FSW Luxury Playbook for 2025: Welcome to the Year of Content-First Brand Strategy (web version)

A web version of FSW's annual preview of the year ahead explores how a changing luxury economy will change luxury strategy.

Insights

As was widely anticipated, 2024 saw the end of the historic post-pandemic retail luxury supercycle, which lifted most (but not all) industry boats. It was also a year of pronounced industry differentiation where some brands continued to meet or exceed expectations. The factors driving this differentiation are highly instructive for the future and are the chief concern of our 2025 luxury industry preview.

The fashion and luxury brands winning with content are winning with consumers. In this report, we introduce our first-ever FSW Content Effectiveness Index, which shows a positive correlation between fashion and luxury brand content effectiveness and top-line revenue growth for most brands that experienced growth in 2025.

One way to think about the relationship between quality content and customer experience is “received value,” or the actual value customers get from content, products, and experiences, rather than “perceived value,” or the value brands assume customers are getting.

In 2025, marketing tactics must be framed and contextualized within a holistic, business-focused, content-first brand strategy. Content strategy is brand strategy in action, and content operations are its engine.

You can watch our webinar exploring the themes of this post:

“Luxury is a culture, which means you have to understand it to be able to practise it with flair and spontaneity."

- JN Kapferer and V Bastien, “The Luxury Strategy: Break the Rules of Marketing to Build Luxury Brands”

Last year was one of contrasts for the luxury industry. On the one hand, luxury fashion is likely to have experienced its first annual decline in sales in 20 years outside of the pandemic and global financial crisis-hit years. On the other hand, many brands continued to record strong sales and provided compelling customer engagement across product lines and geographies.

There is a general feeling that luxury is at a turning point. Some commentators argue that consumers have tired of luxury after several years of record-setting growth, perhaps questioning the creativity and quality of many products whose rising prices have put off even some traditionally price-inelastic consumers. The view that the industry is at a crisis point has reached beyond close industry watchers and was picked up across the popular press as 2024 progressed. The long list of creative director turnovers contributed to this sense of instability and lack of direction. In contrast, the year also brought us some amazing brand storytelling that resonated with consumers across various digital and in-store distribution points.

While there are ups and downs in every industry in a given year, last year seemed to be one of an usually high degree of luxury industry dispersion. Perhaps the differentiation seems especially pronounced after three years of explosive growth following the pandemic. Consumers’ voracious demand for luxury lifted all (or at least most) boats. Perhaps last year reflected the going out of the tide and we can now see which brands were swimming by working hard to engage consumers with quality brand stories and effective content strategy and which were not.

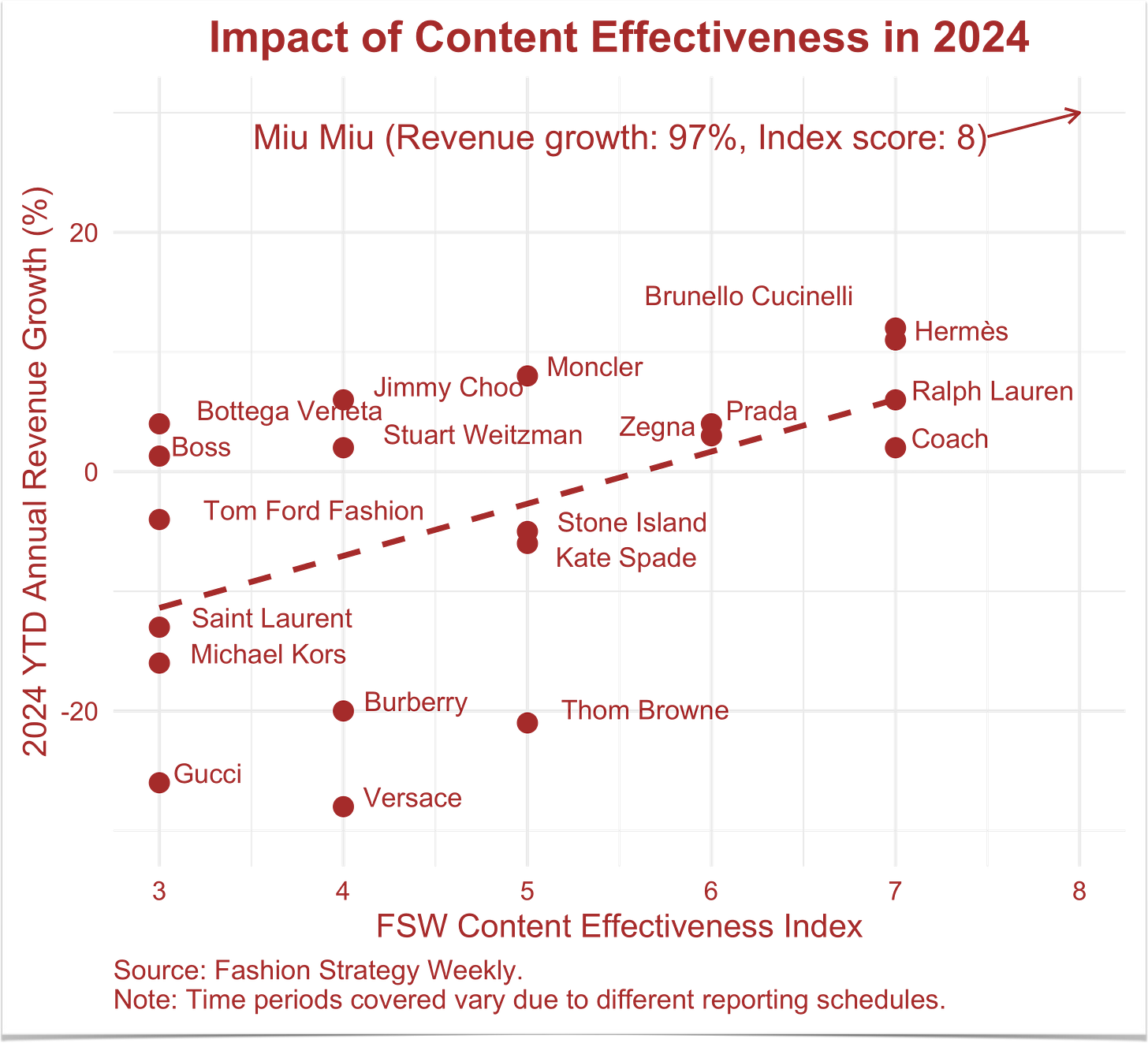

We will present our first-ever Fashion Strategy Weekly Content Effectiveness Index. This novel metric provides a quantitative assessment of the quality of fashion and luxury brands’ content engagement across several dimensions. It teaches us that effective content was positively correlated with strong sales growth in 2024. Luxury is an industry built on storytelling. Our analysis will make the case that even good stories will not beguile consumers and drive engagement if a strong content strategy does not underpin them.

Ultimately, this annual look ahead is not about guessing what will happen next year. In our experience, high-level industry forecasts are typically wrong anyway, and particularly struggle to predict turning points correctly. Rather, it is about laying out how brands can shift their approaches to engaging their markets through the art and science of content strategy. This is what the winners of 2024 did.

2024 was a Year of Differentiation in the Luxury Industry

At the aggregate level, the luxury economy shrank in 2024 but from a very high base.

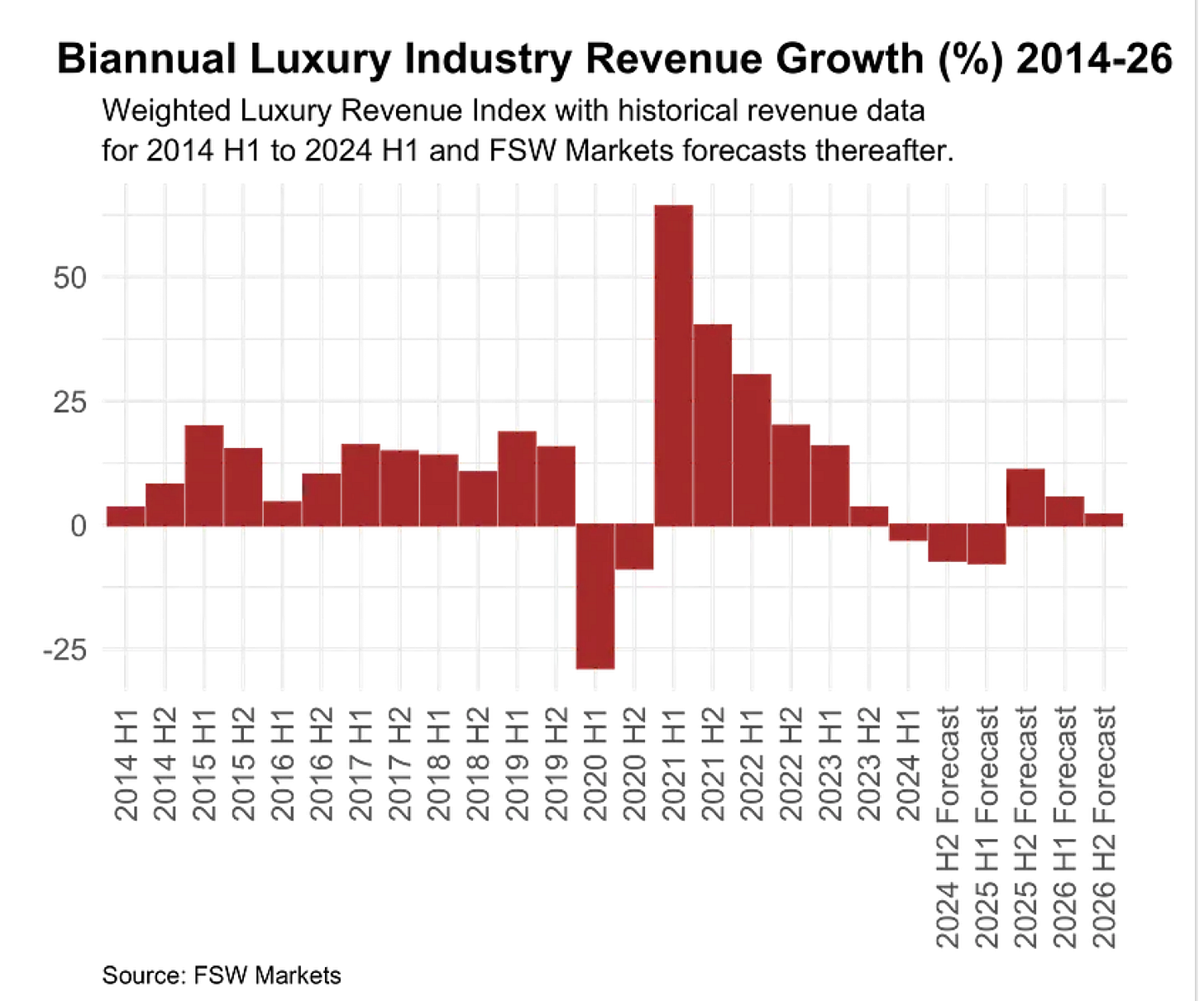

As was widely anticipated a year ago, the retail luxury industry saw the end of the post-pandemic supercycle in 2024. Despite reasonable global economic growth and positive “wealth effect” contributions from generally good global equity market performance, luxury sales slowed across most product categories. In the first nine months of the year, annual luxury fashion and jewelry revenues were down about 3 percent, fine wine and spirits were down around 10 percent, and collectible automobile sales were flat. Our FSW Markets All Luxury equity index was down 10 percent in a year when the S&P 500 was up 23 percent.

So, how big was the slowdown based on current data? Going back to 2004, there have been six years of annual decline in luxury sales: 2004, 2005, 2008, 2009, and 2020. Yet, since the global financial crisis in 2008, there has not been a decline in annual sales until the pandemic year in 2020. But the post-pandemic bounce was historically unique. The average yearly revenue growth from 2010 to 2019 was 11.6 percent. Yet growth in 2021 was almost 50 percent, followed by 24 percent in 2022. After such breakneck growth, it is hardly a wonder that growth slowed to around 9 percent in 2023 (just below the recent historical norm) and was down around 5 percent in the first 9 months of 2024.

So what lies ahead for 2025 and 2026? Based on our best guesses with current data, our FSW Markets econometric model, augmented with AI/ML elements to guard against overfitting, predicts that the industry will experience fairly sharp contractions in H2 2024 and into H1 2025 before experiencing some stabilization in H2 and fairly moderate growth into 2026 that will be below recent, historical norms.

Industry aggregates hide the heightened level of dispersion in luxury performance last year, which will continue into 2025.

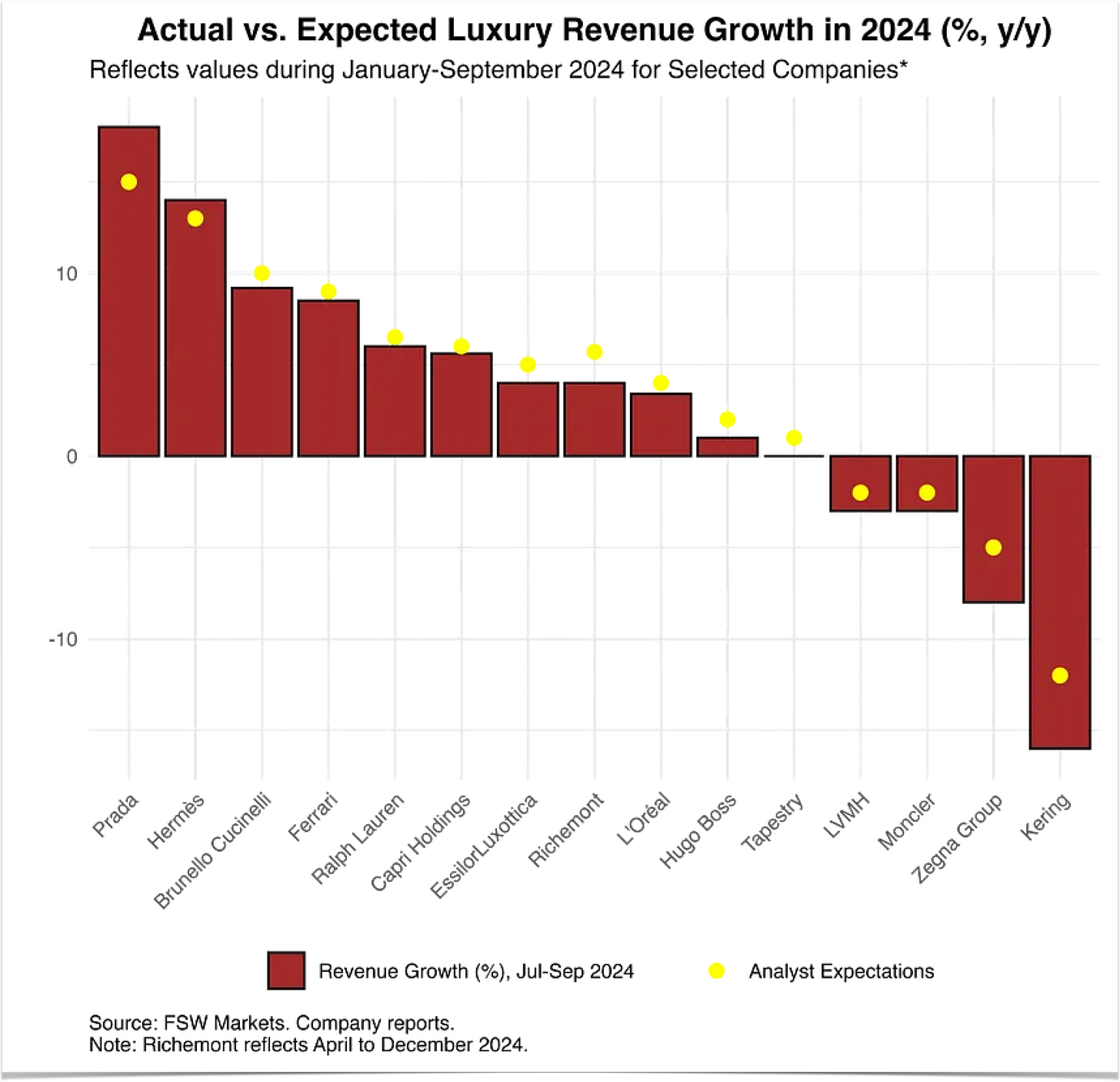

The problem with these figures is that aggregates and central tendencies, such as weighted industry averages, mask the high degree of differentiated performance across luxury brands in 2024. A better and more nuanced look at the industry reveals that while there was an aggregate industry slowdown, there were big winners and big losers last year.

A number of major luxury brands had a strong 2024. Some brands, including Prada (powered by Miu Miu’s astronomical sales growth numbers), Hermès, Brunello Cucinelli, and Ralph Lauren, had strong years that, in some cases, exceeded expectations, while several other brands reported positive growth.

We estimate luxury brands having a good year accounted for about 40 to 45 percent of industry revenues. This is, of course, a minority, which is why we predict that the industry will contract by around 5 percent last year and over 7 percent in the first six months of 2025. Yet, the dispersion story is as important as the slowdown story and is more instructive for the future.

What Drove Industry Differentiation in 2024 and What Does it Mean for 2025 and Beyond?

It is now a euphemism that we live in a world of content.

The digital landscape is so dominated by curated and algorithmic-driven content that real-life experiences can feel disjointed or chaotic by comparison. This is a truth of modern life that affects consumer behavior and expectations and, in turn, shapes how brands should think about their content and the practices, processes, and tools behind it.

For fashion, luxury, and retail brands, storytelling matters not just because it forms the fundamental building blocks of human experience but also because stories are one of the few superpowers brands have left to define themselves and stand out among consumers in an ocean of cross-channel content.

Looking back at 2024, the fashion and luxury brands that won with consumers are the same brands that won with content and content strategy in different ways. This is not an accident.

Holistic content strategy is not just about digital content or even marketing content. Consumers expect your brand to feel the same online and in person and crave experiences that entertain, inform, and inspire.

However, to what degree does the efficacy of a fashion or luxury brand’s content across channels correlate to its top-line revenue growth? This is a question the FSW and FSW Markets teams have been thinking about for a while; but, we have not been able to draw meaningful conclusions because we lacked substantial data. So, we built our own index to compare the relationship between a proprietary measure of brands’ content effectiveness and their top-line revenue growth—i.e. the YTD percentage of revenue change from 2023 to 2024. We approached this index with a simple theory: the brands winning with content are winning with consumers, which is revealed through their revenue growth.

In terms of methodology, this FSW Content Effectiveness Index builds on the FSW Selected Luxury Instagram Shoppability Index that we published in November. This Instagram Shoppability Index scored brands on a scale of 1-3 based on the degree to which consumers could directly purchase products from a brand’s Instagram posts. The FSW Content Effectiveness Index is a broader assessment of 20 premium fashion and luxury brands. It adds in additional dimensions of content quality, which is a qualitative 1-3 score of the uniqueness, consistency, and authenticity of brand content, as well as audience-centricity, which is a 1-3 score of channel-attenuated, audience-targeted content that takes into account content type selection, post cadence and timing, and topic appropriateness for the brand’s target audiences channel by channel, inclusive of digital and IRL. We then aggregated these scores for the 20 brands as a total measure of content effectiveness and plotted them against the percentage of each brand’s 2024 revenue growth.

While there are unsurprisingly several outliers, particularly 2024’s rock star, Miu Miu, whose revenue growth was off the charts last year, this index shows a positive correlation between content effectiveness and bottom-line revenue for most brands that experienced revenue growth in 2024. Brands like Brunello Cucinelli (who for us were among the quiet content leaders in 2024) and Hermès received high scores for content quality and audience centricity for their high-quality, authentic, and original content and consistent but differentiated content marketing strategies across and within channels. These brands scored lower on our Instagram Shoppability Index because, unlike Miu Miu, one of the only major brands with a fully shoppable Instagram account, their Instagram accounts are only partially shoppable.

Most brands on our list that experienced significantly lower revenue growth in 2024 also demonstrate a lack of strategy, consistency, and quality regarding digital and IRL content. Saint Laurent, Gucci, Michael Kors, Burberry, and Versace have minimally shoppable Instagram accounts and received low scores for content quality and audience centricity, largely due to a lack of brand differentiation and unique storytelling across and within channels. The biggest surprise for our team was Thom Browne, known for its innovative collection storytelling. It struggled greatly on revenue growth and received lower-than-expected content effectiveness scores due to a lack of shoppability on its Instagram account and average scores for content quality and audience-centricity. The FSW Content Effectiveness Index is by no means a comprehensive or scientific ranking of fashion and luxury brand content. But, the results of this index do support the view that the brands winning with content are winning with consumers.

What does Luxury Need to Do in 2025?

So, what does our conclusion about the positive correlation between effective content and revenue growth mean in application for fashion and luxury brands? How can they use these insights to consider their brand strategy and content approach in 2025?

As we have explored, the pandemic forced many luxury brands into digital and e-commerce when they were not operationally mature enough or ready for it. This resulted in many luxury creative, marketing, e-commerce, and social teams making investments in highly tactical, often design-first initiatives that looked pretty but lacked purpose.

From a customer experience and content angle, the sudden entry into digital also has had internal repercussions for brands, resulting in extensive internal siloing and a core lack of centralized content strategy and creative operations within luxury brands. In the height of the post-pandemic boom, luxury brand strategy was all about getting ahead and keeping up, not necessarily about appropriate, vision- and customer-centric storytelling.

Think about the Science of Luxury Brand Strategy

Analysts like to talk about brand strategy as the art of brand universe building. Yet, if Kapferer and Bastien’s book “The Luxury Strategy” taught us anything, luxury brand strategy is more an empirical science built on a systematic approach that brands deliberately created and enact in some way every day. As Kapferer and Bastein note:

“Luxury as a strategy refers to the fact that luxury is a very specific business model, which has been invented by those brands that now define the pantheon of luxury brands worldwide.” (17)

Viewed through the lens of science, the practices of luxury brand strategy should evolve through careful observation of consumer behavior, experimentation through a test-and-learn approach to product design, pricing, and marketing, and an evidence-based mindset that enables both short- and long-term strategic decision-making.

This is not to say that luxury brand strategists and marketers should stop with the tactics, slow down, ignore social media, or return to old heritage advertising that may still exist somewhere in university marketing textbooks. Quite the contrary. Piloting tactics and implementing the ones that work should be a core part of luxury brand marketing. But, marketing tactics need to be framed and contextualized within a holistic, business-focused brand content strategy to take shape and sing.

Invest in Content Strategy as Brand Strategy in Action

There are a lot of talented brand strategists and marketers at luxury brands who exercise this brand-strategy-as-a-science approach every day. They are not the problem. What is at issue is the chaos at the top of the corporate pyramid. The problem with the kind of creative director musical chairs happening within luxury is that it is frequently not accompanied by a tailored change management process with clear internal and external communications to keep employees and customers up to date and to help them understand what to expect.

The science of brand strategy and its cousin marketing must be closely aligned with business strategy to keep luxury alive and relevant within the consumer imagination. Otherwise, it becomes stale, predictable, and no longer feels “luxury.” Brand strategists and marketers must be empowered within the luxury organization to make creative decisions and bring consumers the right content, products, and experiences.

Content strategy is luxury brand strategy in action, and content operations are its engine. Indeed, one way to “empower” a luxury brand marketing team is through systemic, process-oriented creative operations to formalize and document processes, templates, and rules for creative projects. Simple documentation like more detailed creative brief templates can drive a shared understanding and, ideally, the agreement between creative directors and budget-conscious CMOs eager to find that happy place between the creative director’s vision, the brand’s values, and customer needs and expectations for a specific collection or campaign.

Know Why Content-First Brand Strategy Wins for Brands and Consumers

It is not enough for brands to plan and publish content on their e-commerce site, social media posts, in-store advertising, or even influencer marketing content. One way to think about the relationship between quality content and customer experience is “received value,” or the actual value customers get from content, products, and experiences, rather than “perceived value,” or the value brands assume customers are getting. Received value is about how brands show up for their customers, whether they find value in the brand and products, and if they are willing to purchase products and return. Received value, rather than just perceived value, is where the rubber meets the road when discussing content marketing strategy vs. holistic content strategy for consumer-facing brands in retail, fashion, and luxury.

Content marketing strategy is important, but it does not differentiate a brand or even necessarily communicate its deep brand value proposition if it is not consistent, attenuated, and relatable. Holistic content strategy, on the other hand, is all about ensuring that a brand’s content aligns seamlessly with its values, narrative, and customer experience and with customer needs, preferences, and habits across every touchpoint.

Taking a content-first, rather than product- or brand-first, approach to brand strategy puts the customer, rather than the product, at the center of the communications equation, making it all about output and outcomes—e.g., the value and impact of brand storytelling to the consumer—rather than the brand's input or goals. This focus is not intended to devalue the brand’s vision and values. Quite the contrary, when connected to a holistic content strategy, content-first brand strategy empowers brand stories through focusing, attenuating, and connecting them to concrete, measurable content performance indicators across and within channels in a way that is more readily linkable to internal KPIs like customer retention and acquisition targets and even sales goals, as our FSW Content Effectiveness Index illustrates.

If fashion and luxury brands want to distinguish themselves and come out ahead of the game after whatever “slowdown” is happening, they must adopt a content-first mindset. What does this involve? While we caution that every brand is in a different stage of content maturity, here are some steps that brands can consider:

Take a step back to assess your “why” for content and communicating with your customers (yes, both digitally and IRL). Are you taking a holistic approach to brand storytelling, utilizing multi-dimensional, dynamic, and channel-appropriate content with consistent but attenuated messaging that invites your customers to interact, contribute, and become part of your brand and its vision, lifestyle, and products? Are you using a top-down brand strategy and communications model and broadcasting your brand and product vision throughout your marketing and advertising?

Spend time to understand not just your general customer personas but the actual needs of your existing and prospective consumers. This should focus on studying customer content consumption habits and preferences, including, but not limited to, preferred content types, channel patterns, cadence and timing of content interactions, dwell time habits, cross-channel behavior, and content category and topic preferences.

Audit and evaluate your content and content processes, standards, templates, guidelines, systems, and tools within and across teams. This not only includes having a documented inventory of where all of your content lives, on what channel, and what team owns it but also documenting publishing processes for different teams, what tools they’re using to plan, manage, store, and publish content, what their cadence and calendar for publishing content is, and how they manage and oversee content production, quality, and editorial appropriateness. This audit process should include a content gap analysis, competition analysis, and a relook at the customer content consumption data you gathered during your early customer persona research process.

Articulate and document your North Star for content by identifying the unique value proposition of your brand in a way that is true to the company’s DNA, relevant to today’s market economy, and memorable to your target consumers. In practice, once you’ve defined your brand content “why,” then define your content vision and goals and specific qualitative and quantitative success measures so you know what you’re trying to do with content.

All of these steps form the foundation of your holistic content strategy. Of course, any experienced content strategist will tell you that more goes into a content strategy framework and operations model than the above steps. We dive deeper into the main elements of this type of framework and model and where to get started in our forthcoming book, “Content Strategy for Luxury Brands: The Playbook to Drive Customer Engagement in Any Market" (Routledge Taylor & Francis Group, 2025).

In all, adopting a content-first brand strategy and investing in holistic content strategy offers retail, fashion, and luxury brands a small path forward to not only differentiate themselves but also to get the right content (and, in turn, the right product) in front of the right customer at the right time on the right channel.