Forecasting the Future of Luxury Strategy in China

FSW explores the near and medium-term prospects for luxury in China and how brands should respond.

Insights

Luxury is set for its worst sales performance in the last 15 years apart from the pandemic-hit 2020. Yet, the downturn has not been universal, and some brands have continued to perform well, especially those that have continued to succeed in China despite the country’s slowing demand for luxury.

Linear regressions conducted by FSW Markets staff find that over the past decade, each 1 percent increase in Chinese GDP growth is associated with a 0.83 percent increase in luxury revenues - so the prospect of a cyclical and potentially structural slowdown in Chinese demand raises real strategy questions for an industry that has been reliant on the market to power growth.

Regardless of whether the Chinese luxury downturn is cyclical or structural, the basics of brand strategy and content strategy matter more than ever to deepen loyalty among existing customers and attract new ones through more tailored, personalized interactions and more immersive, actionable storytelling.

Is the above photo a metaphor for the luxury industry in 2025? So far, luxury seems to be set for its worst performance in about 15 years outside of the pandemic-hit 2020. Though the true picture is more differentiated than a central tendency would suggest and there have been some strong performers (in fact, Miu Miu is off the charts good) the general industry reality met the grim forecasts that most industry watchers generated a year ago.

There have been numerous explanations that all seem to capture a facet of the prism for the industry’s downturn this year. These explanations are now so familiar that they are LinkedIn posts and sell-side analyst tropes: generally slowing consumer demand, price increases that put off even some normally price inelastic consumers, macroeconomic and geopolitical uncertainty, and good old base effects after three years of strong growth underpinned by post-pandemic revenge consumption.

At the heart of several of these explanations is slowing demand from Chinese consumers. Brands that have performed well in 2024 have continued to record strong sales growth in China, but the majority of the industry has struggled. China has been a motor of growth for the luxury industry for at least 10 years. Linear regressions conducted by FSW Markets staff find that over the past decade, each 1 percent increase in Chinese GDP growth is associated with a 0.83 percent increase in luxury revenues. Though this coefficient implies that the industry’s cyclical correlation is moderately connected to China, it does show that the question of whether this slowdown in Chinese growth is merely cyclical or structural is profound and must rattle industry strategy-makers to their core.

How bad has 2024 been so far?

So, let’s look at how bad things have been for luxury in 2024. In short, not a complete disaster but not great and, most critically in the world of financial markets, worse than was expected. The chart below shows annual revenue growth for the first nine months of 2024 (brown bar) relative to market expectations (grey dot). This sample of publicly listed luxury firms is not comprehensive. Still, it covers a relatively wide swath of the market and, in luxury fashion, the overwhelming majority of market share. Every organization in this sample, apart from Prada (driven by Miu Miu) and Hermès, has performed below expectations. Some of the industry’s largest players are experiencing negative or near zero growth, notably industry giant (and owner of about 75 brands) LVMH.

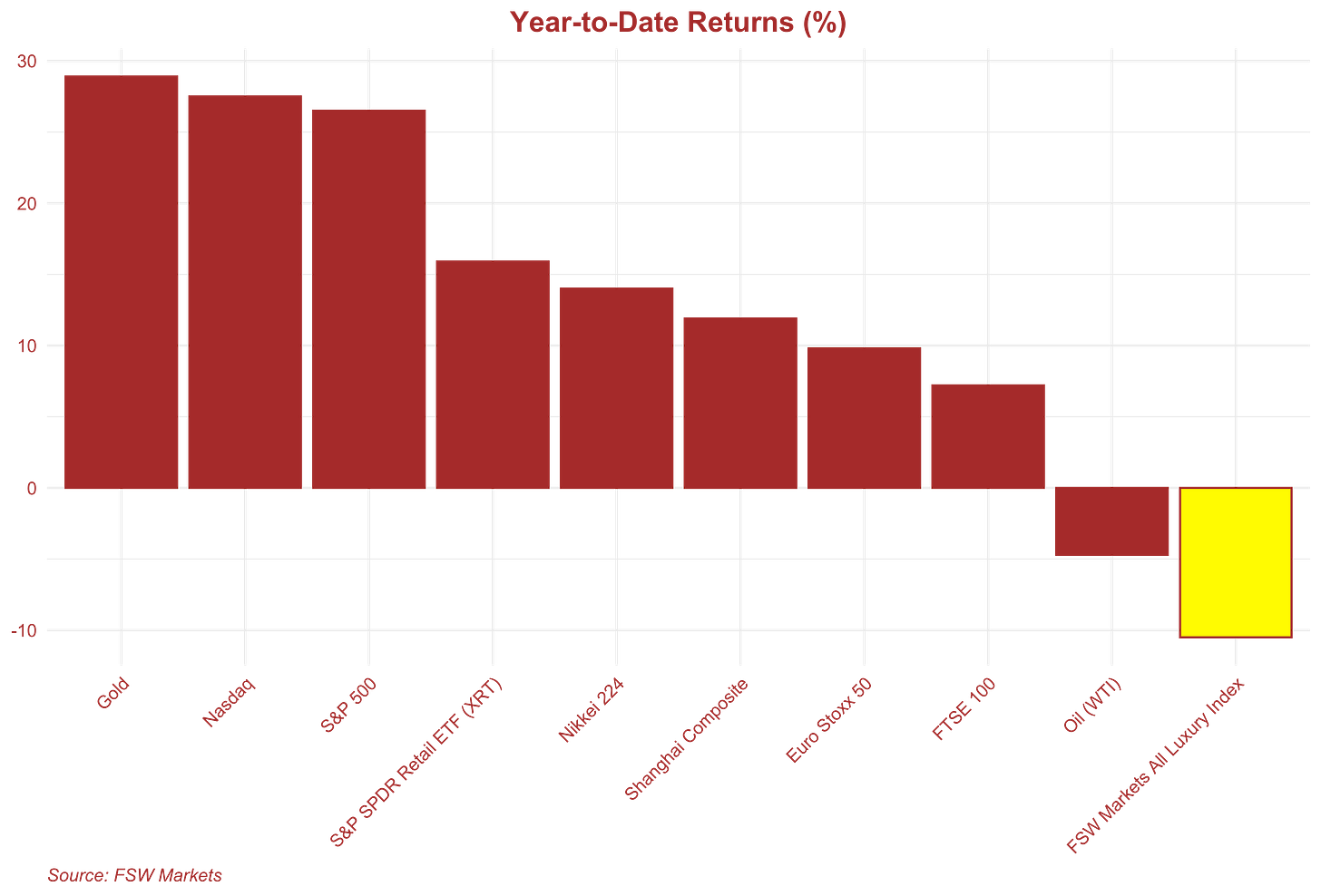

If we compare luxury to performance measures for the broader global economy, then it looks even worse. The below figure compares the year-to-date returns for a wide variety of asset classes. The FSW Markets All Luxury weighted equities index is by far the worst performer among this sample of assets. Compare its roughly -10 percent simple return with the 15+ percent positive return for the S&P SPDR Retail ETF and the 25+ percent return for the broad U.S. market gauge of the S&P 500. Even the Euro Stoxx 50 is up around 10 percent for the year.

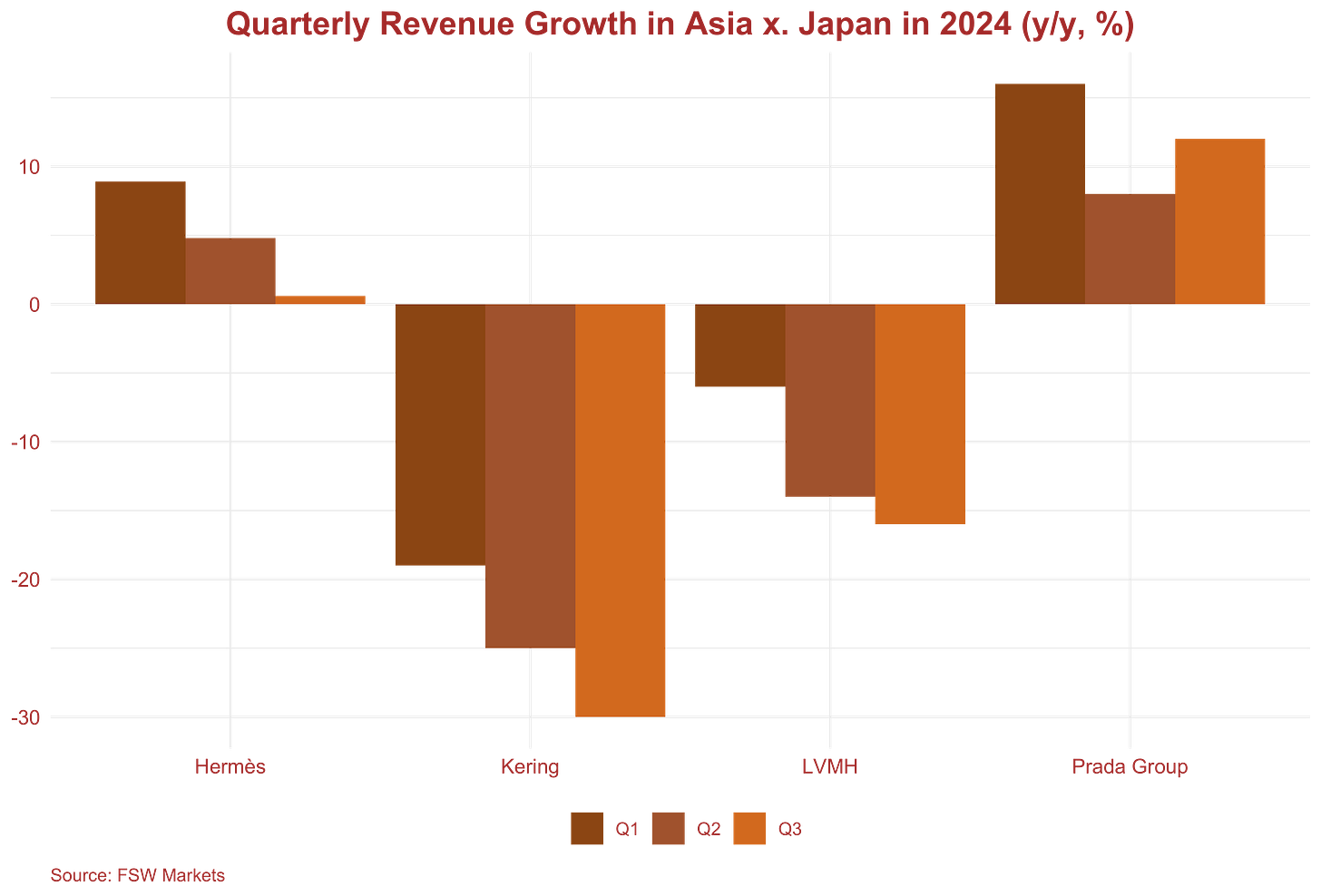

So, how much of this is from slowing volume growth in China? Let’s start with balance sheet data for a sample of brands to give us a top-down perspective. Revenue growth in China, as we expect, has been weaker than in the recent past. The below figure looks at the progression of reported quarterly revenue growth in Asia, excluding Japan, over the year. Though these numbers include economies other than China, this is a decent proxy. Included here are two firms that have had positive overall revenue growth this year (Hermès and Prada Group) and two that have experienced a revenue decline (LVMH and Kering). Year-over-year quarterly revenue growth declined across the board, and it was deep and sharp. Even Hermès saw Asia sales slump to near zero by the third quarter after almost hitting 10 percent growth in the first quarter. The only exception was Prada Group, which was underpinned by explosive growth at Miu Miu. (Please see this Fashion Strategy Weekly post on Prada for our take on what Miu Miu is doing right.)

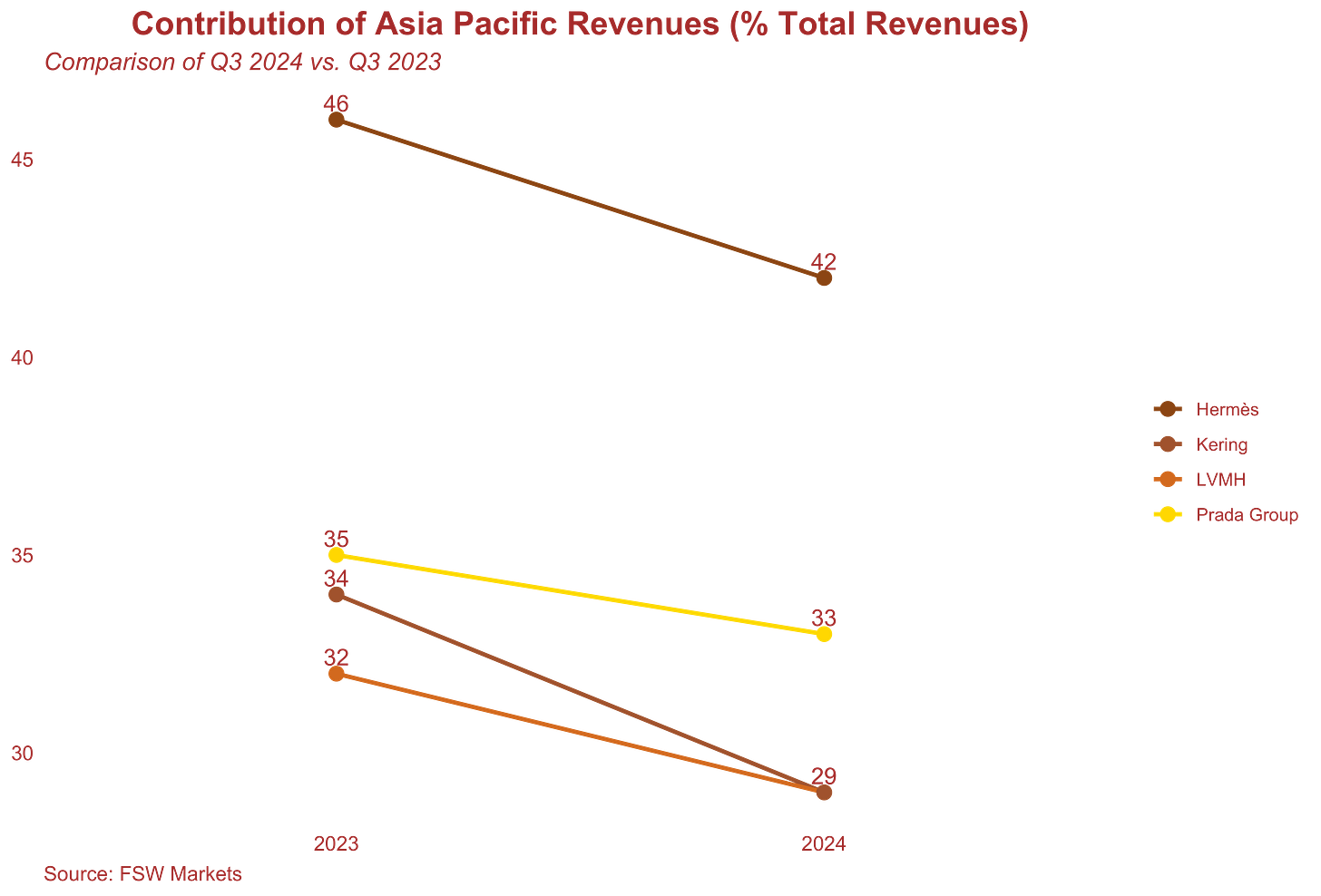

And for all brands, China comprises a shrinking share of revenues. The below plot shows the change in the contribution of Asia (ex. Japan) to total revenues in Q3 of this year compared to 2023. Even for Prada Group, Asia's contribution fell by 2 percentage points. The decline for everyone else was even steeper.

We get a similar picture when we switch to a bottom-up view, which gives us a more granular perspective on this year’s luxury spending dynamics by Chinese consumers. Data presented by Jacques Roizen, of the Digital Luxury Group in the recently released China Luxury And Prestige Market Update found that luxury spending by Chinese consumers in mainland China is expected to decline 21 percent this year while Chinese luxury spending outside of mainland China will fall 13 percent. Roizen has pointed out that looking at Chinese consumption only inside China can be misleading. For example, in 2023, luxury spending inside China was up by 12 percent, while offshore, it was up 52 percent). Therefore, it is noteworthy that the combined offshore and onshore Chinese luxury purchases are expected to fall by 13 percent in 2024.

So what should luxury expect in 2025 and beyond?

Is the weakening contribution of China to luxury sales this year a blip or a new long-term trend? This is a serious question for the industry as, by some measures, China has contributed over a third of luxury sales over the past decade. Moreover, Chinese demand was often counter-cyclical and offset weak sales in other regions.

The answer comes down, in part, to whether a weaker interest in luxury fashion by Chinese consumers is a cyclical or structural phenomenon. If it is the former, we can make some decent projections based on historical relationships between macroeconomic or consumption growth and Chinese households’ propensity to purchase luxury goods and services. If it is the latter, then it is more difficult to predict.

Cyclical growth prospects in 2025

Let’s start with the “easier” job of forecasting the prospects for a 2025 recovery (relative to 2024) based on cyclical developments. Just to keep things manageable, let’s create a quick and dirty forecast based on China's GDP growth and a few controls. As was already noted, there is a robust correlation between growth in the broader Chinese economy and luxury industry sales.

Unfortunately for the industry, the general expectation of economists is that economic growth in China will be weaker next year. How much weaker should it be than this year’s expected 4.8 percent growth rate (slower than the 5.3 percent recorded in 2022)? The current range of consensus guesses is between 3.5 and 4.5 percent. Holding all else constant, the FSW Markets econometric forecasting model finds that the most optimistic outcome for the industry is that it will see a rate of global revenue growth about 0.5 percentage points slower than in 2024. In the most pessimistic outcome, luxury revenue growth will be a full percentage point slower.

As always, there are caveats. One is that the economic forecasts are all wrong. They typically are wrong, but these may be subject to more than the usual risks of error because the Chinese government is rolling out a series of stimulus policies that may not have been accounted for in these forecasts. Second, faster growth in other markets could offset some of the results found in these scenarios. In particular, European sales could pick up after a moribund in 2024, though this seems like a bit of a long shot.

Yet, notwithstanding risks to the forecast, the story is not a good one for the industry in 2025.

Structural constraints on growth for the long-term

So what about the longer-term or structural argument that the industry’s 10-year-long dependence on China will go south? This becomes more complicated. But, one argument is that Chinese preferences for some luxury goods, particularly conspicuous products, are moving into a lower gear. This could benefit some “quieter” brands such as Brunello Cucinelli, Loro Piana, and Zegna. It could also benefit many premium fashion brands.

Another component is that China’s stark demographic transition will hurt luxury. Over the past two decades, China has experienced a significant demographic shift, with declining birth rates and an aging population challenging its long-term economic stability. Between 2003 and 2023, China’s fertility rate dropped to 1.28 children per woman, well below the replacement rate of 2.1. This trend led to a population decline starting in 2022, marking the first contraction in 60 years. The working-age population has been shrinking since 2012, and the number of people aged 65 and older is projected to rise from 14 percent in 2021 to 30% percent by 2050. By 2025, projections indicate that China’s population will fall below 1.4 billion, and by 2043, it may dip below 1.3 billion, accelerating the demographic decline further.

Based on evidence from other countries, there is every reason to believe that an aging population how a lower propensity to spend on luxury. Younger generations, particularly Millennials and Gen Z, have shown a greater willingness to spend on luxury goods, driven by factors such as social media influence, a desire for self-expression, and aspirational consumption patterns. For example, Millennials and Gen Z together accounted for 72 percent of luxury sales growth in recent years, with Gen Z showing the highest growth rate in spending. There may be offsets - for example, a rising share of wealthy Chinese consumers will have a higher propensity to spend on luxury - but the overall trends do not point to robust growth.

Regional investments in experience strategy

Regardless if the Chinese downturn is cyclical or structural, luxury brands will likely batten down the hatches on their ongoing Asian investments to ensure that they do not lose too much ground with HNW consumers, particularly given the seemingly inevitable bottoming out with aspirational consumers. From a simple customer experience perspective, implementing basic measures like a formalized strategy for content regionalization and localization can enable brands to manage and even deepen loyalty among existing customers through more tailored, personalized interactions and more immersive, actionable storytelling.

As we wrote for Jing Daily several months ago, Chinese content consumption habits among HNW consumers are drastically different than their counterparts in other countries. Chinese consumers expect luxury brands to deliver high-quality, story-driven experiences with an authentic point of view that feels rarified and immersive. Despite global data suggesting that the attention economy has reduced our ability to digest longer-form content, Chinese HNW consumers in most demographics prefer longer-form video content types over trends-based snippets and broadcast ads. Hence, the popularity of live-shopping feeds, longer-form narrative social media content, and more immersive digital brand experiences in China is high.

The shifting winds of the luxury economy in China are a potential boon for brands with a well-established footprint that take the time to get the basics of brand strategy and content strategy right. Luxury customer experience balances the tangible aspects of retail shopping and customer service with the intangible aspects of value-based brand storytelling.