Why Do Some Luxury Brands Continue to Grow in this Market?

Brands that articulate their value are defying the narrative of a general industry slowdown

The luxury sector has logged six consecutive quarters of negative revenue growth (the longest contraction since 2008) while performance dispersion has widened sharply. Revenue growth variance, historically in the ~8–10 percentage point range before 2019, has expanded to 20–40 points post-COVID, with stark divergence between outperformers like Miu Miu (+40%) and underperformers like Gucci (–20%).

The pandemic-era acceleration of e-commerce and digital storytelling in the luxury industry has structurally reshaped competition. Brands that invested early in scalable digital infrastructures and narrative architectures underpinned by strong content strategies and more efficient content operations have sustained momentum, while slower adopters have experienced erosion in both brand equity and sales.

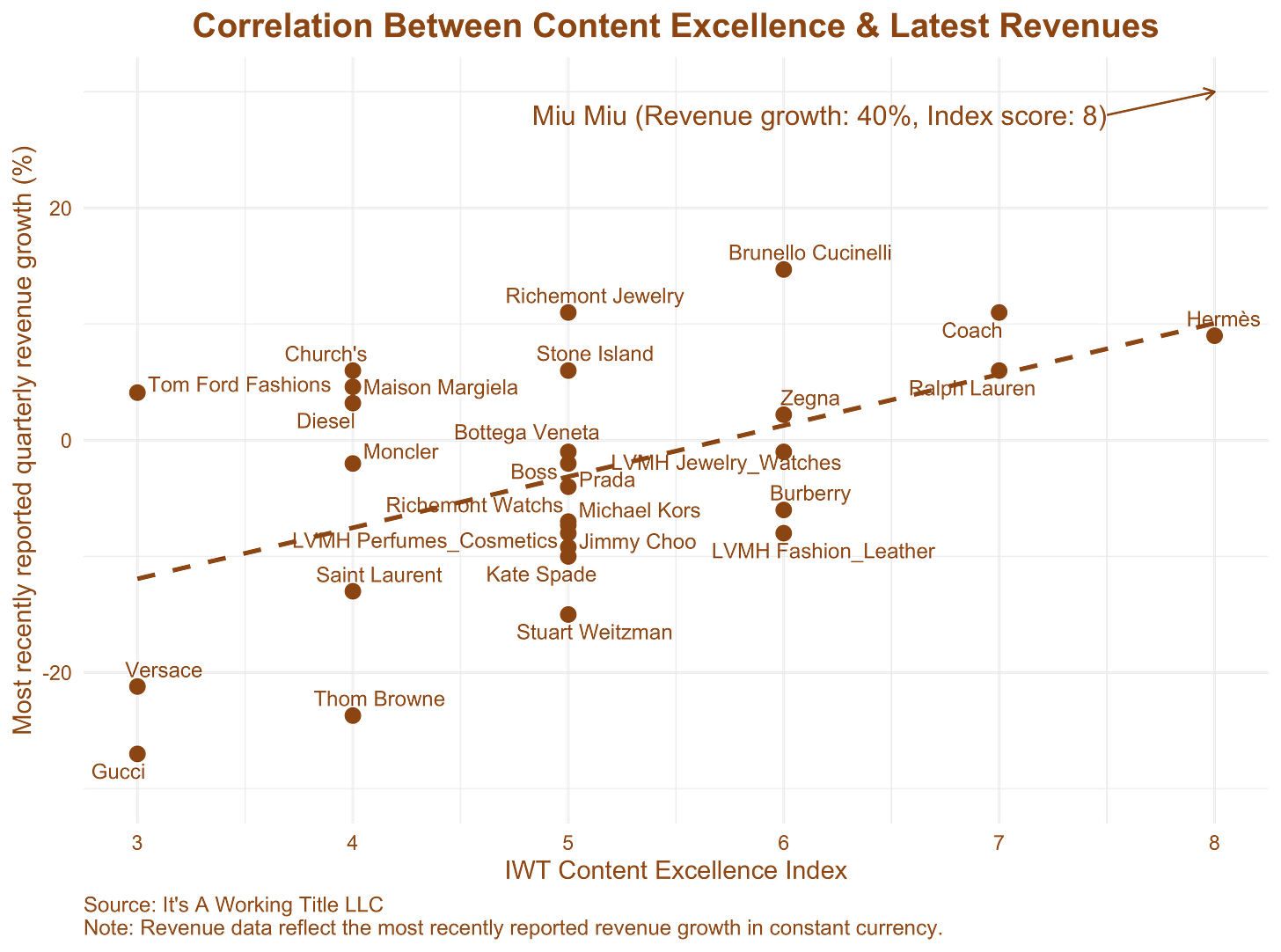

Content strategy has emerged as a predictive driver of performance. The It’s A Working Title LLC Content Strategy Excellence Index reveals a strong positive correlation between content quality—across narrative design, audience and channel fit, and shoppability—and top-line outcomes, positioning content-first strategies as leading indicators of revenue resilience and consumer loyalty.

At It’s Working Title LLC, we have been crafting a new, practical methodology that fuses classic brand storytelling models with holistic content strategy, narrative design architecture, narrative game design, and transmedia storytelling principles. The result is FlexNarra℠, a flexible narrative architecture. This storytelling system helps luxury brands envision and structure both brand and marketing stories as expandable worlds, with beats, arcs, and mythologies (aka suprareferential constructs) that flex seamlessly across platforms and audiences. We’ll be sharing more soon.

It is now pretty widely reported that luxury sales, particularly ‘soft luxury’, have cooled off from the breakneck growth experienced during the industry-wide super cycle that followed the pandemic. Some of the industry’s biggest names are reporting some historically bad numbers. However, industry averages (or medians) mask another trend: a sharp increase in performance differentiation across luxury brands and product categories. If you like, average growth is slowing but the standard deviation of the industry’s performance is rising. There are some losers but also some remaining winners.

This period of performance differentiation is an amazing time to understand what it means to sell luxury products successfully. There was not too much to be learned during the 2019-23 supercycle, as everyone was growing. But why did some brands continue to earn customer loyalty while most have struggled in the past six quarters? A great deal has changed in the way luxury is marketed since the pandemic.

After years of shying away from strong digital presences and e-commerce, most luxury brands have been forced to embrace them.

Technology has transformed how brand stories are created and consumed. In fact, many brands jumped so fast and deep into digital that they were among the first to present themselves in video games and metaverses.

Resale markets are now a thing that many brands now support on their own platforms.

We have seen the rise and fall of platforms like Farfetch and YNAP.

Yet, why have some brands navigated these challenges successfully while others look a bit moribund? Numerous variables may explain this rising differentiation, but in our view, the most important is how well brands explain why consumers should care about their brand and articulate that ‘why’ consistently across digital and IRL consumer touchpoints. In short, brands that are winning with content are winning with consumers.

Who is doing well in luxury this year?

Let’s start by identifying which brands continue to win with consumers. Here, we looked at a large sample of earnings reports, readily available on company websites for public companies, for luxury fashion, jewelry, watches, cosmetics, and fragrance brands. We are excluding some other major verticals, such as eyewear, travel and wellness, and automobiles, for several reasons. In many cases, these brands have characteristics that make comparison with others in our sample difficult, and we can conduct a separate analysis later on that relies less on large-sample (Large-N) comparisons at a later stage.

Below we show annual revenue growth for the period of April to June 2025. (You can find our analysis for the full year 2024 and January to March 2025, which provides a similar comparison.) We cover 24 different public brands or quasi-brands. As LVMH and Richemont do not report individual brand data separately, we pulled out some high-level product categories that are reported: LVMH watches and jewelry, LVMH perfumes and cosmetics, LVMH fashion and leather goods, Richemont jewelry, and Richemont specialist watchmakers. This results in something different than a pure apples-to-apples comparison with the other brands (which themselves may be a mix of different types of products), but this is better than nothing and seems necessary given that LVMH and Richemont represent around 35 and 10 percent of the industry, respectively.

So of our 26 brands, 9 reported positive sales growth during the period of April to June 2025. These brands include Miu Miu, Brunello Cucinelli, Richemont Jewelry Maisons, Coach, Hermès, Stone Island, Ralph Lauren, Church’s, Tom Ford Fashions, and Zegna. The rest of the industry recorded negative growth with three brands (Stuart Wietzman, Thom Browne, and Gucci) recording 20+ percent declines in annual growth during the same period.

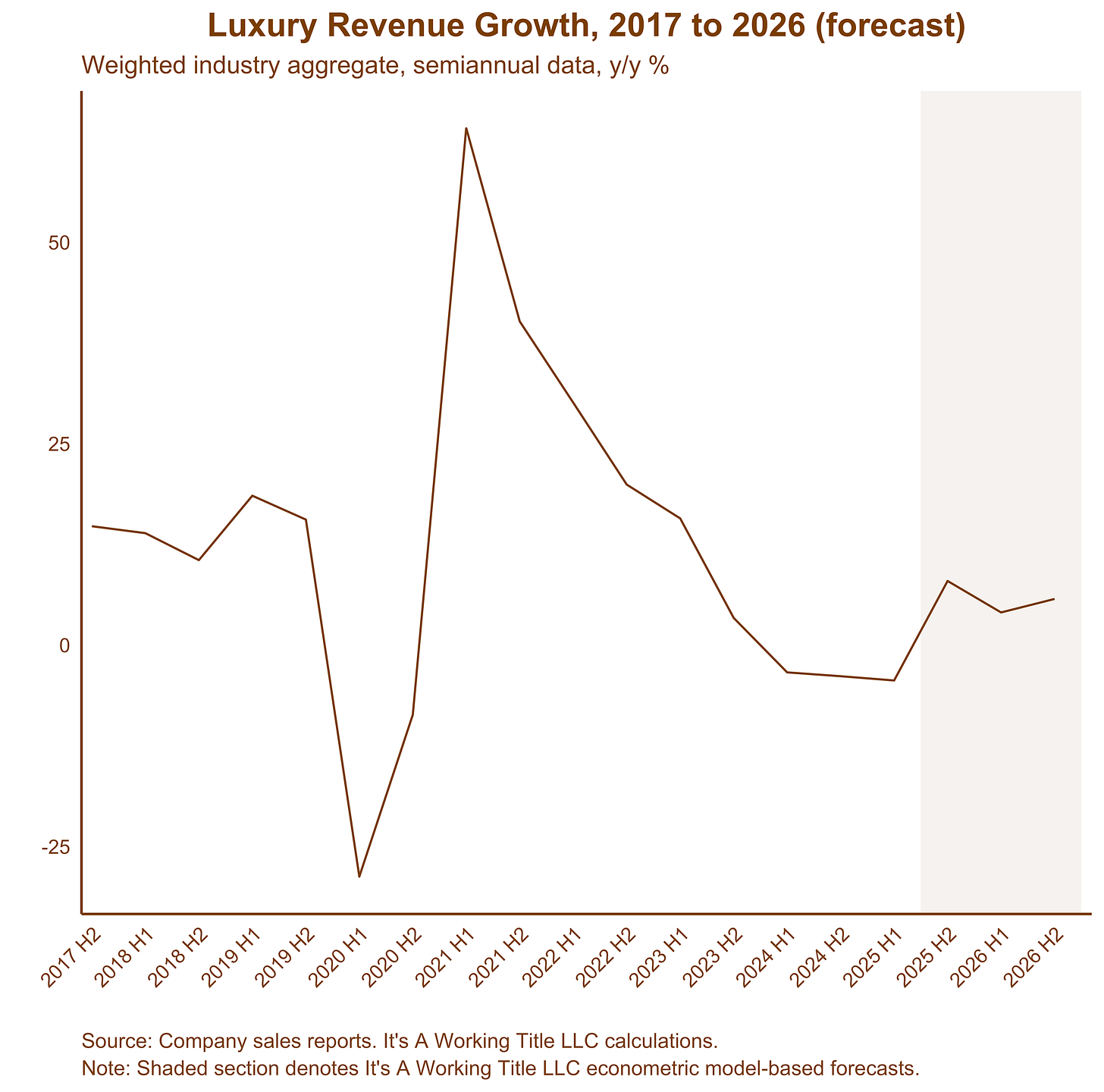

The luxury market is in recession, but there is pronounced volatility and dispersion across firms

At the industry level, luxury remains in recession. The plot below shows annual revenue growth for a weighted index of major luxury organizations. The plot displays a fairly lengthy time series that encompasses semi-annual growth before, during, and after the pandemic, and includes the It’s A Working Title LLC industry forecasts for the period from H2 2025 to H2 2026. The industry has reported negative revenue growth for about six consecutive quarters. By our count, the only other instance of this occurrence was during and after the 2008 global financial crisis. This is a historically unique slowdown.

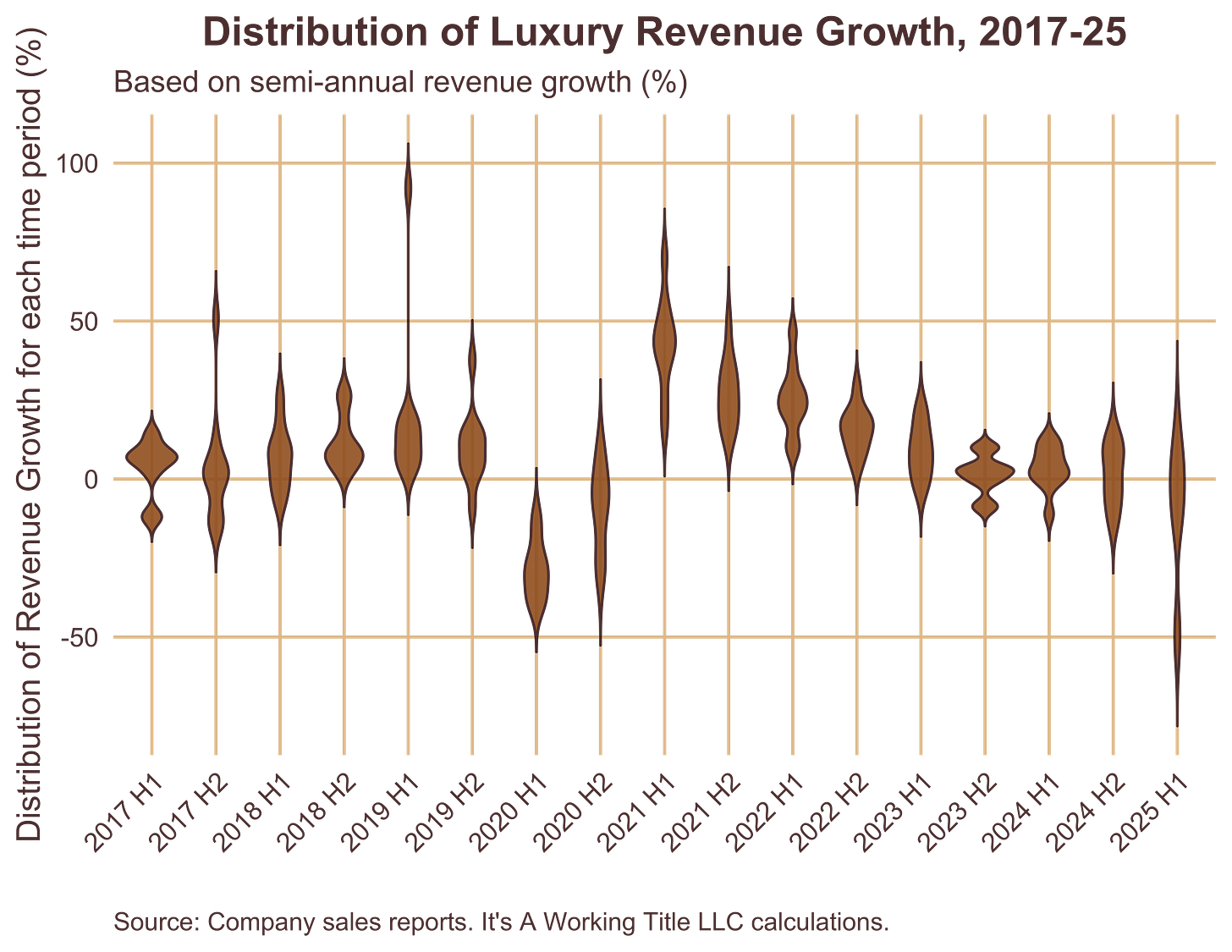

Yet, as we saw in the revenue numbers for the latest quarter, the slowdown is not universal. In fact, there has never been a period in recent history when performance by luxury brands has been so heterogeneous. To get a sense of the heightened level of dispersion in performance, we created a violin plot below, which illustrates how luxury firms’ revenue growth was distributed across the industry from 2017 to the latest results in 2025. The vertical axis shows revenue growth in percentage terms for the luxury firms in our sample, while the width of the “violin” indicates the number of firms with results at that level. Taller, stretched violins indicate that firms’ performances were more scattered, while shorter, wider ones suggest they were more similar. The violin for the last two quarters is the longest over this nine-year period of time, and the thinness shows that there is relatively low clustering of similar results.

In fact since the pandemic, the volatility of luxury revenue growth has risen dramatically. Some standard measures of statistical variance point to this trend. The standard deviation of revenues, which shows the absolute spread of results, jumped from about 8–10 percentage points before 2019 to regularly above 20 and even into the 40s in recent periods. The coefficient of variation, which measures volatility relative to average growth, has spiked erratically since COVID—rising from around 0.7–1.0 before 2019 to levels above 2.0 and even near 4.0 in some recent half-years—showing that even strong years came with unstable performance. Meanwhile, the interquartile range—the spread between the middle 50 percent of firms—has widened from roughly 5–7 percentage points in the late 2010s to more than 12–13 percentage points after 2020, signaling that dispersion is no longer confined to a few outliers but now affects the core of the industry.

The changing nature of luxury content makes content strategy a key differentiator

The surge in volatility and dispersion among luxury firms since the pandemic can be traced to how differently companies adapted to a sudden digital pivot. Before 2020, luxury was one of the few consumer industries still relying heavily on physical boutiques and face-to-face experiences, with only a modest presence in e-commerce. When lockdowns hit, firms had to rapidly roll out digital storefronts, strengthen online storytelling, and build e-commerce platforms that could replicate aspects of the luxury experience. Some companies invested early and executed these digital shifts well, capturing new global customers and sustaining growth, while others lagged behind, struggling with technology, logistics, or brand fit in the online space. This uneven digital transition amplified performance gaps across the industry, adding to volatility already fueled by macroeconomic uncertainty and shifting consumer behavior. As a result, the post-pandemic luxury landscape is more fragmented, with leaders pulling away and laggards facing greater challenges than before.

The digital shift also put a premium on storytelling and content creation, giving firms with strong strategies in these areas a clear competitive edge. Luxury has always been about brand narrative and emotional connection, but in a physical boutique, that story is told through design, service, and environment. Online, however, the story has to be conveyed through digital campaigns, immersive websites, influencer partnerships, and seamless integration with social platforms. Companies that had already invested in compelling content and digital brand-building were able to translate their heritage into engaging online experiences and sustain consumer loyalty. By contrast, firms without well-developed content strategies struggled to differentiate themselves in crowded digital marketplaces, leading to weaker sales growth and a widening gap between leaders and followers in the post-pandemic period.

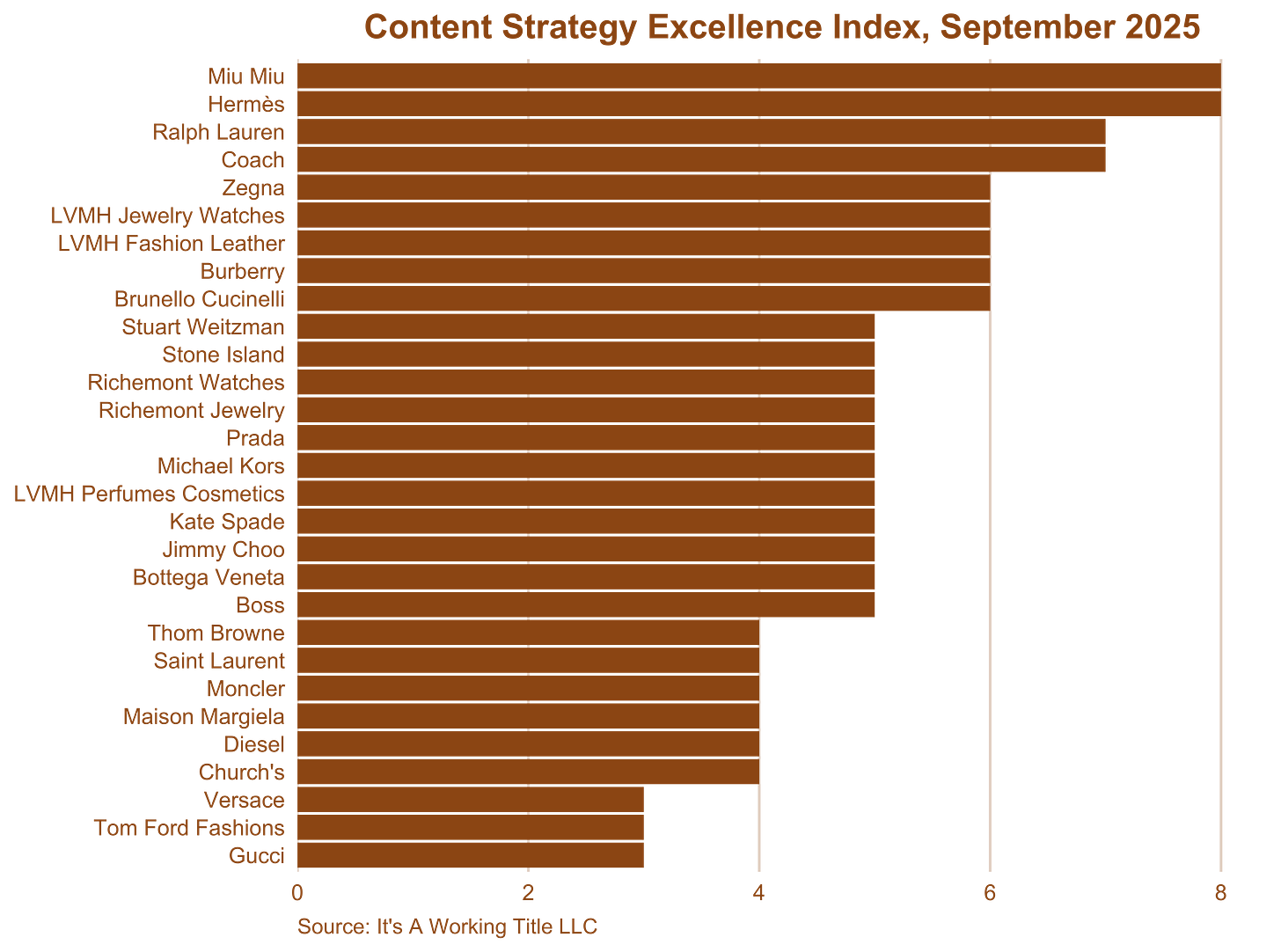

To illustrate the point, our latest release of the It’s A Working Title luxury Content Strategy Excellence index points to a strong positive correlation between brand-level content quality and revenue growth. This is the third update to the index since publicly launching a portion of our quantitative content strategy and marketing diagnostics to the public in a January 2025 white paper. The public version of the broader diagnostics that we present to clients scores brand content quality excellence across three dimensions: (1) narrative marketing quality, (2) audience targeting/channel fit, and (3) content shoppability.

The chart highlights clear contrasts in brand performance. Miu Miu remains the industry standout, combining one of the highest content excellence scores with revenue growth of about 40 percent, signaling strong alignment between digital strategy and commercial results. Hermès and Coach also demonstrate both high index scores and solid positive growth, reinforcing their leadership positions. In contrast, brands like Gucci, Versace, and Thom Browne continue to cluster at the lower end of the index and report negative growth, suggesting weaker content strategies may be weighing on performance. A middle group—including Burberry, Prada, and Michael Kors—sits near the regression line with moderate scores and modest growth, while Brunello Cucinelli and Richemont Jewelry overperform relative to their peers, posting strong growth despite not having the very highest index scores. Overall, the distribution shows a widening gap between leaders who have translated content excellence into revenue momentum and laggards who remain vulnerable.

Why Content-First Brand Strategy Wins for Brands and Consumers

We think that the increasing luxury industry performance distribution and the correlation between performance and content excellence suggest that it is not enough for brands to plan and publish content on their e-commerce site, social media posts, in-store advertising, or even influencer marketing content. One way to think about the relationship between quality content and customer experience is “received value,” or the actual value customers get from content, products, and experiences, rather than “perceived value,” or the value brands assume customers are getting. Received value is about how brands show up for their customers, whether they find value in the brand and products, and if they are willing to purchase products and return. Received value, rather than just perceived value, is where the rubber meets the road when discussing content marketing strategy vs. holistic content strategy for consumer-facing brands in retail, fashion, and luxury.

Content marketing strategy is important, but it does not differentiate a brand or even necessarily communicate its deep brand value proposition if it is not consistent, attenuated, and relatable. Holistic content strategy, on the other hand, is all about ensuring that a brand’s content aligns seamlessly with its values, narrative, and customer experience and with customer needs, preferences, and habits across every touchpoint.

Taking a content-first, rather than product- or brand-first, approach to brand strategy puts the customer, rather than the product, at the center of the communications equation, making it all about output and outcomes—e.g., the value and impact of brand storytelling to the consumer—rather than a brand's input or goals. This focus is not intended to devalue the brand’s vision and values. Quite the contrary, when connected to a holistic content strategy, a content-first brand strategy empowers brand stories through focusing, attenuating, and connecting them to concrete, measurable content performance indicators across and within channels in a way that is more readily linkable to internal KPIs like customer retention and acquisition targets and even sales goals, as our FSW Content Effectiveness Index illustrates.

If fashion and luxury brands want to distinguish themselves and come out ahead of the game after whatever slowdown is happening, they must adopt a content-first mindset. What does this involve? While we caution that every brand is in a different stage of content maturity, here are some steps that brands can consider:

Take a step back to assess your “why” for content and communicating with your customers (yes, both digitally and IRL). Are you taking a holistic approach to brand storytelling, utilizing multi-dimensional, dynamic, and channel-appropriate content with consistent but attenuated messaging that invites your customers to interact, contribute, and become part of your brand and its vision, lifestyle, and products? Are you using a top-down brand strategy and communications model and broadcasting your brand and product vision throughout your marketing and advertising?

Spend time to understand not just your general customer personas but the actual needs of your existing and prospective consumers. This should focus on studying customer content consumption habits and preferences, including, but not limited to, preferred content types, channel patterns, cadence and timing of content interactions, dwell time habits, cross-channel behavior, and content category and topic preferences.

Audit and evaluate your content and content processes, standards, templates, guidelines, systems, and tools within and across teams. This not only includes having a documented inventory of where all of your content lives, on what channel, and what team owns it but also documenting publishing processes for different teams, what tools they’re using to plan, manage, store, and publish content, what their cadence and calendar for publishing content is, and how they manage and oversee content production, quality, and editorial appropriateness. This audit process should include a content gap analysis, competition analysis, and a relook at the customer content consumption data you gathered during your early customer persona research process.

Articulate and document your North Star for content by identifying the unique value proposition of your brand in a way that is true to the company’s DNA, relevant to today’s market economy, and memorable to your target consumers. In practice, once you’ve defined your brand content “why,” then define your content vision and goals and specific qualitative and quantitative success measures so you know what you’re trying to do with content.

All of these steps form the foundation of your holistic content strategy. Of course, any experienced content strategist will tell you that more goes into a content strategy framework and operations model than the above steps.

In all, adopting a content-first brand strategy and investing in a holistic content strategy offers retail, fashion, and luxury brands a small path forward to not only differentiate themselves but also to get the right content (and, in turn, the right product) in front of the right customer at the right time on the right channel.

At It’s Working Title LLC, we have been crafting a new, practical methodology that fuses classic brand storytelling models with holistic content strategy, narrative design architecture, narrative game design, and transmedia storytelling principles. The result is FlexNarra℠, a flexible narrative architecture. This storytelling system helps luxury brands envision and structure both brand and marketing stories as expandable worlds, with beats, arcs, and mythologies (aka suprareferential constructs) that flex seamlessly across platforms and audiences. We’ll be sharing more soon.