FSW Insights: A Structured Case Study of the Brand Strategy of Three Luxury Brands

Insights from a brand and content audit of Hermès, Gucci, and Louis Vuitton

Insights

French luxury brand Hermès, which experienced faster H1 2023 growth than other luxury brands, has a notably different, more artisanal approach to brand and content strategy more directly targeted to high-net-worth consumers.

By contrast, Italian luxury house Gucci, which contracted by one percent in the same period, has a more diffuse brand and content strategy targeted to a wider demographic with more investment in innovation, including Web3.0 and gaming.

Finally, French luxury giant Louis Vuitton, which grew over 21 percent in Q2 2023, has a strong, consistent brand and content strategy targeted to a diverse demographic with significant omnichannel investment at scale.

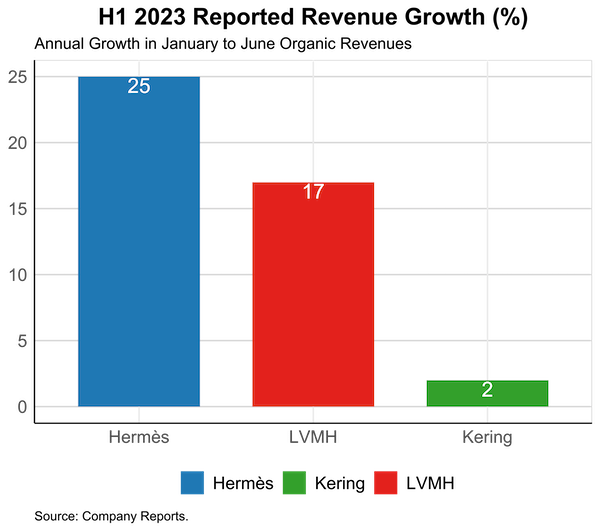

This week’s release of H1 2023 earnings showed that the luxury industry continues to grow globally, though sales in the U.S. are slowing for most brands, particularly among so-called aspirational consumers. But there were two outliers: French maison Hermès, which grew faster than other major luxury firms including in the U.S., and the Kering-owned Gucci, which contracted.

To examine what’s going on more closely, this piece provides a structured case study of these two outliers through the lens of brand and content strategy to see what lessons we can learn. We will fill out the case study to include Louis Vuitton as a benchmark given its sheer weight in the industry.

About Those H1 2023 Luxury Brand Financials

This week luxury brand Hermès revealed extraordinary H1 2023 results with 25 percent growth, while luxury conglomerate Kering grew only two percent with Gucci, which makes up around 50 percent of the group’s revenues, contracting by one percent. Luxury giant LVMH continues to exhibit very strong momentum, growing 17 percent in H1 with Louis Vuitton increasing by 21 percent in Q2, which was significant even if it fell short of analyst expectations. Also, as Imran Amed noted for The Business of Fashion, smaller brands like Miu Miu, Ermenegildo Zegna Group, and Moncler had stellar H1 results.

While these luxury results reflect declining spending by aspirational customers in the U.S., where there was a one percent contraction in all retail sales in Q2, luxury brand sales continue to be bolstered by growth in Europe, China, and Japan.

Considering the outliers of Hermès and Gucci in conjunction with Louis Vuitton as a sort of luxury standard, it is interesting to consider what is going on at a brand level with all of these companies and to note where their strategies differ and to think about what drives storytelling, marketing spend, and content decision making. After all, the big news of the week wasn’t really even the earnings numbers but rather the surprising announcement that Kering is acquiring 30 percent of Valentino for €1.7 billion, which, while likely a smart acquisition, nonetheless served to add more noise to the confusion of organizational changes already happening at the luxury conglomerate.

A qualitative brand and content audit is often a useful way to assess a brand’s health. To get a quick pulse check on the current state of luxury and to examine what the outlier results from Hermès and Gucci may mean, let’s see what we can learn from a high-level brand and content audit of these two brands, respectively, in tandem with Louis Vuitton.

Brand and Content Audits: Hermès, Louis Vuitton, and Gucci

When conducting a formal brand content audit, our team at It’s A Working Title LLC usually uses a battery of eight to 10 evaluation criteria to assess a brand and its content across platforms, both internal and external. For simplicity’s sake in this exercise, we are going to approach these three brands briefly across two broad criteria: Brand Vision and Approach; and Content Strategy and Marketing.

Hermès

Brand Vision and Approach

As its website tagline notes, Hermès, “contemporary artisans since 1837,” brings a deliberately artisanal approach to every level of its branding and product creation.

Founded as a harness workshop in Paris by Thierry Hermès, the company has a traditional business model. It makes almost all of its products in France at Les Ateliers Hermès and outright rejects mass production, assembly lines, and mechanization. Hermès has remained a family-owned company for generations, starting initially as a riding specialty provider for noble families and gradually growing and expanding its offerings over time.

Supposedly, CEO Axel Dumas has to sign off on every Hermès product before it leaves the atelier, an approach that aligns well with that of his uncle, former CEO Jean-Louis Dumas, who once noted, “We don’t have a policy of image, we have a policy of product.”

Content Strategy and Marketing

One look at the Hermès website shows a company that is all about its brand story and leverages a carefully-crafted content strategy to communicate its brand messaging consistently across channels, from its brick-and-mortar stores all the way down to its visual style guide. For example, on its website, the “About Hermès” section gets special treatment and forms a main element in the website’s main navigation so it is easily accessible. Also, the brand’s main font is reminiscent of an archaic typewriter font, which suggests an elevated nostalgia.

Part of the consistency in the Hermès brand vision comes from a tight organizational structure not only at the C-suite level in its generational family approach but also through its creative design leadership since the days of Martin Margiela, Jean-Paul Gaultier, and later Christophe Lemaire. Nadège Vanhee-Cybulski has been in charge after Lemaire left in 2014, and Véronique Nichanian has led menswear since 1988.

Hermès’ approach to product marketing can be summarized in a single sentence: it has no marketing department.

As Lauren Sherman pointed out in an aptly-titled piece (“Hermès’ Anti-Marketing Marketing”) for The Business of Fashion,

Category segregation is critical to the company's strategy. Hermès confines iconic, core-category products like bags to high-end price ranges, while offering other categories, like scarves, at lower price points to aspirational consumers. But so is brand storytelling…. [Without] a marketing department … it employs a communications team to manage press and media buying and a creative team to conceive seasonal campaigns.

While it has no marketing department, Hermès nonetheless brings a consistently branded, relatively non-celebrity-driven approach to content across channels, which include 300 brick-and-mortar stores in 45 countries, its e-commerce site, and the main social media platforms, including Instagram, YouTube, Facebook, and Twitter, a.k.a. X. On its e-commerce site, the brand offers a diverse but controlled range of products at a variety of price points, including its elaborate, hand-painted scarves or carrés, though notably the now-iconic Birkin is not included. Interestingly, while Hermès sells high-end baby gifts, there are no products specifically marketed to children.

When it comes to innovation, Hermès takes a calculated approach to Web3, having filed a trademark to cover all Web3 projects, after winning a lawsuit in 2022 against MetaBirkins for its NFT handbags.

Gucci

Brand Vision and Approach

It is hard to encapsulate Gucci’s brand strategy briefly. For a brand that recently celebrated its centenary, the company’s branding is at times diffuse and inconsistent, even though many parts of its business strategy are innovative and memorable.

Founded in 1921 by Guccio Gucci in Florence, the Italian fashion house grew to prominence in the 1970s and 1980s and operated under family ownership. But, after a long series of highly-public family issues, the family was ousted from corporate leadership in 1993; and in 1999 the firm was acquired by French luxury conglomerate PPR, which became Kering.

To examine Gucci’s brand strategy, it is perhaps easiest to start with its website as a brief snapshot. From a UX standpoint, the current Gucci website is a bizarre experience. Landing on the homepage, a user is greeted with an enormous, almost full-screen “Gucci” logo that eventually shrinks to the top of the page to then highlight the current product promotions in the hero carousel below. The majority of the home page real estate is devoted to its products with minimal brand storytelling. Like many other luxury brands, Gucci uses a generic-feeling luxury sans serif font and buries what there is of a brand story in the website footer. On the “About Gucci” page, one is greeted with a few lines:

Founded in Florence, Italy, in 1921, Gucci is one of the world’s leading luxury brands. Following the House’s centenary, Gucci forges ahead continuing to redefine luxury while celebrating creativity, Italian craftsmanship, and innovation.

Digital branding aside, Gucci has done some amazingly innovative things when it comes to design and product strategy, especially under the guidance of previous creative director Alessandro Michele. One can only assume that Sabato de Sarno will continue this trend toward design innovation when he debuts his first collection as creative director next month at Milan Fashion Week, though the recent departure of Marco Bizzarri does raise some questions about the brand’s longer-term strategy.

Gucci product lines now include womenswear, menswear, childrenswear, and its gender-neutral MX line. The brand has done a number of well-executed collaborations, including the much-anticipated Gucci x Adidas, Gucci x North Face, Gucci x Disney, and Gucci x Commes des Garçons, to name a few. The Gucci Vault by itself is visionary: it is a concept store that aims to bring together the old and the new. It involves a series of smaller initiatives, including collaborations with independent designers using Gucci materials, the restoration of archival pieces, and new branded digital creations in the metaverse.

Content Strategy and Marketing

Like its brand strategy, the Gucci content strategy and marketing are good but sometimes make it seem as if the brand is going through an identity crisis. Although, as illustrated in our Journey Map of Gucci, the brand has an impressively cohesive cross-platform sales experience, sometimes it is not clear what their content goals are and for what target audience their content is designed.

On the one hand, Gucci is leading the way when it comes to Web3.0 and gaming activations in a clear move to attract younger GenZ and GenAlpha consumers. After all, it was the first luxury brand to host a metaverse experience in The Sandbox and to do collaborations with SUPERPLASTIC and Bored Ape Yacht Club. In May 2021, Gucci sold a Roblox digital version of its Dionysus Bag for $4,115, which was $715 more than the “real” version and was not transferable outside of this digital world. Even though NFT mania has cooled, Gucci is continuing to pursue product drops in the Gucci Town experience on Roblox, which shows its commitment to data gathering and evolving its innovation strategy.

On the other hand, the Gucci e-commerce site is clean and functional but minimally interactive, distinctly geared towards GenX and older Millennial consumers. Visually and narratively speaking, the website content is sinuous with its social media channels. Like Louis Vuitton, Gucci’s approach to marketing feels highly product-driven, not brand story-driven, only without the scale or splash of its LVMH-owned competitor.

While we expect that Gucci will continue to grow its brand and content strategy in Bizzari’s absence, it is worth keeping an eye on with so much transition and transformation occurring at the same time.

Louis Vuitton

Brand Vision and Approach

The story of Louis Vuitton as of late is a loud one: it is a tale of big business, splash marketing, celebrity creative directors like the newly-appointed menswear director, Pharell Williams, and rapid product expansion across verticals targeted to wide-ranging demographics. Like Hermès, the French maison had humble origins, founded in 1854 on Rue Neuve des Capucines in Paris by luggage maker Louis Vuitton. In 1858, Vuitton introduced his now-famous flat-topped trunk, which was lightweight and airtight thanks to its fabrication with Trianon canvas. While Vuitton expanded his business into the UK by the time of his death in 1892, it was his son George Vuitton who took the company global in the early 20th century.

Not surprisingly, the Louis Vuitton of the 1900s was vastly different than the LVMH giant, of which the brand is a key component, we all know today. The brand, which was the first European company to over have a valuation over $100 billion, is now valued at over $124.8 billion and operates over 460 standalone stores in 50 countries, leased boutiques in high-end departmental stores, and a profitable e-commerce site. If you add up the revenues of much of the rest of the industry, they do not equal those of LVMH.

If it feels like Louis Vuitton is everywhere, that is not an accident. Louis Vuitton’s branding is, in a very real sense, all about its products, right down to its ubiquitous brand logo. As a company, Louis Vuitton safeguards its logo to prevent counterfeiting, though it may be becoming difficult for consumers to tell the difference.

Content Strategy and Marketing

Content-wise, the Louis Vuitton storytelling is very of-the-moment and not brand-story driven per se. Even at the level of digital information architecture, compare the Louis Vuitton website’s main navigation with the Hermès one: there is not a single nod to heritage in sight. In fact, to even find the brand story of Louis Vuitton, one has to go all the way to the page footer, click on “La Maison,” and roam around to find the “Heritage” section, which is oddly grouped into individual article posts. Even then, the “Designers” tab suggests that there was no Louis Vuitton before Nicolas Ghesquière and Virgil Abloh. Also, the Louis Vuitton website font is a typical luxury sans serif font: heavy, smooth, and forgettable.

When it comes to marketing, there is no brand like Louis Vuitton. In H1 2023, LVMH as a whole spent over €15 billion in marketing and selling expenses (over 1/3 of revenues), including Pharell Williams’ debut Menswear Spring/Summer 2024 show in June on the Pont Neuf in Paris, which garnered over 1 billion views on its website and social platforms and press accounts. If this show and the global saturation campaign it ran for its collaboration with Japanese avant-garde artist Yayoi Kusama are any evidence, Louis Vuitton has a money-is-no-object-if-the-ideas-or-celebrities-are-worth-it marketing strategy.

From the standpoint of omnichannel content distribution, Louis Vuitton takes a differentiated approach because it can afford to do so. The brand no doubt has multiple internal teams managing its website, marketing, and social media content, which allows it the freedom to run more wide-ranging campaigns. The Louis Vuitton social media channels are slick and full of celebrity- and influencer-driven collaborations and bold marketing campaigns; whereas, its e-commerce site is concomitantly aimed at both high-net-worth and aspirational consumers, with an incredibly diverse range of products at all price points. While it still offers the iconic trunks that have been made by hand since the 19th century, the brand’s products cover a full range, from its bags with their easily-identifiable monogram LV initials in its Damier and Monogram Canvas materials, including the celebrated Speedy bag and Neverfull bag, to full collections of womenswear, menswear, childrenswear, accessories, fragrance, and home goods.

Like its other digital content, Louis Vuitton also does innovation in a big way, recently unveiling its iconic trunk as a digital collectible as part of a sophisticated Web3.0 strategy unlike any other brand. This activation, named VIA Treasure Trunk, was released as a soul-bound token, which lets owners unlock a series of unique creations and eventually a physical handmade trunk.

In all, evaluating luxury brands through the lens of a brand and content audit showcases not only the various challenges of the luxury market but also the particularly unique nature of its content and the need for storytelling and consistent, authentic experience across channels.