FSW Briefing: Integrated Approaches to Retail Commerce Amid Continued Luxury Market Turbulence

FSW reviews Q3 earnings from Hermès and Kering, the blocked Capri and Tapesty merger, and explores topics on the future retail commerce

A more purposeful, content-first approach may offer retail brands and consumers a better future

A white paper was released by It’s A Working Title LLC this week that explores different models that retail organizations can explore when managing their tech stack, advocating for content-first approaches.

Many retail brands fall for shiny-object syndrome when it comes to tech, resulting in tactical, reactionary decision-making that may not be right for their business or customers. Enter the overinflated, highly siloed tech stacks at many retail brands, large and small.

Shopify predicts the global e-commerce market will reach $4.8 trillion in 2025. Gartner forecasts that global retail tech spending will top $262.6 billion in 2027. This is a huge opportunity for retail brands and retail tech vendors. However, the rapid growth of e-commerce makes foundational strategy—especially for customer experience, products, and content—critical to ensure that brand investments in technology are scalable, purposeful, and useful to brand teams and consumers.

Many brands may not be operationally mature enough for certain technologies. Digital transformation is an act of change management for which many brands are not culturally prepared. Retail commerce decision-makers need to think about integrated, rather than unified, commerce built on a foundation of collaborative product, digital, data, and customer experience strategy and collaborative internal communications, preferably backed by solid content operations.

A unified solution to retail commerce tech may not be ideal for some brands. Moving into a new unified commerce platform could require a brand to undergo a significant transformation effort, substantially increase its customer acquisition and retention costs, and, worse, ultimately prove an unnecessary shift that would not truly add value to the brand or its consumers.

A better path forward for many brands may be to adopt an integrated approach that seeks to centralize and unify only the systems, processes, and tools that make sense and meaningfully serve the brand and consumers (e.g., to support more centralized content publishing, to deliver personalization, or to improve internal collaboration). This requires brands to establish a “why” for using and integrating specific tech and then to purge unused, duplicative, or legacy systems and tools, allowing other tech to remain independent as long as it strategically makes sense and forms a logical branch of a comprehensive operational tree.

The paper is available for free download.

No Big Surprises in Kering and Hermès’ Q3 Earnings Reports

No trough in sight for Gucci

On the heels of the broader slowdown in the luxury sector and clouded Q3 earnings from peers like LVMH and Swatch Group last week, Kering's disappointing Q3 results were largely anticipated. The group, home to the fashion giant Gucci and brands like Saint Laurent, Balenciaga, and Bottega Veneta, reported a sharper-than-expected 16% year-over-year revenue contraction on a comparable basis, bringing the total to €3.79 billion. This figure includes a 1% negative currency impact and a 2% positive scope effect following the consolidation of Creed. Despite this, Kering's overall revenue shortfall was 5% steeper than analyst forecasts.

The primary drag on performance stemmed from ongoing weak demand in Japan and the Asia-Pacific region, where retail revenue dropped by 30% year-over-year. While China's much-anticipated recent stimulus efforts aim to revitalize the economy, its impact has yet to materialize, with the luxury market there continuing to face headwinds as consumer appetite for high-end fashion remains muted, perhaps due to the lingering property crises and subdued consumer confidence.

Most of Kering's brands saw negative revenue growth this quarter, with Gucci taking the hardest hit, declining 25%. This was 4 percentage points more than analysts expected. Saint Laurent's 12% drop further weighed on the group's results. At the same time, brands, including Balenciaga, Alexander McQueen, and Brioni, amongst others, posted a 14% revenue decline under the "Other Houses" category. However, there were a few bright spots: Bottega Veneta's robust leather goods segment helped the brand achieve a 5% revenue increase in Q3, while Kering Eyewear and Corporate revenues rose 7%, where acquisitions of Maui Jim and Lindberg in 2022 and 2021, respectively having positive impacts.

Gucci's struggles remain the key pressure point for Kering, as the brand accounts for over 50% of the group's annual sales and 66% of its profits. The brand's Q3 performance was particularly weak in critical regions, including the Asia-Pacific (down 38%), North America (down 20%), and Western Europe (down 19%). However, management remains optimistic as Gucci undergoes managerial overhaul and operational transformation. The appointment of Stefano Cantino as CEO, effective January 2025, and new design initiatives are expected to align more closely with evolving consumer preferences.

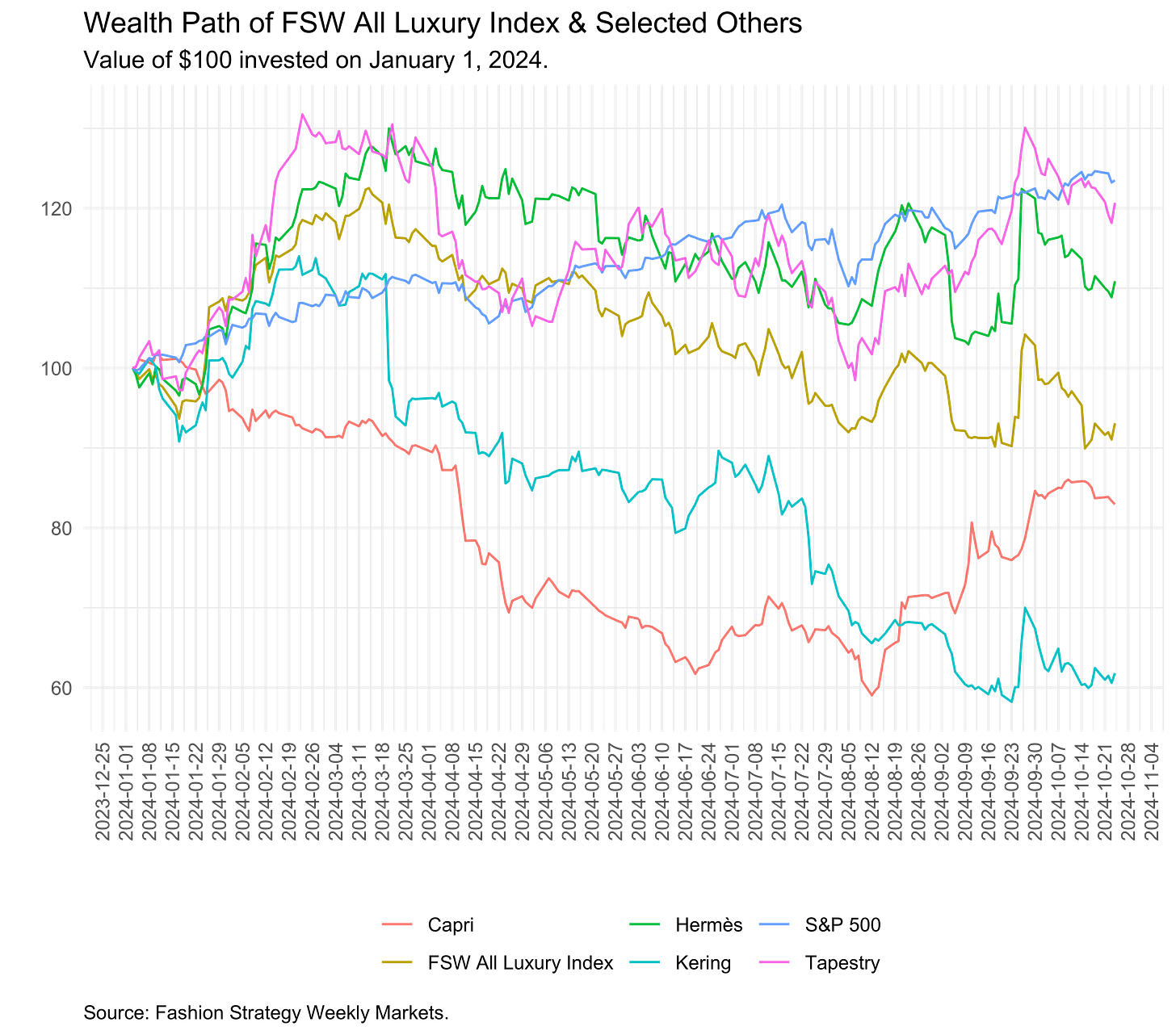

Kering's stock has fallen by over 41% year-to-date, but there are signs of potential stabilization. The group's valuation is projected to rise to 19.3x earnings for fiscal year 2024, with further improvements expected as transformation efforts take hold. By the end of fiscal year 2025, Kering's valuation is anticipated to settle at around 16.4x as managerial and operational restructuring efficiencies become more evident.

Hermès outperforms already rosy expectations

Hermès' Q3 2024 earnings report revealed that revenue for the quarter rose by 14% at constant exchange rates, reaching €3.2 billion, up from €2.83 billion in Q3 2023. This exceeded market expectations, which had anticipated around 10.5% growth for the quarter. The beat was largely due to strong organic growth driven by effective pricing strategies and high demand across key regions. Currency effects, however, posed a slight drag, with revenue growth moderated to 11% at current exchange rates, impacted by the strength of the euro compared to other currencies.

Performance across Hermès’ major product lines was notably robust. Leather goods and saddlery, representing 51% of total revenue, grew by 12% at constant exchange rates, reflecting strong demand for signature pieces such as the Birkin and Kelly bags. Ready-to-wear and accessories, including scarves and ties, grew by 15%, supported by new seasonal launches. Watches, another core category, saw stable growth of 9% year-over-year, underpinned by the success of recent models like the Hermès Cut line. The perfume and beauty segment, though smaller, grew by an impressive 17%, with new additions to the Hermessence collection and H24 men's line contributing to the rise. Overall, this diversified growth across segments was crucial to Hermès surpassing both internal and market growth projections.

Geographic performance also played a critical role in Hermès' success this quarter. Asia-Pacific, which contributes around half of Hermès’ revenue, saw the highest growth, with revenue up 15% year-over-year despite some regional economic pressures. Within this region, mainland China stood out with strong double-digit growth. Europe, including France, performed solidly, growing by 10% due to resilient local demand and increased tourism. The Americas saw more modest growth, coming in at around 5%, with some headwinds attributed to slower retail traffic. This geographic balance has allowed Hermès to sustain its growth trajectory despite economic variability across global markets.

In response to these positive earnings, Hermès' stock rose by approximately 3% immediately following the report. Year-to-date, the stock is up around 15%, reflecting strong investor confidence in the brand’s resilience. Hermès' price-to-earnings (P/E) ratio remains among the highest in the luxury sector, hovering around 45x earnings. This elevated P/E ratio is largely a reflection of the brand’s premium status, consistent revenue growth, and steady expansion into new product lines and markets. Over the course of 2024, the P/E ratio has shown minor fluctuations but remains above the industry average of around 30-35x, signifying sustained optimism from the investment community despite broader economic concerns.

Tapestry and Capri’s Plans to Create an American Luxury Giant Blocked

A federal judge blocked the proposed $8.5 billion acquisition of Capri Holdings by Tapestry, Inc. yesterday, agreeing with the FTC's concerns over reduced competition in the luxury handbag market. This decision thwarted Tapestry's strategic plan to create an American luxury conglomerate, which was intended to better compete against European rivals like LVMH. Both Tapestry and Capri argued that the deal would not limit consumer options or lead to monopolistic practices, pointing to their unique customer bases and competition within a fragmented luxury sector.

The acquisition had been strategically designed to merge Tapestry’s Coach, Kate Spade, and Stuart Weitzman brands with Capri’s Versace, Jimmy Choo, and Michael Kors lines, boosting their collective footprint in the accessible luxury market. By combining strengths, the companies aimed to capitalize on operational efficiencies and market expansion. Following the court's decision, it’s uncertain if Tapestry will appeal; both companies may now prioritize organic growth within their existing brand portfolios.

The blocked merger rattled investors. Capri’s stock plummeted by nearly 50% as investors questioned its standalone growth prospects, while Tapestry’s shares dipped more modestly. Moving forward, the companies are likely to explore new avenues, potentially considering other partnerships, investments in innovation, or regional expansions to maintain competitive momentum in the global luxury landscape.