Slowing Luxury Growth Means Now is the Time for Content Strategy

Weak H1 2024 earnings reports this week point to the urgency of changing from tactics to content strategy.

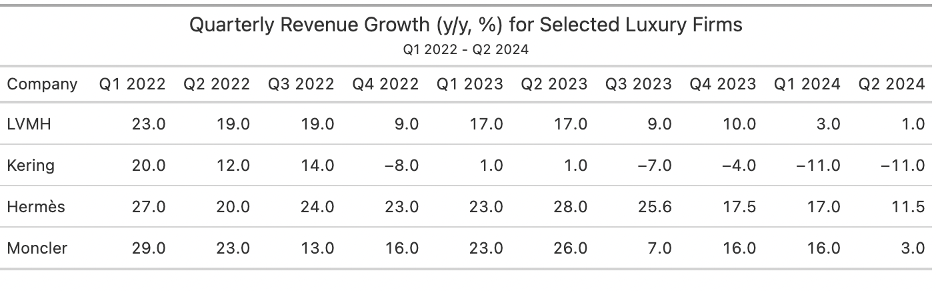

The luxury industry is facing a significant slump from its post-pandemic high, as confirmed by a slew of earnings reports released during the past week. While LVMH saw a modest 2 percent revenue growth in the first half of 2024, Kering experienced an 11 percent decline, and Gucci a 20% drop. Hermès and Moncler had better outcomes, but still showed signs of slowing growth compared to previous highs.

Poor performance in China, a crucial market for luxury brands, exacerbates the industry's struggles. LVMH's revenue in Asia (excluding Japan) fell by 10 percent, Kering's by 22 percent, and Hermès saw a deceleration in growth. This trend suggests a cooling off of aspirational luxury spending, which comprise potentially 60 percent of luxury revenues.

The end of the luxury industry’s post-pandemic super cycle makes strategic planning more critical. Brands need to focus on robust content strategies to navigate the slowing market and power future growth by ensuring that brand stories meet a diverse and changing group of consumers at every touchpoint. As growth rates return to the single digits for most brands across most product verticals, the wild ride of tactical actions that the industry engaged in over the past few years need to evolve into the steadier tiller of strategy.

The Luxury Industry Continues to Shift into a Lower Gear

This week’s super storm of earnings reports from the luxury industry confirmed everyone’s fears that the industry is continuing to slump and slump deeply from its post-pandemic zenith.

On July 23, LVMH, the industry’s largest player by almost any measure, reported that overall revenue growth was up 2 percent in the first six months of 2024 when compared to the same period in 2023. The picture was much worse at industry laggard Kering, which reported a decline of 11 percent during the same period, with a whopping 20 percent decline at Gucci. Earnings reports by Hermès and Moncler, released on June 25, were less troubling with H1 growth rates up 12 and 11 percent. Yet even though these were well off the post-pandemic highs and Q2 outturns were significantly weaker than those in Q1.

Repeated poor attempts to forecast the state of the luxury market show how difficult it is to predict how industries will perform in the short-run. Yet, the leading indicators are not good. First, the numbers out of China were bad. For LVMH, H1 revenue growth in Asia (excluding Japan) was -10 percent and for Kering it was -22 percent. Hermès’ sales were up 6.8 percent, yet this was less than a third of the 24 percent growth rate recorded in H1 2023. Moreover, while Hermès has consistently been a strong industry performer, its strongest growth segments in H1 were its higher priced leather goods and saddlery sector (which contributes just over 40 percent of total group revenues) while its lower priced priced silks/textiles and perfume/beauty sectors (collectively less than 10 percent of revenues) came in at -1.7 percent and 3.9 percent. This lends some support to the view that the aspirational customer really is cooling their luxury spending. If there is any empirical veracity to the oft repeated maxim that the wealthiest 2 percent of global consumers account for 40 percent of luxury spending, then the inverse shows that 60 percent of luxury revenues are at risk for at least the rest of the year and into Q1 2025.

Investors certainly believe this to be true as luxury equities have tanked since early May while the broader stock market has continued to trend upwards. The Fashion Strategy Weekly All Luxury Stock Index has fallen over 11 percent since May 1 while the S&P 500 has risen by 6.5 percent.

This slowing in luxury sales will increase the importance of getting strategy right amid the unpredictability of the market. The industry has grown by 25 percent since 2019, fueled by a successful industry-wide shift into more and better digital distribution combined with an evolution of aspirational consumer preferences towards luxury (“revenge buying”). Though the benefits were not symmetrically distributed across luxury organizations and bigger brands tended to benefit more (apart from Kering), global social and economic trends lifted most boats. The industry shifted from being laggards in digital commerce to retail leaders and has even led the way in Web3 experimentation.

In this bull market of strong demand for luxury products, brands did not have to invest too much or too effectively in strategy to attract customers. Yet, it is easier to churn out experimental or ad-hoc forms of marketing and customer outreach of when revenue growth is in the mid-teens for many quarters in a row and the outlook is upbeat. Strategy is less important than execution when the going is good.

With the tide going out on the supercycle, questions about ROI in marketing and tech spend become more pointed. Investment of time and treasure across all customer touch points need to be effectively coordinated. In short, as growth rates return to the single digits for most brands across most product verticals, the wild ride of tactical actions needs to evolve into the steadier tiller of strategy.

Getting a content strategy in place is where to begin. Apart from addressing the challenges from a short-term cyclical slowdown, content strategy is part of a toolkit to help prepare brands to meet structural challenges such as meeting sustainability regulations, facing rising geopolitical uncertainty, and appealing to a range of consumers across demographics and geographies.

The post-pandemic era was one of easy growth

The post-pandemic luxury boom was driven by all three terms of the revenue equation: price, volume, and mix. The ability of most major luxury organizations to control pricing power while maintaining strong unit volume growth with a revenue-enhancing mix of products over the past few years has delivered strong sales and stable margins. Looking at just revenues, the post-pandemic period from Q1 2021 up until Q2 2023 is associated with large double digital quarterly growth rates across the board at major European organizations.

This explosion in revenue growth translated into a surge in shareholder value that dwarfed other sectors of the economy. From January 1, 2020 until mid 2023, share price appreciation for the industry’s giant LVMH (which became the first European-based company ever to achieve a $500 market capitalization in April 2023) was over 60 percent, Hermès was 165 percent, and Richemont was 59 percent. Among the giants only Kering (which has been undergoing numerous transitions simultaneously) had a bad result with a -35 percent. This is in comparison with a much more meager 11 percent gain for the Eurostoxx 50 index over the same period.

In this period of heady growth, luxury brands leaned into an amazing array of innovative tactics to connect with customers across a range of demographics. We saw an explosion in major luxury brands experimenting with what had previously been deemed edgier technologies like NFTs, the metaverse, gaming, and AI, partially to attract younger Gen Z and Gen Alpha consumers. This included the launch of Metaverse Fashion Week in 2022 and a wide array of individual activations from a range of brands from Gucci to Tommy Hilfiger across platforms like Roblox, the Sandbox, and Decentraland. This led to brands jumping into NFTs, the metaverse, or gaming without a real plan for building longer-term customer engagement or loyalty.

Slower growth should mean prioritizing content strategy

The post-pandemic supercycle is over, but this represents an opportunity to turn quick and easy growth and tactics back into durable growth and strategy.

The sales equation is adjusting in a way that suggests the weak H1 2024 results are a harbinger of a weak H2 and a concerning Q1 2025. An assessment from RBC Capital Markets found that LVMH’s sales equation during 2019-22 was 11 percent price, 3 percent volume, and 3 percent mix. This is adjusting down to a forecast of 2-3 percent price, 0 percent volume, and 5-6 percent mix over the next fiscal year. This is a pretty broad-based slowdown in the drivers of margins and points to a sharp slowdown in buying by aspirational customers and an increasing reliance on the higher income and net worth customer base (about 225 million or 60 percent of luxury customers as we previously noted). Concerningly, this is probably cutting out a lot of the Gen-Z and even some Gen-Y customers who collectively powered all of the industry’s growth in 2023 according to Bain & Co.

Luxury firms should not allow this period of slower growth to go to waste. JP Morgan estimates that luxury downturns have occurred three times since 2010 and lasted six months, on average. There are reasons to think this time may be worse given slowing economic growth, high interest rates, and just general unease owing to the lurch of world economic and political affairs from one crisis to another over the past few years.

In particular, brands can use this opportunity to begin introducing or refining their content strategies. Periods of rapid growth, both in terms of sales and market reach but also experimentation with new technologies and customer touchpoints, do not tend to be well correlated with good content strategy. They may be the result of good strategy, but rapid growth leads to an unrolling of events that often occur outside of previously considered strategies. A slowing down provides an opportunity to recalibrate to a new and evolving commercial landscape. The accelerated expansion of tactics adopted by luxury brands during this period of rapid growth, with new adventures into digital and metaverse and games and blockchain-based applications, seems to be no exception.

Content Strategy Can Be A Hedge Against Uncertainty

Like all strategies, creating a content strategy begins with being mindful of the way that you use your internal resources to engage with customers. Content strategy is unique from other forms of strategy in that it must involve integrating high-level strategy with marketing, UX, and CX functions, and even finance. At least at the start, you need to bring together corporate strategy functions with tactical functions and ensure that the strategy encompasses both front-end areas of client engagement with the back-end technical departments that support the various channels by which your audience is reached. This is especially important if you reach your audience through multiple channels as having separate strategies for IRL engagement, web2 digital engagement (e.g., social media), and even web2.5 to web3 outreach (e.g., immersive digital experiences or various co-creating platforms) will waste resources at best and likely result in the splintering of corporate strategy into ways that are diluting.

Content strategies can be as diverse as the organizations using them, but there are seven steps that are essential:

Step 1: Define Your Objectives. Before creating a content strategy, it's essential to determine the goals you want to achieve.

Step 2: Understand Your Target Audience. It is crucial to understand their needs, interests, pain points, and the type of content they prefer. You can gather this information through surveys, interviews, or social media listening. Once you have a clear understanding of your audience, you can tailor your content to meet their needs.

Step 3: Conduct a Content Audit. A content audit is an analysis of your existing content. It helps you identify the content that performs well, the gaps, and the opportunities.

Step 4: Develop a Content Plan. A content plan is a roadmap that outlines the types of content you will create, when and where you will publish it, and how you will promote it. Your content plan should align with your objectives, target audience, and content audit.

Step 5: Create and Publish Your Content. Once you have a content plan, you can start creating your content. Your content should be relevant, valuable, and engaging to your target audience. It should also align with your brand values and tone of voice.

Step 6: Measure Your Results. Measuring the results of your content strategy is crucial to understanding its impact and making improvements. You can track metrics such as website traffic, engagement, leads generated, and conversions. By analyzing your results, you can identify what works and what doesn't and adjust your content plan accordingly.

Step 7. Create a Content Governance Plan. A content strategy governance plan is a framework that provides guidelines and processes for managing content creation, distribution, and governance across an organization. It includes defining roles and responsibilities, creating standards for content quality and consistency, establishing workflows for content creation and review, and ensuring compliance with legal, regulatory, and ethical requirements.

Following the actions in these steps, and refreshing them as needed, permits an organization to be flexible and adapt quickly to a changing environment. If different parts of an organization draft their own content without an enterprise-wide strategy then reactions to changing external events become piecemeal and generate risk as messaging may vary from touchpoint to touchpoint and all may deviate from the broader values and goals of a brand.

These risks are especially acute for the luxury industry. The pricing power and exclusivity that drive luxury sales results from well-crafted and consistent storytelling that is appropriately applied in physical (permanent or pop-up physical locations), digital (social media such as TikTok or Instagram), and other (games, metaverse) touchpoints. These stories are more important to luxury than other types of consumer discretionary sectors.

Getting content strategy on track also helps brands prepare for future challenges whose impact is hard to measure in present value terms. In particular, we do not know exactly how regulations will fully be enforced for moving the industry towards a more sustainable path. We know that they are coming, albeit slowly. Content strategy will need to play a key role in communicating data to regulators and internal stakeholders and accurately marketing green credentials to customers.

For another example, in terms of marketing products and messages to younger demographics, content strategy can also help brands ensure that they get the right messages that are tailored to specific demographic groups in the right touchpoint at the right time. These messages need to be encapsulated and executed with a broader strategy so that the brand’s values are communicated either equally or equivalently to customers in a way that resonates over a video game as much as a storefront. Even if the content is user-generated, content strategy is essential to put that content in the broader strategy that luxury brands need to manage.

If content is a product, then the future of luxury brands and the luxury experience depend on determining the right strategy to bring consumers the content they need and want when and where they want it. We are no longer in the age of broadcast brand marketing. Luxury brands must build tailored strategies that can flex and scale over time as technologies, platforms, and consumer tastes evolve. The future of content and, in turn, luxury is experience-driven and participatory. This is an approach well suited for appealing to consumers in a market downturn such as now, and for preparing a plan to power growth in the future.