U.S. Consumer Spending Weakens in November Despite Strong Black Friday

A Fashion Strategy Weekly note on macroeconomic trends impacting the retail fashion and luxury sectors

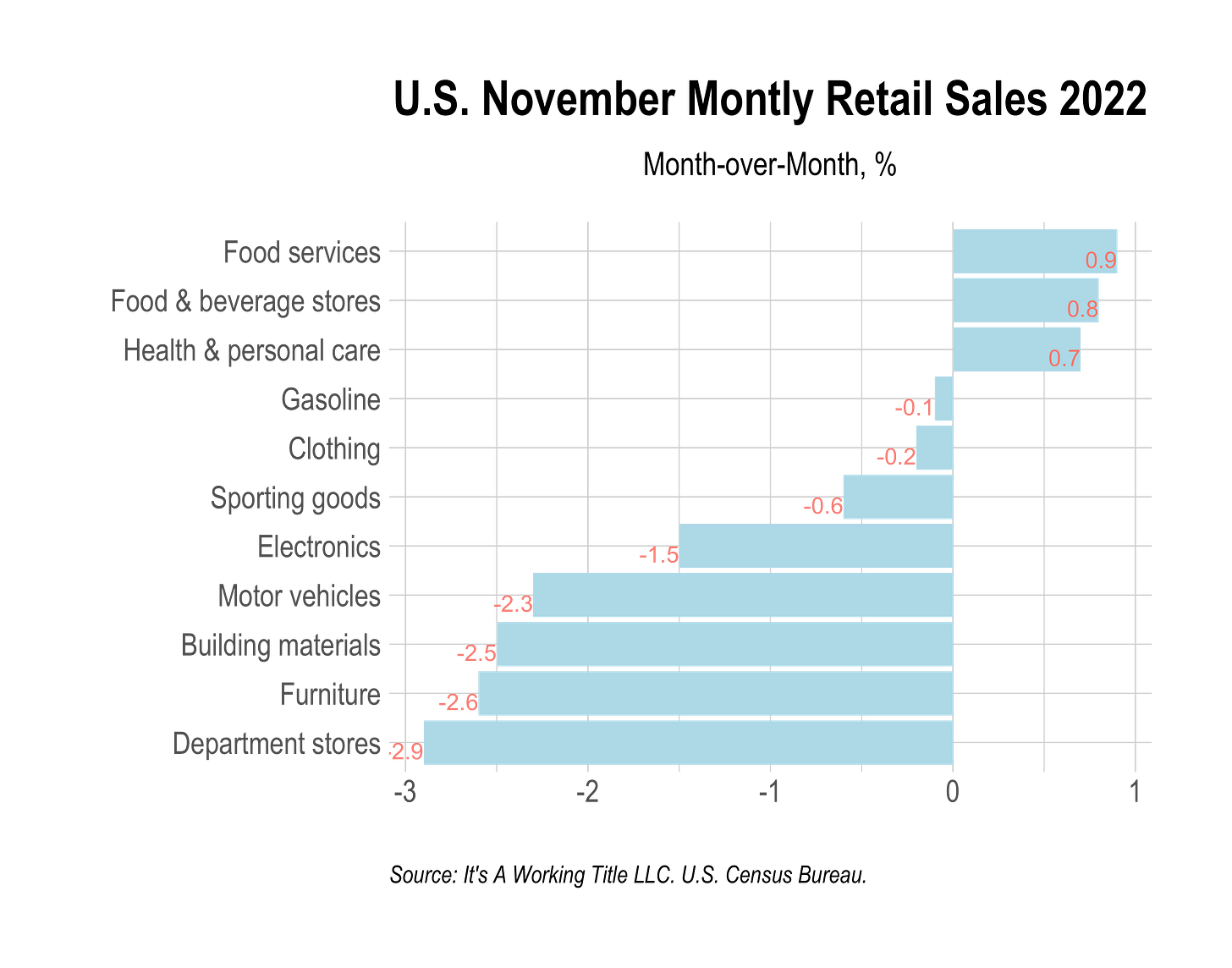

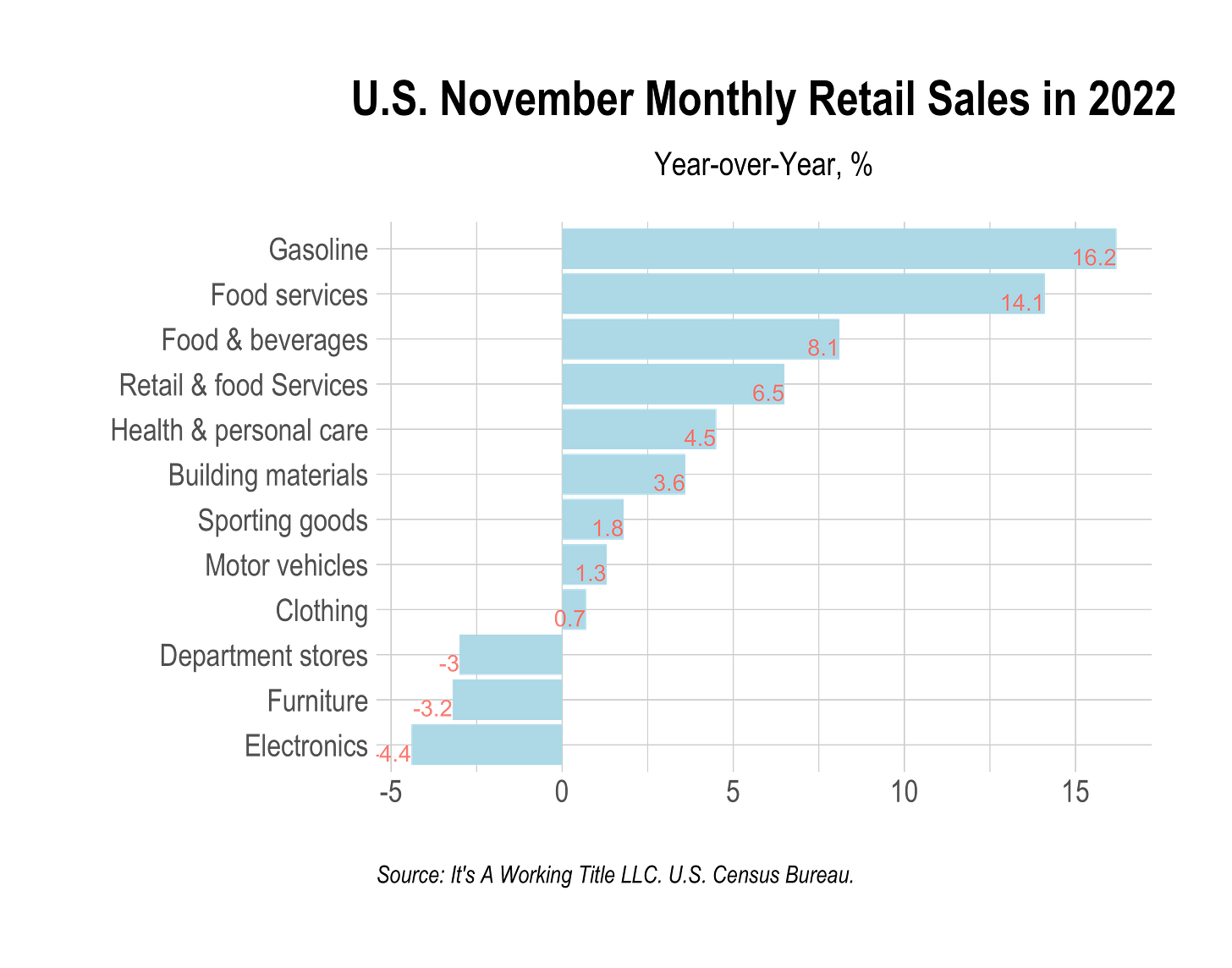

Despite a strong Black Friday, U.S. retail sales in November were down 0.6 percent versus October 2022, according to advance estimates released by the U.S. Census Bureau on December 15. This was triple the 0.2 percent decline that the market expected. Declines in consumer spending were broad-based with the biggest monthly losses recorded in department stores (-2.9%), furniture (-2.6%), building materials (-2.5%), and cars (-2.3). Clothing and apparel sales were slightly down at -0.2 percent. Retail spending as a whole was down -0.8 percent. Even in areas where growth in spending was positive, the orders of magnitude were small: food services were up 0.9%, food stores were up 0.8 percent, and health and personal care was up 0.7 percent. Consumer spending was up 6.5 percent as compared to November 2021, yet this reflects a strong loss of momentum in spending activity as year-over-year sales were 8.3 percent in October. Retail was in line with broader annual consumer spending, up 6.7 percent year-over-year. These numbers are adjusted for seasonality but not inflation. Yet, they are concerning given the strong role that Q4 holiday spending plays in consumer retail in particular.

Putting these numbers in the context of various segments of the retail clothing market, the luxury and premium end of the retail market has been robust for most of the year, yet mid-market shops have suffered as evidenced by the sharp decline in spending at department stores. These trends are likely to continue into H1 2023 as consumers reduce discretionary spending in the face of decades of high inflation and growing fears of sharply slower economic growth, or even a recession, in 2023 as the Federal Reserve and other central banks around the world continue to raise interest rates to combat inflation and, in some places, support weakening nominal exchange rates. Luxury is not immune to slowing economic growth and in October, the major credit card companies reported that Americans were slowing spending on luxury items. Typically sales of luxury products do decline during the trough of the economic cycle, but by lower magnitudes than lower priced items and the bounce back tends to be faster when the cycle trends back up. Looking at luxury beyond apparel, the relatively strong performance of health and beauty shows that the strength of this market segment, which began during the pandemic, continues.