sort of half hot and half cool.

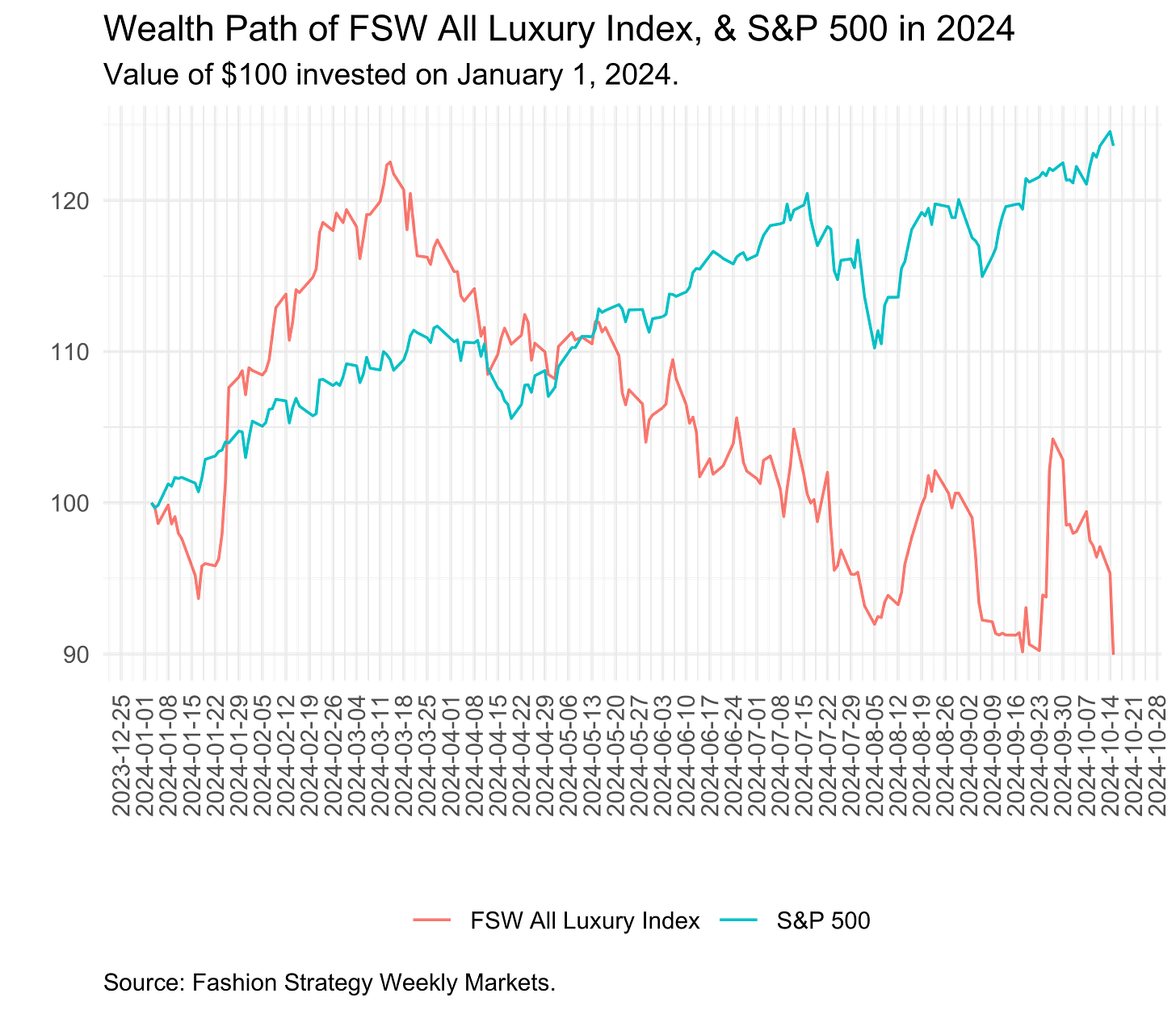

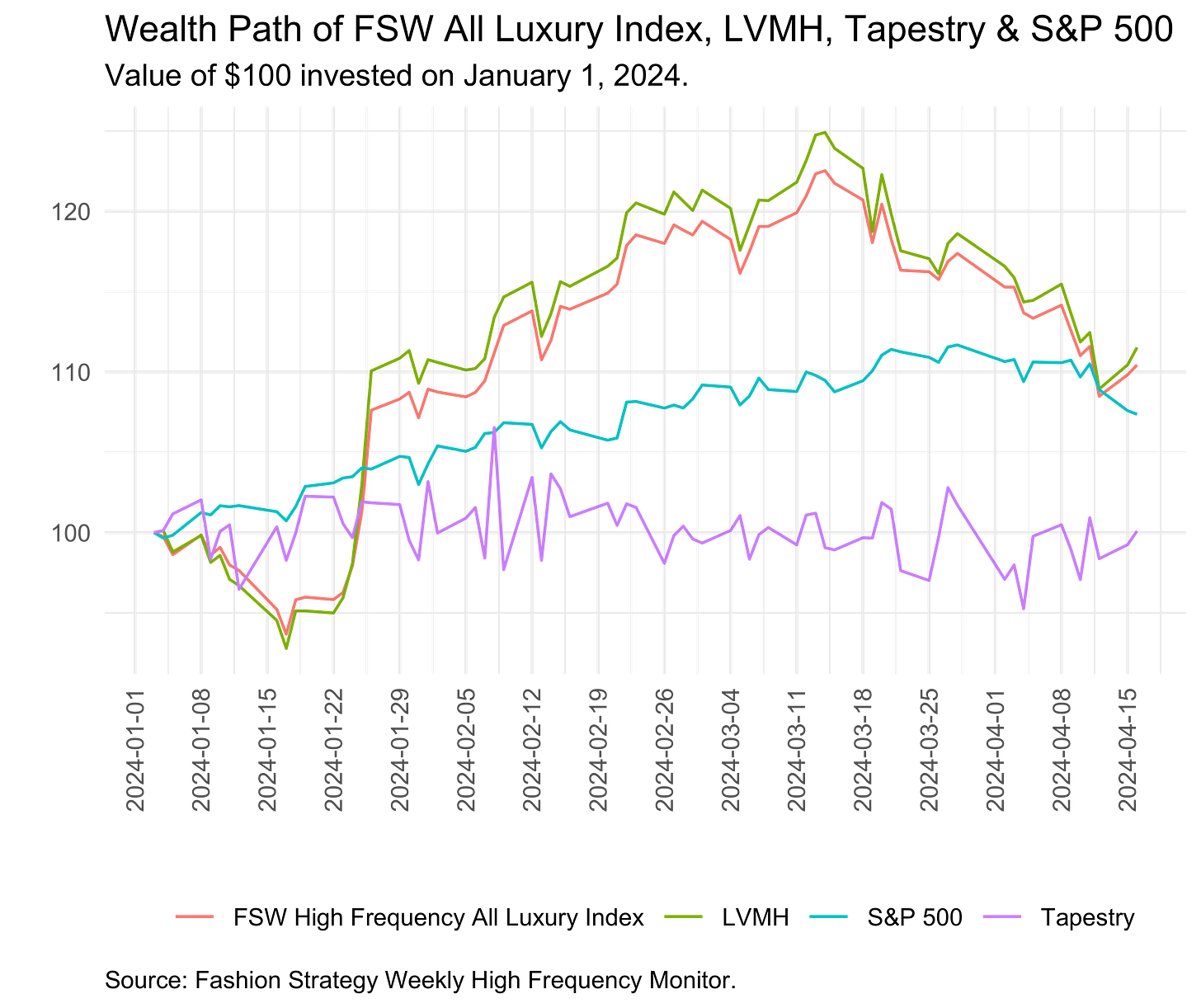

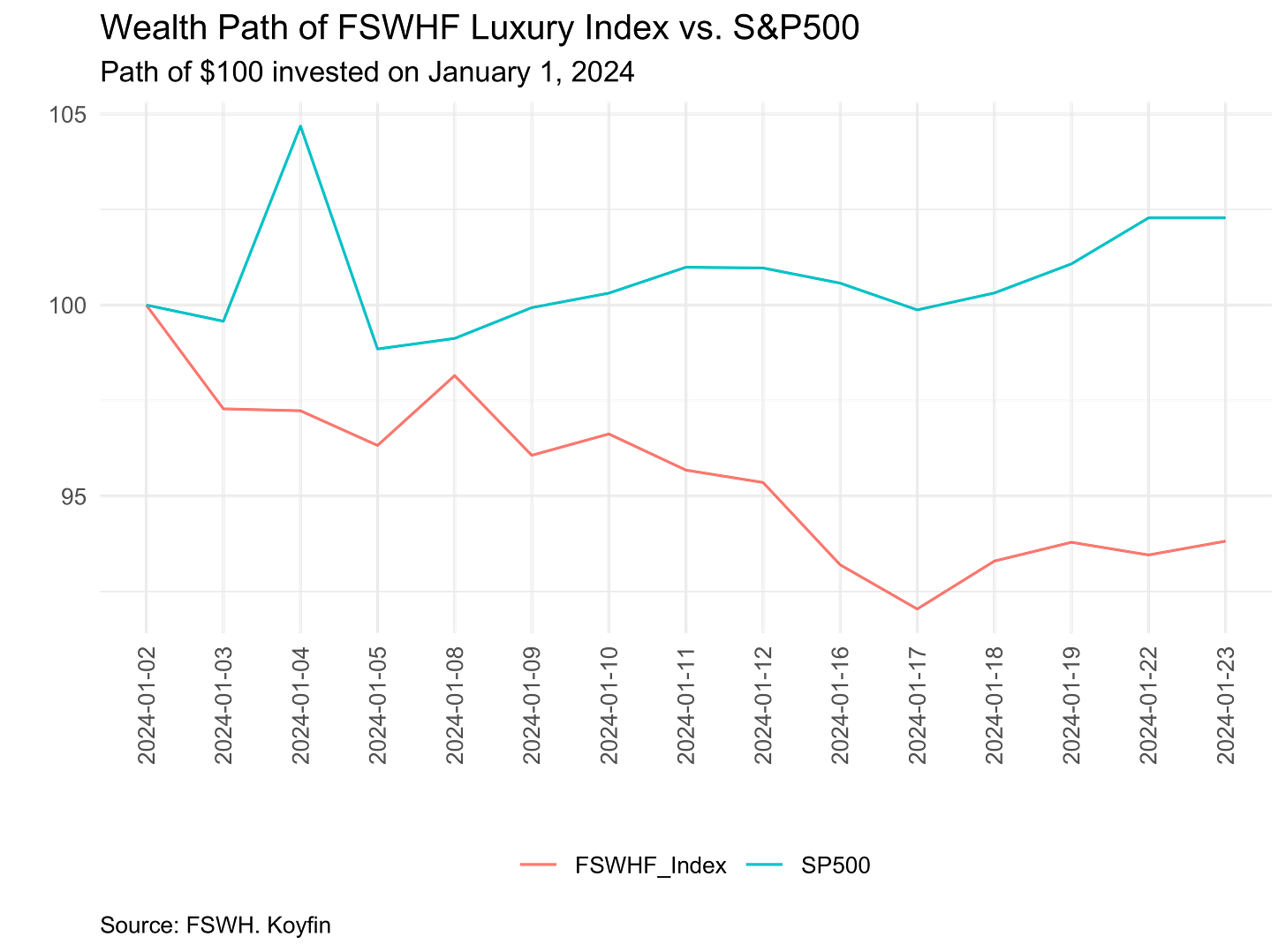

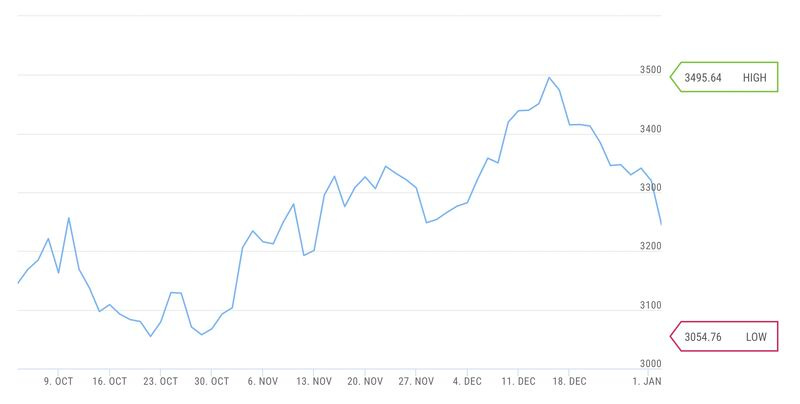

In the midst of these reports, investors’ confidence in a bounceback for the industry this year has turned south. As the below line plot exhibits, our FSW Markets All Luxury equity index came out of the gate quickly in January, but earnings reports combined with fears over the impact of U.S. tariffs on the mostly Europe-based luxury industry has taken its toll. On January 27, the index was up almost 21 percent for the year while bellweather LVMH was up 25 percent. Since then, both have lost about 10 percentage points. This still puts the industry above benchmarks such as the S&P 500 and Euro Stoxx 50, but the trend is not going in the right direction as more earnings reports are released.

Though we are still waiting for more 2024 results, it seems likely that the industry suffered its first negative annual growth rate last year if we exclude years impacted by the GFC and Covid. We continue to forecast a weak H1 2025 followed by a small bounce back in H2. You can find our forecasts here: https://www.fashionstrategyweekly.com/p/lvmhs-full-year-2024-results-point

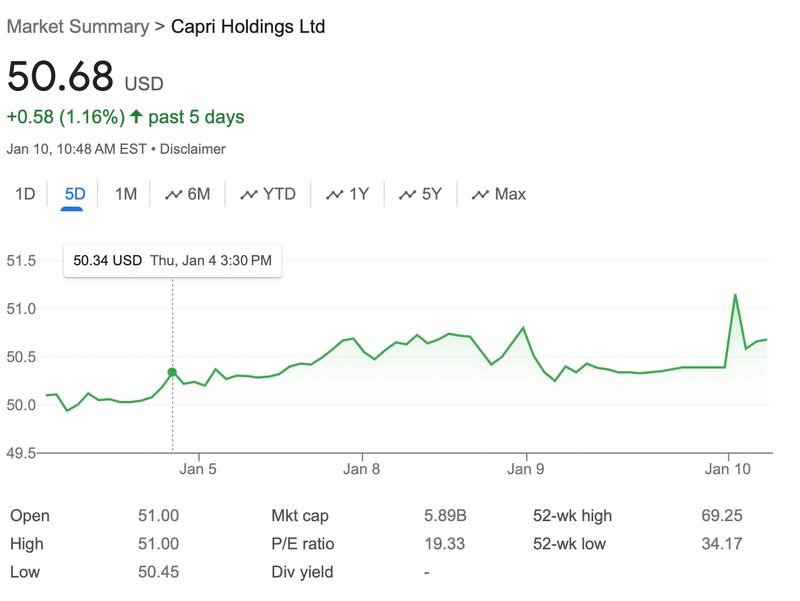

Looking at the markets intraday, Capri Holdings Limited is down almost 13 percent today after reporting a $547 million net loss for the period of October to December, primarily due to a non-cash impairment charge of $602 million. On an adjusted basis, earnings per share were $0.45, falling short of analyst expectations of $0.66. Revenue decreased by 11.6 percent year-over-year to $1.26 billion, with declines across all major brands: Michael Kors' revenue in the Americas declined by 10 percent while Asia experienced a 27 percent drop. Both Versace and Jimmy Choo reported sales declines during the holiday quarter. Looking ahead, Capri forecasts fiscal 2025 revenue of $4.4 billion and fiscal 2026 revenue of $4.1 billion, both below Wall Street estimates, indicating a slow recovery in luxury goods demand.

FSW Markets Weekly Roundup: Luxury Industry Retreats for the First Time this Year after LVMH Results and Looming Tariffs

Our FSW Markets All Luxury Index was down 6 percent over the past week, following a sharp decline in LVMH after releasing its full-year 2024 earnings report on January 27. Half of the index’s 18 constituents were down as LVMH was joined by Ralph Lauren, Tapestry, Kering, L'Oréal, PVH Corp., Capri Holdings Limited, and Moncler, which were roughly down 2 percent for the week.

The index remains up 14 percent for the year compared to a 2.3 and 8.6 percent return for the S&P 500 and the Euro Stoxx 50, respectively. However, the market’s reaction to LVMH’s earnings report will be cautionary for the industry as we continue to wade into further 2024 earnings reports. As we discussed in our review of the LVMH report (https://www.fashionstrategyweekly.com/p/lvmhs-full-year-2024-results-point), there were some positives and negatives to read into its 2024 results.

One negative that stands out more prominently now than it did mid-week is the possibility that hopes that growth in U.S. sales would be able to fill some of the gap left by Chinese consumers could be misplaced. For LVMH, sales in Asia (excluding Japan) were down 11 percent, while U.S. sales were up 2 percent. However, the rollout of broad-based and untargeted U.S. tariffs against Canada and Mexico last week will send a shiver down the spine of the luxury industry. The U.S. administration has suggested that tariffs against the EU are coming, prompting a promise of retaliation from Europe.

This is bad news for the luxury industry and Europe more broadly. Triangulating among a variety of sources, luxury products account for around 5-8 percent of European exports to the U.S. The American market represents about 25 percent of the global demand for European luxury organizations, and this percentage has been growing.

In other news, in the past week, U.S. GDP grew at 2.3 percent in Q4 and 2.8 percent for the full year, slightly below consensus forecasts but ahead of long-run forecasts. The European Central Bank cut rates by 25 basis points to 2.75 percent amid continued weak eurozone growth. News continued to be poor out in China as PMI data pointed to worsening conditions across manufacturing, services, and construction.

In the week ahead, we will get an interest rate decision from the Bank of England, further PMI data from China, and a U.S. inflation report.

Luxury share prices surging ahead of LVMH's full-year 2024 earnings release on Tuesday

The FSW Markets All Luxury Index is up over 14 percent this year. This compares with a nearly 10 percent decline in 2024. Fifteen of the index’s eighteen constituents are up, led by Richemont (up around 25 percent YTD) after their strong Q3 report, Burberry (up around 18 percent) after a better-than-feared full-year 2024 report and enthusiasm for its new strategic direction. Industry giant LVMH, which comprises around a third of luxury fashion revenues, is up over 17 percent as investors hope that the doom and gloom surrounding the industry last year has begun to lift as hopes that American consumers will help fill the void left by China’s luxury shoppers.

Part of the story on the equity side is a generally strong Europe so far this year. The Euro Stoxx 50 is up over 6 percent, while the Paris CAC-40 is up closer to 8 percent. It is well worth noting that luxury is a big constituent of European exchanges, kicking in about a third of the CAC’s value.

After Paris closes on Tuesday we will get a major industry barometer for holiday sales success as LVMH will report its full-year earnings. Analysts have set cautious expectations for LVMH's upcoming full-year and fourth-quarter 2024 financial results. The consensus anticipates a 1% decline in fourth-quarter sales, with the pivotal fashion and leather goods division projected to experience a 3% decrease. This follows on from a weaker-than-expected Q3 where a 3 percent sales drop disappointed investors who, on the median, predicted a 1 percent increase.

The FSW Markets industry forecast is still for a 5 percent industry contraction in full-year 2024, followed by a 1.7 percent gain in full-year 2025 with a weak H1 2025.

You can find the Fashion Strategy Weekly 2025 year-in-preview here: https://lnkd.in/eXQWXGmW

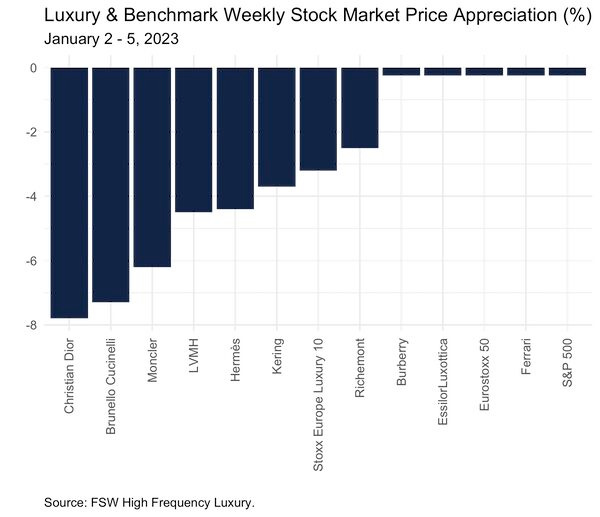

Luxury Strikes Back as Luxury Earnings Season Kicks Off

The start of the year looks, for a potentially brief moment, like a reboot for luxury after some strong earnings releases from Brunello Cucinelli and Richemont over the past week. The sour mood surrounding the retail luxury industry, particularly luxury fashion, for the past six months or so may lift for at least a bit after Brunello Cucinelli announced full-year 2024 revenue growth of 12.4 percent with strong growth across all geographies, including China. This was not a total shock as Brunello Cucinelli was among the strongest performers in a year when dispersion in sales growth was the theme of the first nine months of the year.

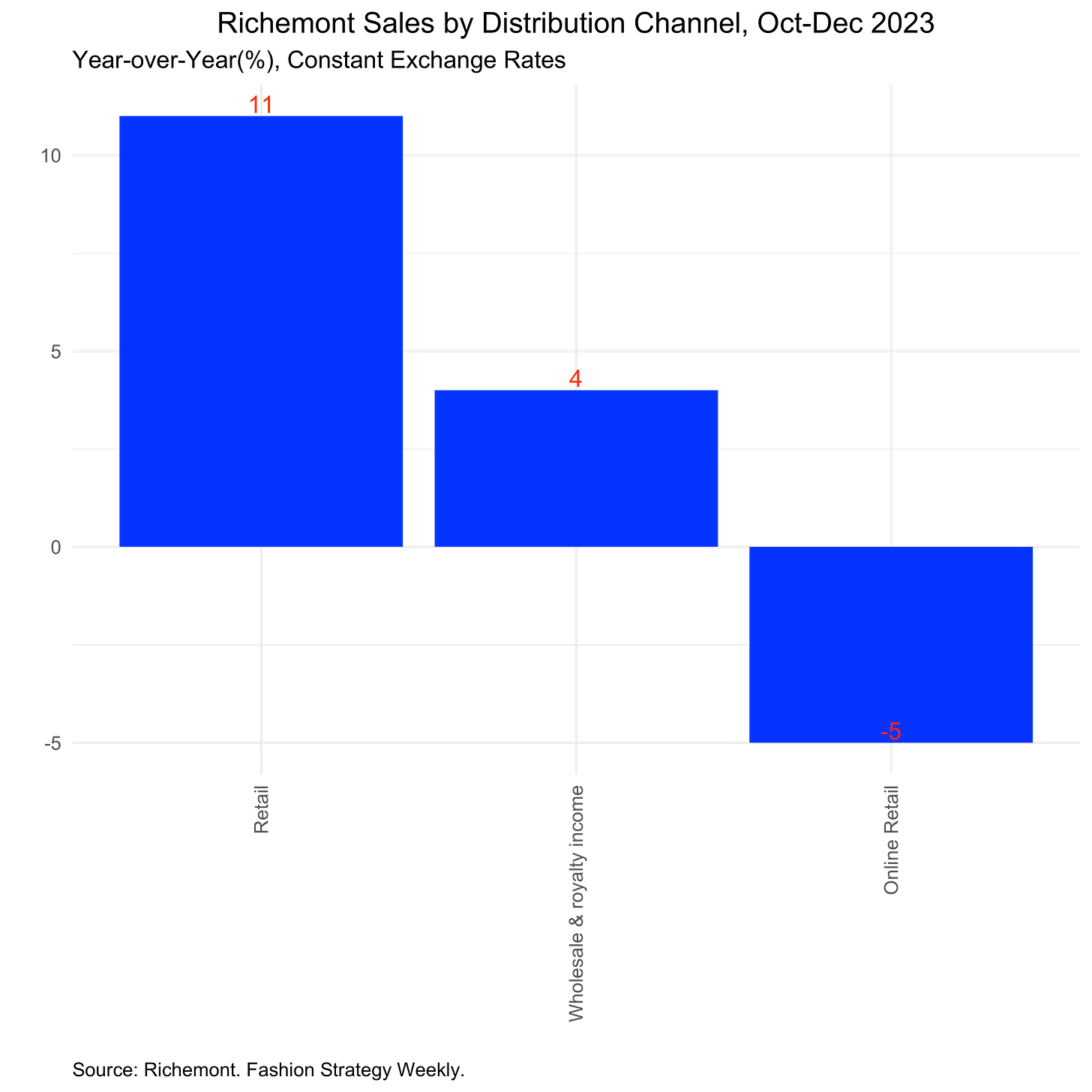

However, Richemont surprised investors by posting a strong Q3 (October to December on the fiscal calendar) of 10 percent growth, implying a 4 percent growth rate during the first nine months of their reporting year. Like many of the larger luxury groups, sales were weak in Asia Pacific (down 7 percent, comprising about a third of sales) during the quarter, with growth powered by ~20 percent growth in the Americas (24 percent of sales), Europe (23 percent) and MENA (0.08 percent).

These results powered optimism for luxury in financial markets. Our cap-weighted FSW Markets All Luxury Index was up 17 percent on the week and is now up almost 20 percent on the year. Luxury represents about a third of the Paris CAC-40 and that index was up 2.8 percent on the week and 4.5 percent on the year. This compares to a 2 percent return for the S&P 500 and 1.4 percent decline for the SPDR S&P Retail ETF (XRT) this year. Industry titan LVMH, which kicks in about a third of global luxury fashion revenues, has at least briefly regained its crown as the largest company in Europe from a slumping Novo Nordisk.

It is unclear to what extent this past week’s results are a leading indicator for the rest of the industry as we wade further into the full-year 2024 earnings season. Richemont’s sales are dominated by its Jewelry Maisons division, including Cartier and Van Cleef & Arpels. This division represents almost three-quarters of group revenues and was up 14 percent for Q3. So, groups with heavier exposure to soft luxury and aspirational consumers may struggle. For what it is worth, Richemont’s “Other” division, which includes fashion and accessories brands, such as Chloé and Maison Alaïa, was up 11 percent for the quarter even though they are a small part of the Richemont pie.

In global macro news that impacted the industry last week, China’s Q4 GDP growth print beat expectations at 5.4 percent. However, recent private consumption numbers do not point to a near-term rebound. U.S. CPI came in at 2.4 percent, countering fears that we may see more hikes.

Coming up this week, we will see some economic activity indicators out of Europe on Friday. Most critically, we will see what the first few days of the Trump administration bring regarding tariffs and other announcements.

Brunello Cucinelli Reports Industry Beating 2024 Revenues

Brunello Cucinelli continues to outperform most of the luxury industry, announcing full-year 2024 revenue growth of 12.4 percent (constant exchange rates) on January 13. With much of the luxury industry slowing from the rapid rates of growth experienced during the post-pandemic supercycle, Brunello Cucinelli has been one of those brands that has continued to grow.

Most of the luxury fashion industry has been pulled down by weak growth in Asia, but Brunello Cuccinelli was among the few brands that powered past that trend. Its revenue growth in Asia, which comprises about a third of total revenue, was up over 12.6 percent in 2024, second only to growth in the Americas at 17.8 percent.

After the brand experienced unprecedented post-pandemic growth in 2021, its owner, Brunello Cucinelli, told Vogue Business, “We do not wish to grow fast. Rapid, sudden growth isn’t rational, and it isn’t sustainable. It creates problems.”

Regardless, in a year in which we have seen differentiation across the luxury industry after several years of broad-based growth, Cucinelli has grown fast. The figure below exhibits semi-annual revenue growth rates for Cuccinelli, reflecting Monday's data release, and the FSW Markets forecast for the rest of the industry.

You can read Brunello Cucinelli's 2024 full-year earnings release here: https://lnkd.in/eyhg4EQx

You can read our views on why Brunello Cucinelli has been one of the year's top performers in a recent Fashion Strategy Weekly post here: https://lnkd.in/e6dvEbZD

The New Year Brings Key Macro News for the Luxury Industry

There was a lot of global macro news released during the first full trading week of the year with the potential to impact the retail luxury and premium sector. The FSW All Markets Index is now up 4.5 percent on the year with 14 of the 18 index constituents gaining. The first wave of macro news this year points to a mix of head- and tail-winds for the industry.

The biggest gainers have been Capri (up 17 percent) on rumors that Prada may purchase Versace from the struggling group, Moncler (up 7.6 percent) as extremely cold weather strikes across the U.S., and Brunello Cucinelli (up 5.7 percent) as the brand continues to go from strength to strength. Industry giant LVMH is up 4.6 percent so far this year.

Key macro news for luxury and premium market watchers this week included:

Deflationary pressures in China continue as consumer prices in December were up 0.1 percent while producer prices fell for the 27th consecutive month. This is more bad news for the industry given the role that China has played in powering growth over the past decade. You can find our view and China forecasts here: https://www.fashionstrategyweekly.com/p/forecasting-the-future-of-luxury

Interest rates in the U.S. may be holding steady in 2025. Minutes released by the Federal Reserve reflected a hawkish stance with no significant rate cuts expected this year. The yield on the U.S. 10-year note rose to 4.77 percent, signaling diminished expectations for further cuts that might help spur demand from U.S. aspirational consumers. Yet, countering this is a persistently strong labor market as the December jobs report saw 256,000 jobs added, blowing past expectations for 100,000. The unemployment rate fell to 4.1 percent.

Consumer prices in the Eurozone rose 2.4 percent in December. This was in line with economists’ forecasts, yet expectations are becoming more mixed about ECB plans for 2025 rate cuts. The Euro is down over 1 percent to the U.S. dollar so far this year.

You can find the current annual FSW Markets luxury industry forecasts here: https://itsworkingtitle.com/what-lies-ahead-for-luxury-in-2025/

What lies ahead for luxury in 2025?

January 6, 2025

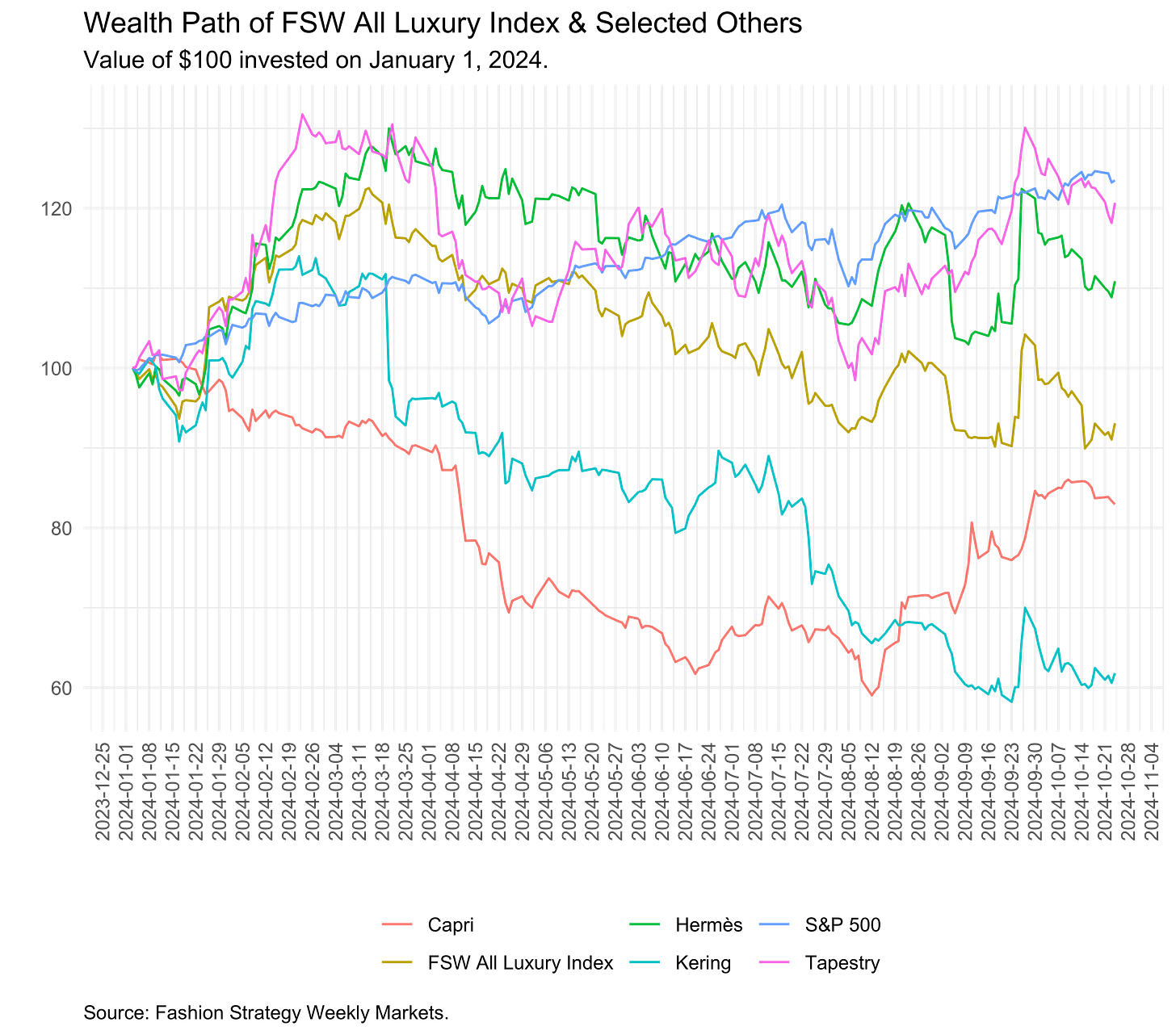

As was widely anticipated a year ago, the retail luxury industry saw the end of the post-pandemic supercycle in 2024. Despite reasonable global economic growth and positive “wealth effect” contributions from generally good global equity market performance, luxury sales slowed across most product categories. In the first nine months of the year, annual luxury fashion and jewelry revenues were down about 3 percent, fine wine and spirits were down around 10 percent, and collectible automobile sales were flat. Our FSW Markets All Luxury equity index was down 10 percent in a year when the S&P 500 was up 23 percent.

The reasons for this slowdown have been fairly well understood. There has been slower demand by Chinese consumers both onshore and offshore. Middle-class consumers across all geographies have slowed discretionary spending with economy-wide higher prices. Double-digit luxury price increases have put off even some normally price-inelastic consumers. We should also add the importance of good old base effects after three years of strong growth underpinned by post-pandemic revenge consumption.

So, how big is the slowdown so far? Going back to 2004, there have been six years of annual decline in luxury sales: 2004, 2005, 2008, 2009, and 2020. Yet, since the global financial crisis in 2008, there has not been a decline in annual sales until the pandemic year in 2020. But the post-pandemic bounce was historically unique. The average yearly revenue growth from 2010 to 2019 was 11.6 percent. Yet growth in 2021 was almost 50 percent, followed by 24 percent growth in 2022. After such breakneck growth, it is hardly a wonder that growth slowed to around 9 percent in 2023 (just below the recent historical norm) and was down around 5 percent in the first 9 months of 2024.

So what lies ahead for 2025 and 2026? The FSW Markets econometric model, augmented with AI/ML elements to guard against overfitting, predicts that the industry will experience fairly sharp contractions in H2 2024 and into H1 2025 before experiencing a decent bounce back in H2 and fairly moderate growth into 2026.

Luxury Slowdown Has Been Broad-based in 2024

December 30, 2024

Luxury assets across almost all classes has been poor this year. Despite reasonable global economic growth and good “wealth effect” contributions from generally good equity market performance across most large economies this year, the post-pandemic supercycle has slowed on everything from luxury fashion to jewelry, watches, art, wine, and automobiles.

As the figure below illustrates, a snap shop of some specifics includes:

Fine wine has lost about 10 percent

Diamond prices were down by 29 percent

Collectible car prices were flat

Our FSW Markets All Luxury Index is down almost 10 percent

The explanations for the end of the supercycle have been pretty consistent over the course of the year: slowing demand by Chinese consumers both onshore and offshore, as we discussed in this issue of Fashion Strategy Weekly (https://www.fashionstrategyweekly.com/p/forecasting-the-future-of-luxury) and a drawdown in demand from “aspirational” consumers unable or unwilling to keep up with the 54 percent increase in luxury prices over the past five years amid rising costs for necessities. Further, The Economist notes strong performance of equity markets and even crypto (Bitcoin is up over 120 percent YTD) this year means that the opportunity costs of investing in luxury (for those who treat it as an asset class rather than a passion project) have been high. (https://www.economist.com/finance-and-economics/2024/12/27/why-fine-wine-and-fancy-art-have-slumped-this-year)

Many believe that 2025 may be better than 2024, yet it is unclear what variable that pulled down growth in 2024 looks more positive 2025 based on near-term forecasts. But, of course, most forecasts tend to be grounded in a mathematical or mental model that is effectively some extrapolation of the most recent past, so in short, things change.

The biggest takeaway for any brand in these broad-based asset classes is that while all brands are subject to the same macroeconomic environment, only some have unveiled innovative holistic brand content strategies that deeply resonate with a commitment to luxury brand storytelling. This year's most successful brands have tended to feature content strategies that represent an on-brand, well-thought-out plan that perfectly shows how content and technology can work together to bring a more authentic approach to digital customer experience.

We have covered why we think some brands are winning the content, and hence the sales wars this year for Brunello Cucinelli (https://lnkd.in/e6dvEbZD), Loro Piana (https://lnkd.in/eW6VQYhK), and Miu Miu (https://lnkd.in/eCWjKd25).

Luxury assets pullback after their strongest week of the year

December 22, 2024

After recording one of the best weeks of the year, luxury assets were down around 2 percent last week, which was in line with a fairly risk-off five days of trading. Of the 18 constituents of our FSW Markets All Luxury Index, 11 were down on the week, led by Ferrari (-4.6 percent), Kering (-4 percent), and Prada Group (-3.3 percent). HUGO BOSS led the gainers and was up by over 4 percent though Boss remains down by over 30 percent year-to-date. Tapestry continued to gain this week and is now up over 70 percent in a tumultuous year for the group.

Looking at macro news impacting the industry over the last week, China's retail sales rose by 3% year-on-year in November, slowing from a 4.8% growth in the previous month and below market expectations of a 4.6% gain. This marked the weakest growth in retail activity since August. On the other side, retail sales in the U.S. increased 3.8% year-on-year in November, the biggest annual rise since December last year, following an upwardly revised 2.9% gain in October. As expected, the Federal Reserve announced a 25 basis point interest rate cut on Wednesday though the path of interest rate cuts next year looks shallower than that expected a month or so ago.

Macro news will be fairly thin for the remainder of the calendar year. FSW Markets will release its year-end review next week while Fashion Strategy Weekly will post its views on what to expect in retail, luxury, and fashion strategy in 2025 in early January.

To what extent is China pulling down the luxury industry?

December 17, 2024

Luxury is set for its worst sales performance in the last 15 years apart from the pandemic-hit 2020. Yet, the downturn has not been universal, and some brands have continued to perform well, especially those that have continued to succeed in China despite the country’s slowing demand for luxury.

So, how much of the industry's slowdown is due to China? Looking at balance sheet data for a sample of brands to give us a top-down perspective. Revenue growth in China, as we expect, has been weaker than in the recent past.

The below figure looks at the progression of reported quarterly revenue growth in Asia, excluding Japan, over the year. Though these numbers include economies other than China, this is a decent proxy. Included here are two firms that have had positive overall revenue growth this year (Hermès and Prada Group) and two that have experienced a revenue decline (LVMH and Kering). Year-over-year quarterly revenue growth declined across the board, and it was deep and sharp. Even Hermès saw Asia sales slump to near zero by the third quarter after almost hitting 10 percent growth in the first quarter. The only exception was Prada Group, which was underpinned by explosive growth at Miu Miu. (See this Fashion Strategy Weekly post on Prada for our take on what Miu Miu is doing right).

Luxury assets have one of their best weeks of the year

December 15, 2024

Luxury assets had one of their best weeks of the year during December 13-20. The FSW Markets Market All Luxury Index closed up almost six percent. Gainers heavily outweighed losers as 13 of the index’s 18 constituents had positive simple returns during the week: Brunello Cucinelli was up over 7 percent and Zegna, which has had a generally poor 2024, was up over 6 percent. Capri Holdings Limited took the biggest fall of the week, down over 4 percent, amid speculation that they will look to unload Versace and Jimmy Choo after their failed attempt to link up with Tapestry.

But this was an outlier week for the industry, particularly in H2, as the FSW Index is down 5.8 percent year-to-date. This is compared to a nearly 27 percent positive return for the S&P 500, 10 percent gain for the Euro Stoxx 50, and a 15 percent gain for the S&P 500 SPDR Retail ETF (XRT).

Looking towards the week ahead, the Federal Reserve is expected to cut rates by a further 25bp on December 18 as it continues to move policy from restrictive territory to somewhere closer to neutral. We will also see China and U.S. November retail sales released (expected to be fairly flat).

A Look at Brunello Cucinelli

November 25, 2024

In this week's Fashion Strategy Weekly, we analyze Brunello Cucinelli's content strategy after the recent launch of its holiday campaign and considers what the brand's approach to content suggests about the future of luxury experience.

With much of the luxury industry slowing from the rapid rates of growth experienced during the post-pandemic supercycle, Brunello Cucinelli has been one of those brands that has continued to grow. Its July to September revenues were among the strongest in the industry (see below), while its first-half revenues were up almost 15 percent at constant exchange rates.

Most of the luxury fashion industry has been pulled down by weak growth in Asia, but Brunello Cuccinelli was among the few brands that powered past that trend. Its revenue growth in Asia, which comprises about a third of total revenue, was up over 14 percent, second only to growth in the Americas.

After the brand experienced unprecedented post-pandemic growth in 2021, its owner, Brunello Cucinelli, told Vogue Business, “We do not wish to grow fast. Rapid, sudden growth isn’t rational and it isn’t sustainable. It creates problems.”

We know that there is a tension between long-term and short-term growth optimization strategies in the luxury retail space. Bruenello Cucinelli seems to have got the balance about right.

Luxury Suffers Another Poor Week with Some Exceptions

November 17, 2024

Luxury equities had another tough go around last week. The FSW Markets All Luxury Index was down 4.3 percent. This was just over 2 points lower than returns for the S&P 500 and the CAC 40.

There was quite a bit of diversity among top luxury names, however, and the below bar plot shows the five day returns for a number of luxury assets (blue bars) as compared with some benchmarks (red), and the EUR-USD exchange rate (green) is thrown in for good measure.

The industry’s large caps continued to sink over the past week as investors continue to worry about the industry’s cyclical slowdown and are increasingly concerned that it forebodes a structural weakening due, in great part, to weaker demand in China. The titan LVMH was down 3.8 percent on the week and is now down 18 percent on the year while Hermès and L'Oréal were down 3.6 and 4.7 percent, respectively.

On the upside, Burberry’s release of its “Burberry Forward” strategy on Nov 14 led to a 13 percent surge. This took one of the industry’s worst 2024 performers to a mere 0.33 percent decline year-to-date. Lastly, the end of the Tapestry and Capri Holdings Limited tie up was greeted positively by investors this week.

You can read the views of the FSW Markets team on the new Burberry strategy in this November 14 discussion with Glossy magazine.

LVMH Market Share Ticks Down in 2024

November 13, 2024

As we are in the process of updating our year-end and 2025 luxury industry sales and stock price forecasts, we updated our figure on the level of industry concentration.

As the below line plot illustrates, LVMH's share of industry sales has, so far, ticked down slightly this year from 35 to 34 percent given the relatively weak growth that the industry's giant has reported this year.

Yet, overall it is still a picture of a moderately concentrated industry, which is not uncommon in retail sectors. There remains room for competitive pricing and innovation does not appear to be stymied by the current level of concentration.

Having said that, many have noted that the level of industry creativity is flat lining, though it is not clear to us that this is function of industry concentration so much as the impact of structural market pressures (e.g., mainstreaming of e-commerce, creator economy, rising supply chain and manufacturing costs) that has left brands struggling to keep up and differentiate themselves.

What Did the Jul-Sep Earnings Reports Teach Us About the Luxury Slowdown?

November 8, 2024

With a few exceptions, we have come to the end of the latest luxury earnings season, and it was not all doom and gloom. As the bar chart below displays, Prada and Hermès recorded strong double-digit revenue growth (blue bar) that exceeded market expectations (red dot) from June to September. Both organizations reported strong earnings growth across all geographical areas, including Asia, with Prada supported by 105 percent growth from Miu Miu. A range of brands, from Brunello Cucinelli to Ferrari and even Capri, also reported decent earnings growth, albeit below expectations.

On the downside, we saw much worse-than-expected results from Kering and Zegna. On the former, some analysts had hoped that Gucci’s string of quarters of negative revenue growth might hit a trough. However, Kering’s 16 percent decline was much worse than analyst expectations, with Gucci down about 25 percent.

Industry giant LVMH’s Q3 revenue growth was slightly worse than analyst expectations, but many commentators have looked at this as a leading indicator for the industry as a whole. Some of the commentary has forecasted that we are at the beginning of a much longer-than-usual downturn in luxury, particularly luxury fashion. The arguments have suggested that the downtown will be driven not just by slowing cyclical demand, but sharply slower structural demand as consumers have grown tired of luxury overexposure or perhaps have had enough of the aggressive price increases, or perhaps now want to spend put their luxury spending into travel and health and wellness rather than fashion.

Forecasting is always difficult so we will see. Yet, the Q3 earnings do not conclusively support this doom and gloom scenario. Many luxury brands, and not just those in the quiet luxury corner that has seemed to operate with its own rules of supply and demand over the past year or so, continue to show impressive growth. Maybe this growth is not at the rates seen in the supercycle that followed the pandemic and lifted most luxury boats (Kering excepted), but some regression to a mean does not presage an industry-wide depression.

A Threads post by Vogue Business editor-at-large Christina Binkley this week noted:

Rather than a luxury slowdown, I’d say RL, Hermès, and Prada/Miu Miu are taking market share from LVMH and Kering.

Earlier in the week, FSW discussed some reasons why we believe Miu Miu are performing well and it is worth reflecting on what other brands are doing to grab market share this year.

Investors have certainly seen cause to differentiate among luxury brands. The below line plot displays the 2024 evolution of selected luxury share prices along with our FSW Markets All Luxury Stock Index and, for benchmarking purposes, the S&P 500. Our FSW cap weighted index is down around 11 percent this year, which is sharply below the 25 plus percent gains in the S&P 500, a broad measure of stocks listed in New York. Yet, relatively high performers such as Prada have actually outperformed the S&P on a good year for the broad index while Hermès has provided strong returns.

Introducing the FSW Markets Instagram Shoppability Index

The FSW Markets team created an index of Instagram content shoppability with a select range of luxury brands to evaluate which brands use Instagram’s built-in shopping features and functionality.

The “mostly shoppable” category is a signal of customer-centric, content-first social strategy with posts that are easily shoppable. This is as opposed to a brand-centric, creative-first social strategy with posts that are often a creative mood board or are celebrity or product-focused from a specific campaign or event and not shoppable. Some results:

* BALENCIAGA and Miu Miu top the list, with the most fully shoppable Instagram accounts. The main caveat here is that Balenciaga regularly cleans its social media accounts and only has seven Instagram posts at the time of publication. Miu Miu, on the other hand, has been making use of Instagram’s shoppable features and functionality for a while, with a significant majority of shoppable product posts.

* In the tier below, a small portion of brands—namely, Loro Piana, Valentino, Versace, and Zegna—occasionally post shoppable content, though these posts are in the minority and are almost always handbags.

* The rest of the index, which comprises 29 major luxury brands, make zero use of Instagram’s shoppable content functionality, even though many have been experimenting with the platform’s calendar and broadcast subscription direct messaging functionalities.

Luxury Among the Worst Performing Sectors this Week

It was a generally turbulent week for global markets with most major indices closing down. The S&P 500 was down 1.4%, the FTSE 100 down 0.9%, and the Nikkei 225 was flat on the week.

The CBOE Volatility Index, which many call the market’s “fear gauge” ticked up 12 percent as markets entered the last few sessions before the U.S. presidential elections.

Despite a stunningly weak U.S. jobs report on Friday, the yield on the U.S. 10-year note continued to climb and reached a four month high of 4.361%.

Most sectors of the economy had a tough week. The below chart shows the performance of major sectoral ETFs of the S&P 500 as well as our FSW All Luxury Index. In particular, tech (XLK) and utilities (XLU) had a tough week and closed down 2.8%. The luxury index closed down 2.2%, pulled down by a 3.7% decline at industry giant LVMH.

Luxury Asset Have Performed Poorly This Year

The Q3 premium market earnings have been a bit of a mixed bag as we have been reporting over the past two weeks.

To take another cut, let's look at the year-to-date returns for a wide variety of global asset classes and compare with them with our FSW Markets All Luxury Index.

Though luxury earnings have been mixed, the largest names by market cap have, reported fairly weak sales with particularly poor volume growth in China offsetting some positive contributions from price and mix. This has pulled down our index to -8.5 percent over the course of the year.

This performance stacks up poorly against other major global assets. U.S. stock markets have had a strong year, driven heavily by the tech sector with the Nasdaq up over 20 percent. The majority of the FSW Market All Luxury Index is comprised of European-based firms, but the index has performed poorly when compared with the broad sector Euro Stoxx 600, which has recorded low single digit but still positive YTD growth.

Prada Group reports decent earnings, driven by Miu Miu

October 30, 2024

Prada released its Q3 earnings in the mid-afternoon, Central European time, on October 30 and met analyst expectations for continued strong volume growth at Miu Miu.

Net revenues in Q3, compared with Q3 2023, were up 18 percent for the Prada Group. The Prada brand (which comprises just under 75 percent of group revenues) was up around the Q3 industry average of 2 percent while Miu Miu (around 25 percent of revenues) hit another remarkable growth number at 105 percent.

In terms of positive contributors to growth, the biggest contributor was volume growth at Miu Miu with pricing and mix making a small contribution for Prada. The observation was made that Prada has room to stretch pricing more across its range of products so that is something to have on the radar looking into next year.

Unlike most industry peers this earnings season, Prada Group reported balanced growth across geographies. Growth was in double digits across all regions lead again by Japan at 48 percent growth followed by the Middle East (36 percent), Europe (18 percent), Asia Pacific (12 percent), and the Americas (10 percent).

Forward guidance was for continued strong growth into H1 2025 unless there is a broader luxury market crash. Some specific observations were made during the earnings call:

* European growth continues to be resilient and dynamic, which is not the case for much of the industry and runs counter for the weak economic growth that is expected this year and next.

* Dynamics in the U.S. were described as being driven by dynamics consistent with pre-election periods. The meaning of this is not clear given strong consumer demand in the U.S., which has generally powered good luxury industry sales in H2 so far.

* Asia Pacific growth, ex China, has been rough this year but is expected to improve in the next 3-9 months. However, expectations are for continued weak growth in China into next year. The IMF lifted its 2025 economic growth forecast for China but consumer luxury demand seems like it will not rebound soon.

The extraordinary growth of Miu Miu is the result of strong creative decisions made by the brand, supported by the resources of the broader Prada Group.

Prada brand will continue to focus on improving margins by pursuing more cost efficiencies.

As the below chart details, the year-to-date return from Prada has significantly outperformed our FSW Markets All Luxury Index throughout the year and outperformed the S&P 500 on its strong year. Despite this strong growth, Prada continues to look like a good value with a P/E ratio of about 20x as compared with 22x for LVMH and 46x for Hermès.

No Big Surprises in Kering and Hermès’ Q3 Earnings Reports

October 26, 2024

No trough in sight for Gucci

On the heels of the broader slowdown in the luxury sector and clouded Q3 earnings from peers like LVMH and Swatch Group last week, Kering's disappointing Q3 results were largely anticipated. The group, home to the fashion giant Gucci and brands like Saint Laurent, Balenciaga, and Bottega Veneta, reported a sharper-than-expected 16% year-over-year revenue contraction on a comparable basis, bringing the total to €3.79 billion. This figure includes a 1% negative currency impact and a 2% positive scope effect following the consolidation of Creed. Despite this, Kering's overall revenue shortfall was 5% steeper than analyst forecasts.

The primary drag on performance stemmed from ongoing weak demand in Japan and the Asia-Pacific region, where retail revenue dropped by 30% year-over-year. While China's much-anticipated recent stimulus efforts aim to revitalize the economy, its impact has yet to materialize, with the luxury market there continuing to face headwinds as consumer appetite for high-end fashion remains muted, perhaps due to the lingering property crises and subdued consumer confidence.

Most of Kering's brands saw negative revenue growth this quarter, with Gucci taking the hardest hit, declining 25%. This was 4 percentage points more than analysts expected. Saint Laurent's 12% drop further weighed on the group's results. At the same time, brands, including Balenciaga, Alexander McQueen, and Brioni, amongst others, posted a 14% revenue decline under the "Other Houses" category. However, there were a few bright spots: Bottega Veneta's robust leather goods segment helped the brand achieve a 5% revenue increase in Q3, while Kering Eyewear and Corporate revenues rose 7%, where acquisitions of Maui Jim and Lindberg in 2022 and 2021, respectively having positive impacts.

Gucci's struggles remain the key pressure point for Kering, as the brand accounts for over 50% of the group's annual sales and 66% of its profits. The brand's Q3 performance was particularly weak in critical regions, including the Asia-Pacific (down 38%), North America (down 20%), and Western Europe (down 19%). However, management remains optimistic as Gucci undergoes managerial overhaul and operational transformation. The appointment of Stefano Cantino as CEO, effective January 2025, and new design initiatives are expected to align more closely with evolving consumer preferences.

Kering's stock has fallen by over 41% year-to-date, but there are signs of potential stabilization. The group's valuation is projected to rise to 19.3x earnings for fiscal year 2024, with further improvements expected as transformation efforts take hold. By the end of fiscal year 2025, Kering's valuation is anticipated to settle at around 16.4x as managerial and operational restructuring efficiencies become more evident.

Hermès outperforms already rosy expectations

Hermès' Q3 2024 earnings report revealed that revenue for the quarter rose by 14% at constant exchange rates, reaching €3.2 billion, up from €2.83 billion in Q3 2023. This exceeded market expectations, which had anticipated around 10.5% growth for the quarter. The beat was largely due to strong organic growth driven by effective pricing strategies and high demand across key regions. Currency effects, however, posed a slight drag, with revenue growth moderated to 11% at current exchange rates, impacted by the strength of the euro compared to other currencies.

Performance across Hermès’ major product lines was notably robust. Leather goods and saddlery, representing 51% of total revenue, grew by 12% at constant exchange rates, reflecting strong demand for signature pieces such as the Birkin and Kelly bags. Ready-to-wear and accessories, including scarves and ties, grew by 15%, supported by new seasonal launches. Watches, another core category, saw stable growth of 9% year-over-year, underpinned by the success of recent models like the Hermès Cut line. The perfume and beauty segment, though smaller, grew by an impressive 17%, with new additions to the Hermessence collection and H24 men's line contributing to the rise. Overall, this diversified growth across segments was crucial to Hermès surpassing both internal and market growth projections.

Geographic performance also played a critical role in Hermès' success this quarter. Asia-Pacific, which contributes around half of Hermès’ revenue, saw the highest growth, with revenue up 15% year-over-year despite some regional economic pressures. Within this region, mainland China stood out with strong double-digit growth. Europe, including France, performed solidly, growing by 10% due to resilient local demand and increased tourism. The Americas saw more modest growth, coming in at around 5%, with some headwinds attributed to slower retail traffic. This geographic balance has allowed Hermès to sustain its growth trajectory despite economic variability across global markets.

In response to these positive earnings, Hermès' stock rose by approximately 3% immediately following the report. Year-to-date, the stock is up around 15%, reflecting strong investor confidence in the brand’s resilience. Hermès' price-to-earnings (P/E) ratio remains among the highest in the luxury sector, hovering around 45x earnings. This elevated P/E ratio is largely a reflection of the brand’s premium status, consistent revenue growth, and steady expansion into new product lines and markets. Over the course of 2024, the P/E ratio has shown minor fluctuations but remains above the industry average of around 30-35x, signifying sustained optimism from the investment community despite broader economic concerns.

Market Expects Mixed Results from Q3 Luxury Earnings Reports this Week

October 21, 2024

After last week's mixed bag of Q3 earnings from LVMH and Brunello Cucinelli, this week we turn attention to what will probably be another set of mixed results from Kering and Hermès.

Kering is set to release its Q3 2024 earnings report on October 22 after market close in Paris. Analysts have been cautious about Kering's outlook, expecting the company's key brand, Gucci, to show signs of continued weakness due to lagging sales in recent quarters, particularly in China, though there is some hope that they have reached a trough. In the U.S., Kering's performance in Q1 and Q2 2024 was mixed, with ongoing challenges at Gucci, although other brands like Saint Laurent and Bottega Veneta showed some resilience in earlier periods.

Hermès is scheduled to release its Q3 2024 earnings on October 24. Analysts anticipate that Hermès will continue its robust momentum from earlier this year, with strong demand for its luxury goods in Asia, especially in China. In Q1 and Q2 of 2024, Hermès posted impressive growth, driven by sustained demand across all regions and categories, and its high-end craftsmanship and strong content strategy remain a major competitive advantage.

A tougher than expected start to luxury earnings season

October 16, 2024

Analysts expect weak H2 results from luxury so forecasts for the Q3 earnings season, which kicked off this week, were low. So far, those expectations are not proving low enough. The industry’s giant, LVMH, which has a market capitalization greater than its six largest competitors combined, was in the spotlight yesterday.

LVMH reported Q3 revenue of €19.1 billion, which fell short of analyst expectations. The company posted a 3% organic decline in sales, whereas analysts had predicted 2% growth. This disappointing performance was primarily driven by a 16% revenue drop in Asia (excluding Japan), particularly in China, where consumer demand softened and which comprises about a third of LVMH’s sales. Growth in Japan was the only bright spot (up 20%) yet Japan contributes to less than 10% of group revenue. Sales growth in the U.S. was flat, but the U.S. continues to become a more important market for LVMH given the protracted slump in Asian sales.

Revenues were negative across all LVMH business groups apart from Perfumes and Cosmetics (3%) and Selective Retailing, principally SEPHORA (2%). One of the most impacted sectors was fashion and leather goods, which fell by 5% when a slight 0.5% growth had been anticipated. This is especially bad news as this segmented comprises almost half of LVMH’s revenues.

LVMH’s share price closed down almost 7% yesterday, which drove down the FSW Markets All Luxury Index by over 5% on a day when the benchmark S&P 500 was flat. Over the second half of the year, the FSW Index and the S&P 500 have moved in almost complete opposite directions as per the below figure. Our index is now down about 13 percent year YTD while the S&P is up about 23%.

Earnings season continues this Friday with Kering and Brunello Cucinelli due to report on Q3. General expectations are that Gucci will continue to pull down Kering while Cucinelli may continue to show some resilience. Investors did show some appetite for LVMH today as its share price is up over 1%. LVMH’s valuation has turned more attractive over the course of the year with its P/E ratio declines from over 25x in March to around 21x now.

Q3 Earnings Reporting Season Starts Next Week

October 4, 2024

After luxury brands reported a generally poorer than expected H1 and gloomy forward guidance (with some notable exceptions), we are gearing up for the start of Q3 earnings releases next week. The newly re-branded FSW Markets will be previewing market expectations over the next few days.

As a preview of coming attractions, this is the release schedule as it now stands for the month of October:

October 15 - LVMH & Swatch Group

October 18 - EssilorLuxottica & Brunello Cucinelli

October 23 - Kering

October 24 - Hermès

October 31 - Prada

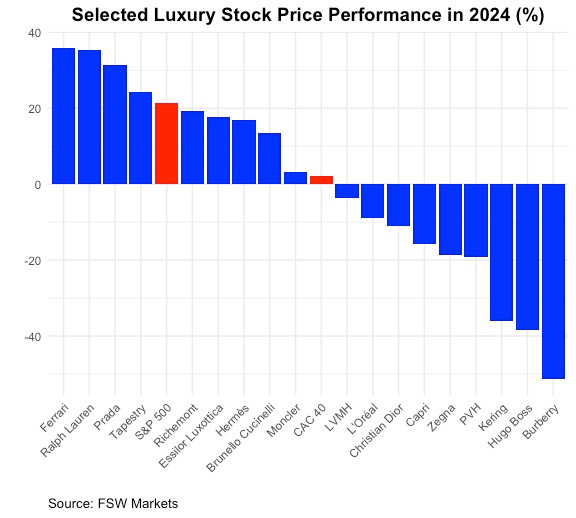

Stock valuations for luxury have generally been pretty weak this year, in step with previously reported earnings and discounted future earnings. The FSW Markets All Luxury Index is down about 1.5 percent while the S&P 500 is up over 20 percent.

As the chart below shows, there are some exceptions with Ferrari, Ralph Lauren, Prada Group, and Capri Holdings Limited suitor Tapestry outperforming the S&P while Richemont, EssilorLuxottica, Hermès, and Brunello Cucinelli posting positive year-to-date returns.

Brands struggling with both creative and corporate strategy, particularly Kering and Burberry, are faring the worst and find their share prices down over 35 and 50 percent, respectively.

Tapestry to sell Stuart Witzman

September 7, 2024

According to Footwear News, Tapestry is reportedly close to selling its Stuart Weitzman brand. The sale comes as Tapestry is preparing to face the Federal Trade Commission over its attempt to stop the $8.5 billion purchase of Capri Holdings Limited.

Seeking Alpha commented that the sale of Stuart Weitzman may help Tapestry fund the Capri deal.

Capri’s share price has tumbled over 30 percent year-to-date amid the takeover turbulence while Capri is up over 10 percent. The FSW High Frequency Luxury Monitor All Luxury index is down around 5 percent.

Burberry’s woes continue as it is ejected from the FTSE 100

September 6, 2024

The decision of the FTSE Russell to relegate Burberry from the FTSE 100 to FTSE 250 index on September 5 is not a surprise. Membership in the FTSE 100 is reviewed quarterly and there are usually a change or two. One of the key criteria is market capitalization, which is driven in part by share price. And Burberry's share price has been the worst performer on the index over the past year.

Burberry has also easily been the worst performing stock within the luxury industry this year. If we we compare Burberry's share price performance against the FSW High Frequency Luxury Monitor All Luxury Index, we find that it has fallen over 50 percent year-to-date as compared to a 5 percent decline for the industry as a whole (see plot below). So while the industry as a whole is facing macroeconomic headwinds this year, with some notable exceptions, Burberry has been in a class of its own.

This halving of Burberry's share price has led to a steep decline in Burberry's market capitalization, which currently stands at around 2.3 billion pounds, down from 6.5 billion pounds in 2023. This is probably the biggest decline of any company in the world over this period.

It is not unheard of for companies to be moved back up to the FTSE 100 index after a relegation to the FTSE 250, but this seems unlikely for Burberry in the near term. The company reported a 22 percent decline in Q1 retail revenues and the guidance from Burberry itself is for an operating loss in H1.