How Luxury Strategists Should Think about Geography

Changing global luxury trends may require some tweaks to global strategies

Insights

LVMH H1 2023 earnings, released on July 25, showed organic revenue growth at 17 percent as the world’s largest luxury group continued to experience rates of growth that are almost double the long-term average growth rate of its stock price.

Strong sales in Asia offset weaker growth the U.S. as aspiration consumers continue to hold off on luxury purchases due to macroeconomic headwinds.

Apart from the past few years, luxury brands have benefitted from strong sales to China, yet have they become over-reliant as the Chinese economy is slowing from historic rates of economic growth and its population ages, potentially slowing the strong growth in consumer discretionary spending experienced in the past decade?

Luxury brands may well want to continue to diversify their business and content strategies into higher economic and population growth centers in Latin America, the Middle East, and South and Southeast Asia.

LVMH kickstarted the mid-year earnings seasons reporting on July 25, giving analysts and luxury market watchers a picture of the year’s first two quarters and hopefully a hint about what’s to come for the balance of 2023. The industry has been growing in the range of 15-20 percent a year for the past several years. This rate of growth is expected to moderate in the quarters ahead (as LVMH CFO Jean-Jacques Guiony noted, if the long-term growth rate of LVMH’s share price provides a rule of thumb then the industry’s steady growth rate is more like 10 percent), yet that moderation has not yet started. LVMH reported organic revenue growth of 17 percent in H1 2023. FSW is not in the business of revenue forecasting, but simple and complex forecasting models will probably give you at least a 15 percent forecast for H2.

Geography of sales this year

Yet, what we went looking for in H1 results was less the overall volume of sales but where those sales took place. The large contribution of consumers in Asia to both the overall size of luxury sales and a driver of sales growth is now old news. Looking at LVMH fashion and leather goods sales by region, the contribution of total Asia (including Japan) rose from 30 percent in 2015 to 50 percent in 2021. Over the same period, the contribution of the U.S. to luxury sales remained broadly flat while Europe, the home to the majority of the world’s luxury brands, contracted by six percentage points to 16 percent.

Geographical distribution of the sales value of fashion and leather goods by the LVMH group , 2015-2021

The LVMH H1 results bore out a similar pattern. Out of €42.2 billion in revenue, 51 percent originated in Asia (up 4 percentage points from H1 2022), 24 percent in the U.S. (down 3 points), 15 percent from Europe (unchanged), and 12 percent from all other markets (unchanged). The fall in U.S. demand was expected and has been slowing gradually, partly due to base effects (Americans spent an usually large amount on luxury during and just after the pandemic) and macroeconomic headwinds. On the latter, though unemployment remains historically low in the U.S., persistent inflation has eaten into real household earnings and created some uncertainty that has impacted so-called ‘aspirational consumers,’ or those in the $40,000-$100,000 earnings bracket according to The Business of Fashion. This was borne out globally in the LVMH H1 report as ‘selective retailing’ experienced the group’s largest annual organic growth rate of 26 percent versus 20 percent for fashion and leather goods. (In contrast, the full year selective retailing growth was 3 points slower than fashion and leather in 2022.) Selective retailing or distribution is primarily Sephora so this shows increased demand for lower-priced LVMH goods. These trends have further powered Asia as the major driver of global luxury sales and we expect to see similar trends from other major luxury brands.

But can China continue to drive luxury sales growth?

First, let’s look at the near-term in China. The story behind China’s massive growth as a luxury consumer has come as years of double digital economic growth lifted up a numerically large middle class with growing disposable incomes and tighter integration into global markets. The result has been what some have described as an over-reliance on China by the luxury industry. This sort of commentary is not new as they used to say that the industry was over-reliant on Japan about 25 years ago. But is there an over-reliance on what is becoming a slower growth China?

The high growth era for the Chinese economy is over, by design. From 1990 to 2000, China’s economy grew 9.8 percent a year on average. This bumped up to 10.5 percent over the next ten years. From 2010 until the start of the pandemic, this slowed to 7.7 percent. The IMF expects that this rate will slow down to under 4 percent from now until 2028. This is not a surprise as rates of economic growth slow as economies develop and shift from high productivity manufacturing to lower productivity services. In fact, some of this slow down was by design as policy-makers sought to shift the country’s source of growth to be less reliance on investment and more heavily driven by consumption. Yet what does it imply for luxury?

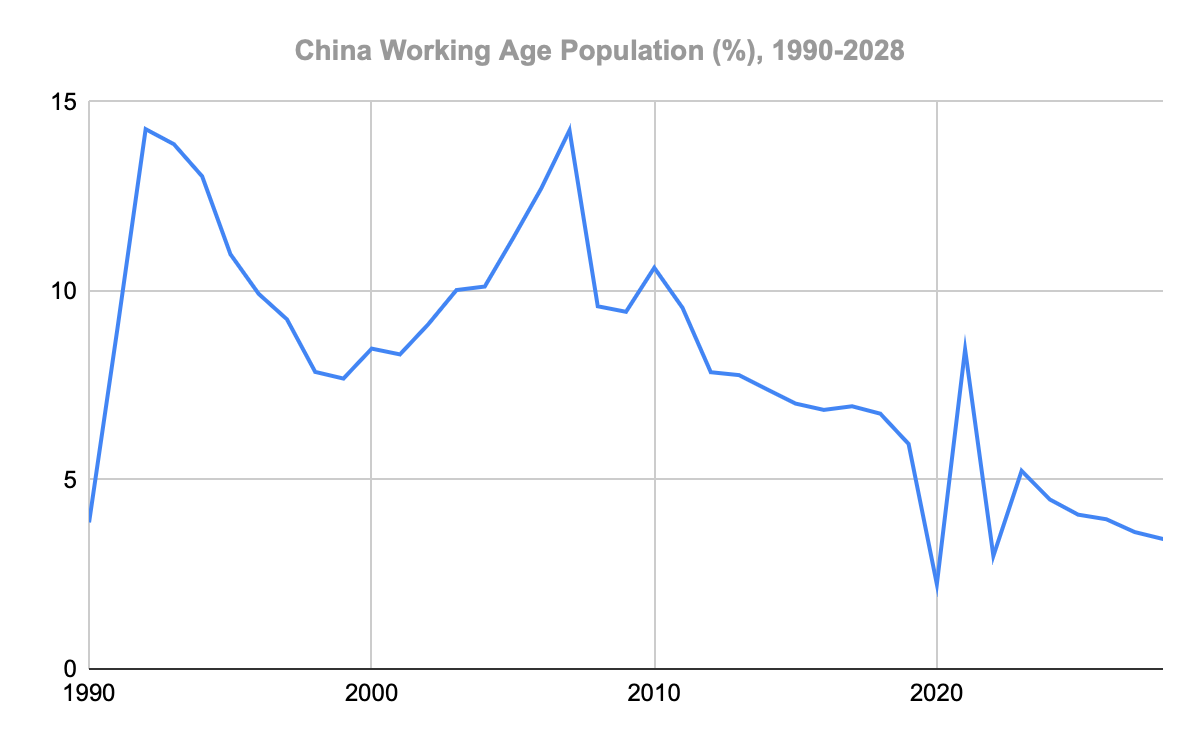

Clearly, China will continue to be a huge growth pole for luxury sales in the foreseeable future. Yet, can it continue to generate such large growth rates for luxury sales? The answer is likely no for the same reason that its economic growth rate slowed. There is a natural sort terminal velocity to these sorts of things. Moreover, the labor force of China is shrinking at a much faster rate than it did in the U.S. and Europe and similar levels of per capita income. The UN expects that China’s working age population will decline by 3 percent over the next ten years and by 10 percent over the next 15 years. This will represent a headwind for China’s economic growth prospects generally, but more particularly for discretionary household spending in particular. This may not present a limit on growth in luxury sales to high income earners, but it will constrain the movement of aspirational buyers to high income status and put a cap on the growth of aspirational luxury expenditures.

What should luxury brands do next?

Over the next decade, China may well join the ranks of the U.S., Europe, and Japan as a mature luxury market. These markets will represent the largest geographies of luxury sales yet annual growth rates may slow as these economies age. For dynamism and faster growth rates, even if from a lower base overall revenues, luxury brands would benefit from further diversification into emerging markets where we expect to continue to see strong economic and population growth.

One way to conceptualize these potential growth markets is to look at the role that demographics will play in providing either a positive or negative impact on the economy. The World Bank calculated the below map that categorizes the world’s countries into ‘pre-dividend’, ‘early dividend’, ‘late dividend’, and ‘post dividend’ status based on estimates of the contribution of younger demographics to the economy. According to this typology, China is a ‘late dividend’ country, meaning that its population dynamics contributed to strong economic growth, but this ‘dividend’ is waning.

Global Demographic Typology

Brands may want to focus on countries in the ‘early dividend’ stages. This includes a wide swatch of economies in Latin America, the Middle East, and South and Southeast Asia. Though luxury organizations have recognized the potential of these markets for some time, redoubling efforts to align product and content strategies towards these regions may help nurture markets that can add more dynamism and growth to organic revenues.