FSW Briefing: Luxury's Practical Phase; Lookahead to Luxury Q3 Earnings; ABG and Saks Launch Authentic Luxury Group

FSW examines the aftermath of Fashion Month in the world of fashion and luxury.

The first few weeks after Fashion Month can feel like a disappointment, yet as strategists, we find this time of year the most interesting.

For luxury fashion, moving from collection presentation to production and then merchandising should be a time of strategic execution, creative craftsmanship, and story-based brand universe-building. But, the business of luxury is still at the end of the day about selling products, which has resulted in many brands taking a more practical approach to ready-to-wear, as we explored last week. The question remains as to whether this is a response to the current state of the luxury market or is a new phase in the evolution of luxury.

Interestingly, this week, retailer Zara launched its anticipated collaboration with YSL-alum Stefano Pilati. The elevated design and presentation of this collection had fashion pundits questioning whether or not Zara should now be considered luxury.

This fall and winter, we are keeping an eye on fashion and luxury brands to see how brands continue to adapt to market conditions, constantly changing consumer preferences, and the always-on, ever-evolving world of content.

Luxury’s Q3 Earnings Reporting Season Starts Next Week

After luxury brands reported a generally poorer than expected H1 and gloomy forward guidance (with some notable exceptions), we are gearing up for the start of Q3 earnings releases next week.

As a preview of coming attractions, this is the release schedule as it now stands for the month of October:

October 15 - LVMH & Swatch Group & Ferragamo

October 18 - EssilorLuxottica & Christian Dior & Brunello Cucinelli

October 23 - Kering

October 24 - Hermès

October 29 - Moncler

October 30 - Prada

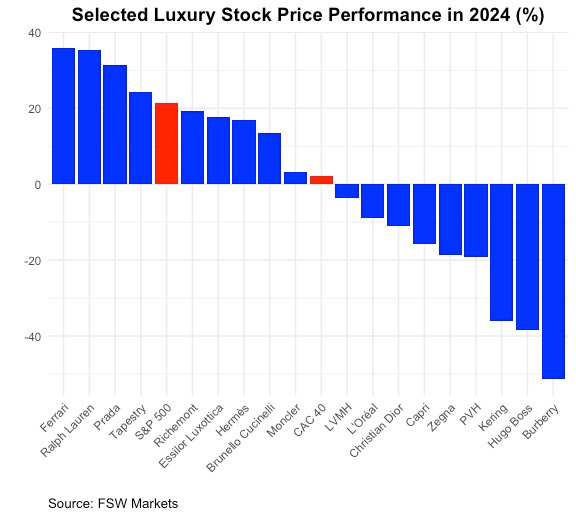

Stock valuations for luxury have generally been pretty weak this year, in step with previously reported earnings and discounted future earnings. The FSW Markets All Luxury Index is down about 1.5 percent while the S&P 500 is up over 20 percent.

As the chart below shows, there are some exceptions with Ferrari, Ralph Lauren, Prada Group, and Capri Holdings suitor Tapestry outperforming the S&P while Richemont, EssilorLuxottica, Hermès, and Brunello Cucinelli posting positive year-to-date returns.

Brands struggling with both creative and corporate strategy, particularly Kering and Burberry, are faring the worst and find their share prices down over 35 and 50 percent, respectively.

Authentic Brands Group and Saks Global Launch Authentic Luxury Group

FSW staff spoke with Vogue Business this week about the creation of the Authentic Luxury Group (ALG). ALG is a newly announced venture formed through a partnership between Authentic Brands Group and Saks Global. The collaboration aims to enhance the growth and reach of luxury and accessible luxury brands owned by Authentic Brands. This joint venture is designed to leverage the combined strengths of both companies in fashion, retail, digital, hospitality, real estate, art, and travel.

ALG will serve as an incubator for luxury brands such as Barneys New York, Judith Leiber Couture, Hervé Léger, and Vince, focusing on strategic licensing and expanding distribution channels. ALG claims that the aim is to redefine the luxury experience by broadening these brands’ presence globally through retail, e-commerce platforms, and even branded luxury residences and hotels.

For example, Barneys New York will expand its presence through new collaborations, like a recent pop-up in New York City, and further integrate into Saks Fifth Avenue locations. Similarly, Vince and Hervé Léger are expected to benefit from increased visibility and reach under ALG’s guidance.

This new venture may well provide an opportunity for ALG to deepen its footprint in luxury. However, given that the offerings at this early stage are in the struggling premium and entry-level luxury space, we question the timing of this move. Is this an opportunity to build something that may be propelled by future growth trends once global consumer spending on premium and lower-end luxury picks up? Perhaps but this is a wait-and-see for us.