Retail Economics and the Luxury Economy

A publication of It's A Working Title LLC

This weekly publication focuses on how business and economics trends, technology, and the drive for sustainability impact the global luxury, fashion, and experience economy industries. Prepared by the staff of content strategy agency and think tank It’s a Working Title LLC, each issue provides coverage and analysis of forces and events that shape the B2B and strategy landscape for fashion and luxury.

Contents

Retail Economics

Revenue growth remained strong in Q1, but for how much longer?

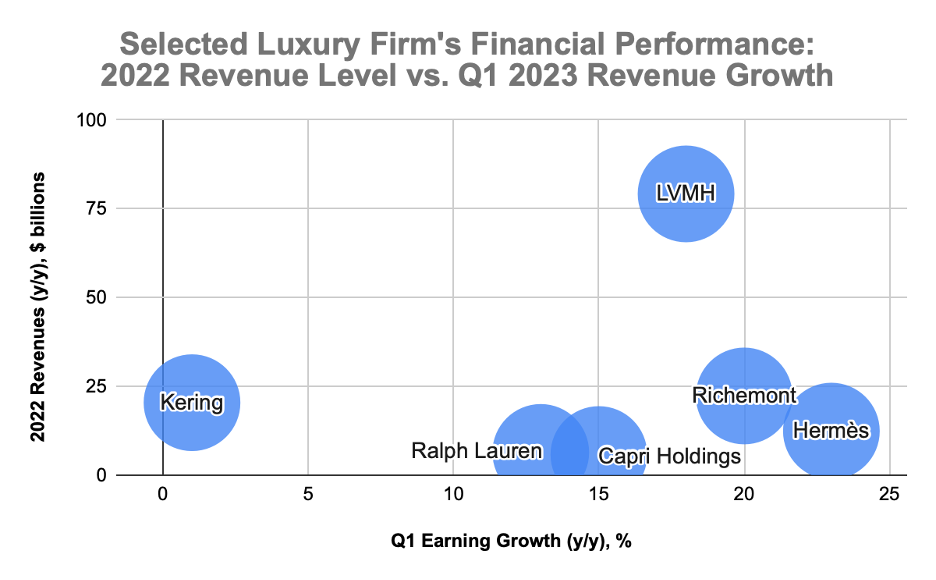

Despite the slowing of global economic growth, luxury sales remained strong last quarter. Outside of Kering, the world’s largest luxury organizations all posted double digit Q1 organic revenue growth with Hermės leading the way with a growth rate of 23 percent, followed by Richemont at 20 percent, and LVMH at 18 percent (these revenues are all reported on a constant currency basis). Even Kering, which has been outlier due to shifts in its strategic direction, was a positive story as its 1 percent Q1 growth exceeded analysts’ expectations and was a big turnaround from the 7 percent contraction reported in Q4. LVMH’s stock price hit a record level and its market capitalization surpassed $500 billion in April, the highest ever by a European firm in any sector.

So why has luxury been so resilient amid the broad-based macroeconomic uncertainty and persistent fears of recession in advanced economies? A big part of the story is the re-emergence of the Chinese consumer after the end of the zero-Covid policy in January, yet this not the whole story with luxury revenue growth relatively strong around the world. Looking at the regional breakdown of Q1 revenue growth at LVMH, spending in Japan was the most robust of any region at 34 percent as compared to the same period last year. Next was Europe at 24 percent, Asia (excluding Japan) at 14 percent, and North America at 8 percent. The relatively tepid North America number may be a source of pause, yet there is substantial space for Chinese consumers to add to revenue growth over the remainder of this year at home and abroad.

So is there a cause for concern over the next year or so for luxury brands? As an industry, luxury is relatively demand inelastic, meaning that slowing economic growth or weakening discretionary consumer income does not tend to translate into big declines in the demand for luxury goods. In fact, economists consider luxury products unique and label them “Veblen goods.” The idiosyncratic properties of these goods was witnessed last year. Luxury revenue growth hit records while economic growth rates were about half in 2022 what they were in 2021 and China recorded its lowest growth rate in decades at 3 percent. Moreover, demand for luxury goods remained strong even though retailers raised prices with LVMH reporting it hiked the cost of its goods by 8 percent on average. This is consistent with other periods of slow economic growth where luxury revenues fall less than most other discretionary sectors during a recession and bounce back faster. Some brands will fare better than others and it is possible that more mid-market luxury names like Ralph Lauren or Michael Kors (part of the Capri Holdings) may struggle more than marquee European firms.

Over the longer term, the ability of luxury to continue to record such strong growth will hinge not just on the rate growth in discretionary income, but demographic preferences. The upside risk story for luxury is that the growth of the middle class in emerging and developing economies will translate into a broader geographical base of demand for their products. The downside here is many of these markets in Latin America and Asia are aging so the question is the extent to which younger societies in the Middle East, South Asia, and Africa can sustain growth.

Another open question across all of these markets and all advanced economies is whether Gen-Z and Gen Alpha consumers will continue to support these brands like earlier demographics. Early evidence is promising as a study by Bain & Co found that the 2022 growth rate was powered by younger consumers. Yet, these consumers are different from Gen Y, Gen X, and Baby Boomer generations. They have a strong interest in supporting sustainable brands, favor co-creation and community over the old one-way producer to buyer relationship, and are less brand loyal. So the historical inelasticity of luxury is not certain to be as fully sustained over the longer term if brands do not engage with these consumers on their own terms.

Technology

Will AI improve fashion content?

How do we balance the potential of AI to create content at scale with the current desire of consumers towards quality, authentic content? And can consumers even tell the difference?

Some interesting stats:

64% of people in a recent ToolTester survey couldn’t tell the difference between AI and human content

58% of people in a Dentsu survey support or somewhat support AI-created brand ads or content

Yet, to judge by social media trends, consumers find the world of content already overwhelming and may not necessarily want entirely AI-generated content.

Some additional stats:

71% of people in the ToolTester survey said they would trust a brand less if they used AI content without telling readers.

The hashtag “deinfluencing” has had over 584 million views on TikTok.

We’re already in a digital content glut thanks to the proliferation of social media and automated content marketing and AI tools enabling a 24/7 diffuse content ecosystem across channels.

Fashion wise, trends and social content change every second to the point that it is almost impossible to keep track.

If quality, authentic content is a differentiator, will AI make it easier or harder for brands to stand out through increased targeting and personalization, better quality, and lower creation costs?

Or will AI-created content just add further to the cacophony of content users encounter every day?

Of course, none of this gets into data privacy, ethical, and misinformation concerns of setting AI content creation tools out into the world without deep and active monitoring.

As content strategists, we know the impact of high-quality, vision-centric content to engage consumers and communicate brand vision. But, creating content at scale can be a challenge.

Strategy

Does fashion business media need to evolve?

The world of fashion business media has changed a lot over the last decade. While the market remains dominated by big players like WWD, Vogue Business, and The Business of Fashion, independent media voices, including indie mags, content creators, and other creatives, now have an equal place at the table.

But, along with independent media has come a cacophony of armchair critics across social channels eager to offer their point of view and perspectives on what’s happening in fashion. For anyone who follows the business of fashion, it can be hard at times to sift through the morass to find the real stories and to understand important news, happenings, and trends within the fashion and luxury industries.

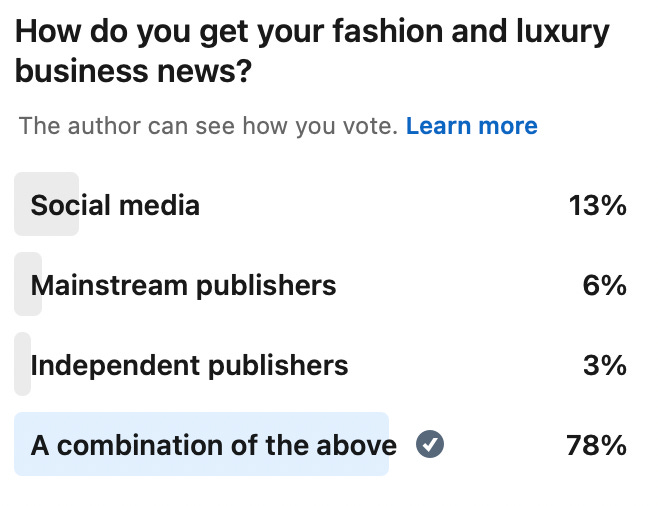

To explore this topic further, the It’s A Working Title team recently ran a LinkedIn survey to assess consumer consumption patterns of fashion business media at a high level. The question we posed was “How do you get your fashion and luxury business news?”

Through this small survey, we were interested to find out not only how people get their news but whether social media is in fact the main source of news publishing, rather than the websites of mainstream publishers and independent publishers.

Perhaps not surprisingly, the results of our survey were mixed. In the end, 78 percent of people cited “A combination of the above,” indicating they get their news through a mix of social media, mainstream publishers, and independent publishers, whereas 13 percent said “social media,” 6 percent “mainstream publishers,” and only 3 percent “independent publishers.”

Obviously, one should not jump to any conclusions about the state of the fashion business press based on a random LinkedIn survey of just over 100 people. But, the results are nonetheless interesting and speak to the diversity of options people now have to get their fashion and luxury business news and how they choose to exercise this power of choice.

Now is the time for emerging tech strategy

The honeymoon phase of the metaverse and NFTs may be over. Now it’s time to build a real marriage between emerging technologies and marketing.

In a recent article, Morgan Pomish of Digitas offers a healthy perspective on where we are with emerging tech like the metaverse and NFTs and why marketing needs to focus on how these tools are evolving into entities with more utility and use cases, bringing business solutions to consumer problems.

As Pomish notes, “Exploring emerging technologies should be considered an important component when building a modern marketing strategy. By incorporating innovative technologies, brands can distinguish themselves from competitors, gain insights into consumer preferences, and create one-of-a-kind experiences that reach new audiences. However, to maximise the benefits of these cutting-edge technologies, it's essential to understand the underlying business or consumer problems, as well as the goals and obstacles of consumers.”

In short, brands need strategy, particularly content strategy, to build more meaningful, useful experiences with emerging technologies.

Let’s get to work.