FSW Briefing: Diagnosis of the Extent and Implications of a Luxury Slowdown

FSW prepared three essays looking at the industy's performance in Q3 and the impact on content and sustainability strategies.

What Did the Jul-Sep Earnings Reports Teach Us About the Luxury Slowdown?

With a few exceptions, we have come to the end of the latest luxury earnings season, and it was not all doom and gloom. As the bar chart below displays, Prada and Hermès recorded strong double-digit revenue growth (blue bar) that exceeded market expectations (red dot) from June to September. Both organizations reported strong earnings growth across all geographical areas, including Asia, with Prada supported by 105 percent growth from Miu Miu. A range of brands, from Brunello Cucinelli to Ferrari and even Capri, also reported decent earnings growth, albeit below expectations.

On the downside, we saw much worse-than-expected results from Kering and Zegna. On the former, some analysts had hoped that Gucci’s string of quarters of negative revenue growth might hit a trough. However, Kering’s 16 percent decline was much worse than analyst expectations, with Gucci down about 25 percent.

Industry giant LVMH’s Q3 revenue growth was slightly worse than analyst expectations, but many commentators have looked at this as a leading indicator for the industry as a whole. Some of the commentary has forecasted that we are at the beginning of a much longer-than-usual downturn in luxury, particularly luxury fashion. The arguments have suggested that the downtown will be driven not just by slowing cyclical demand, but sharply slower structural demand as consumers have grown tired of luxury overexposure or perhaps have had enough of the aggressive price increases, or perhaps now want to spend put their luxury spending into travel and health and wellness rather than fashion.

Forecasting is always difficult so we will see. Yet, the Q3 earnings do not conclusively support this doom and gloom scenario. Many luxury brands, and not just those in the quiet luxury corner that has seemed to operate with its own rules of supply and demand over the past year or so, continue to show impressive growth. Maybe this growth is not at the rates seen in the supercycle that followed the pandemic and lifted most luxury boats (Kering excepted), but some regression to a mean does not presage an industry-wide depression.

A Threads post by Vogue Business editor-at-large Christina Binkley this week noted:

Rather than a luxury slowdown, I’d say RL, Hermès, and Prada/Miu Miu are taking market share from LVMH and Kering.

Earlier in the week, FSW discussed some reasons why we believe Miu Miu are performing well and it is worth reflecting on what other brands are doing to grab market share this year.

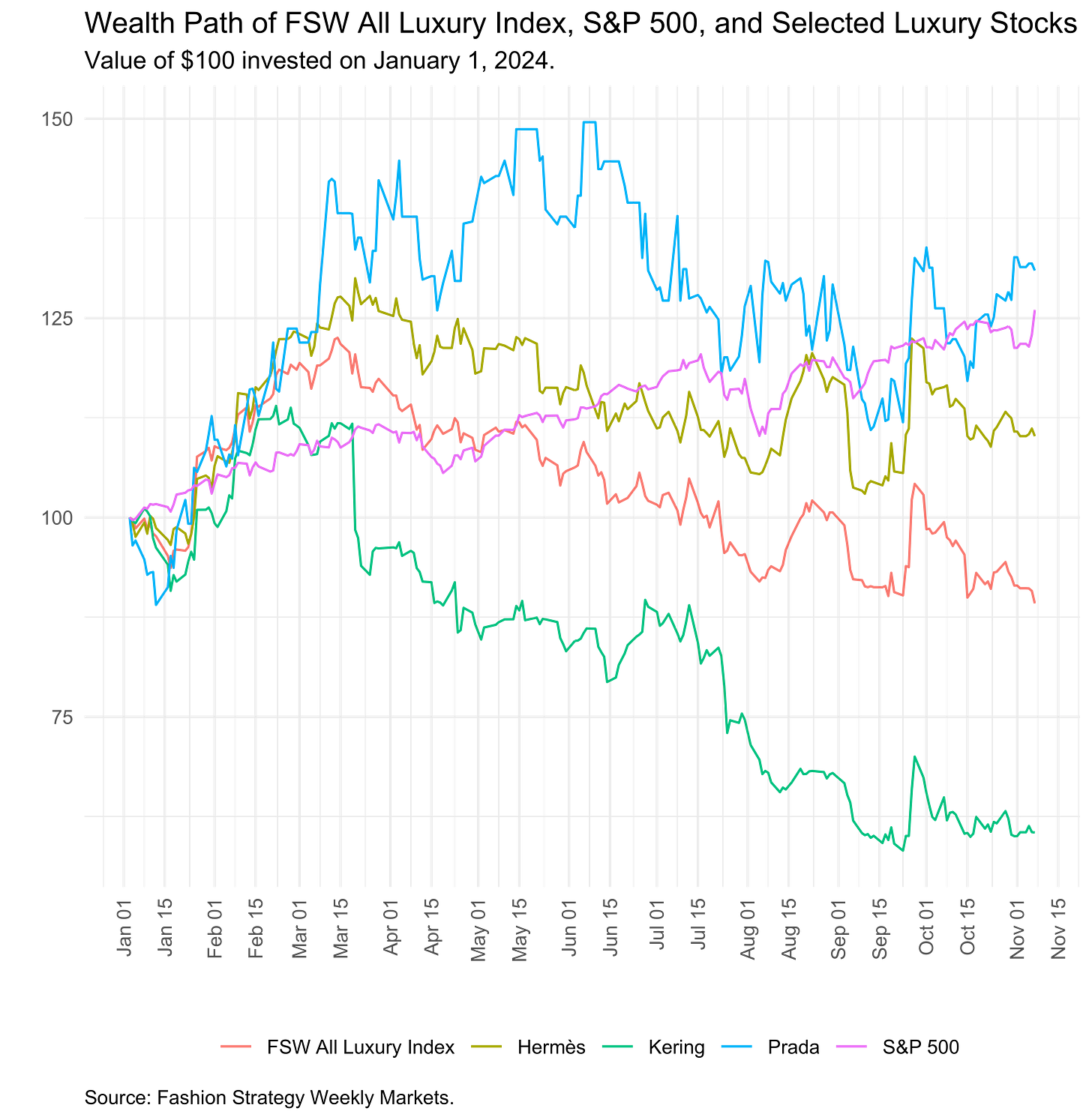

Investors have certainly seen cause to differentiate among luxury brands. The below line plot displays the 2024 evolution of selected luxury share prices along with our FSW Markets All Luxury Stock Index and, for benchmarking purposes, the S&P 500. Our FSW cap weighted index is down around 11 percent this year, which is sharply below the 25 plus percent gains in the S&P 500, a broad measure of stocks listed in New York. Yet, relatively high performers such as Prada have actually outperformed the S&P on a good year for the broad index while Hermès has provided strong returns.

A Cyclical Slowdown in Sales Growth Makes Getting Content Strategy Even More Important

In this bull market of strong demand for luxury products, brands did not have to invest too much or too effectively in strategy to attract customers. Yet, it is easier to churn out experimental or ad-hoc forms of marketing and customer outreach when revenue growth is in the mid-teens for many quarters in a row, and the outlook is upbeat. Strategy is less important than execution when the going is good.

With the tide going out on the supercycle, questions about ROI in marketing and tech spend become more pointed. Investment of time and treasure across all customer touchpoints need to be effectively coordinated. In short, as growth rates return to the single digits for most brands across most product verticals, the wild ride of tactical actions needs to evolve into the steadier tiller of strategy.

Getting a content strategy in place is where to begin. Apart from addressing the challenges from a short-term cyclical slowdown, content strategy is part of a toolkit to help prepare brands to meet structural challenges such as meeting sustainability regulations, facing rising geopolitical uncertainty, and appealing to a range of consumers across demographics and geographies.

In particular, brands can use this opportunity to begin introducing or refining their content strategies. Periods of rapid growth, both in terms of sales and market reach but also experimentation with new technologies and customer touchpoints, do not tend to be well correlated with good content strategy. They may be the result of good strategy, but rapid growth leads to an unrolling of events that often occur outside of previously considered strategies. A slowing down provides an opportunity to recalibrate to a new and evolving commercial landscape.

Like all strategies, creating a content strategy begins with being mindful of the way that you use your internal resources to engage with customers. Content strategy is unique from other forms of strategy in that it must involve integrating high-level strategy with marketing, UX, and CX functions, and even finance. At least at the start, you need to bring together corporate strategy functions with tactical functions and ensure that the strategy encompasses both front-end areas of client engagement with the back-end technical departments that support the various channels by which your audience is reached.

This is especially important if you reach your audience through multiple channels as having separate strategies for IRL engagement, web2 digital engagement (e.g., social media), and even web2.5 to web3 outreach (e.g., immersive digital experiences or various co-creating platforms) will waste resources at best and likely result in the splintering of corporate strategy into ways that are diluting.

Is the End of the Luxury Supercycle A Good Time to Invest in Sustainability?

The slowing of the luxury industry off the post-pandemic supercycle raises the question of whether this would be a good time for brands to lean heavily into sustainability. Though we are seeing cost-cutting at many brands, calibrating strategies around sustainability could be a new source of competitive advantage and there are new regulations on the horizon, particularly in Europe.

For example, the European Union is implementing the Ecodesign for Sustainable Products Regulation (ESPR), which entered into force on July 18, 2024, aiming to enhance product sustainability across various sectors, including fashion. In addition, starting in 2026, the EU will require the separation of textile waste from other waste streams, with full application expected by July 26, 2029, to promote circularity in the textile industry. The EU also plans to introduce Digital Product Passports (DPPs) for textiles, with specific requirements to be established by December 31, 2025, and businesses will have 18 months following that date to comply.

The luxury sector faces unique challenges with its significant reliance on natural resources—rare materials and intricate production processes. Just looking at fashion, according to the World Bank, the $2 trillion fashion industry is responsible for 10 percent of annual global carbon emissions, more than all international flights and maritime shipping combined, and they will rise by another 50 percent by 2030

To maintain exclusivity and secure a competitive advantage, luxury brands must approach sustainability with innovation and authenticity. This includes building sustainable supply chains to mitigate environmental risks, align with eco-conscious consumers, and strengthen brand prestige. Solutions include sourcing sustainable raw materials that showcase craftsmanship, investing in eco-friendly production technologies, using mono-material recyclable packaging, and fostering transparency and ethical practices through supplier partnerships.

Sustainability also opens doors to new business models, such as luxury upcycling, limited-edition eco-collections, and take-back programs that enhance exclusivity while supporting circular economy principles. By embedding sustainable practices across their supply chains, luxury brands can redefine luxury itself—not just as an exclusive but as a mindful, purposeful lifestyle.

Content strategy is an important part of the story. Content strategy is about aligning changing corporate objectives to the flow of data and messaging, both internally and externally. Ensuring that data is managed across your various distribution channels to consumers (whether this is through digital product advertising or clothing labels that detail its origins and environmental impact) as well as backend to frontend (such as identifying how ESG corporate standards are implemented through each link of the supply chain) is the heart of a good content strategy and will be an essential, though of course not sufficient, condition to move the industry forward on sustainability commitments.

Consumers need to know the true environmental impact of their choices and regulators are increasingly demanding it. This information must be accurate and well-aligned with what corporate leaders mandate and the activities of the production process. A content strategy is what unifies these disparate elements.